The financial system

The financial system plays an important role in the economy, with three primary tasks:

- Providing consumers and businesses with borrowing and saving opportunities,

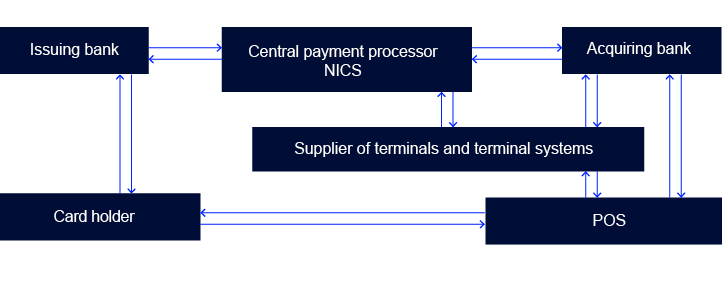

- Providing payment services

- Managing risk.

In a well-functioning financial system, these tasks are performed securely and efficiently. A system that is resilient to shocks reduces the probability of financial crises.

The financial system consists of many different institutions, markets and infrastructures. In this Report, the financial system is divided into financial markets, financial institutions and the financial infrastructure (Table 1).

Table 1

|

1. Financial markets |

2. Financial institutions |

3. The financial infrastructure |

|

Marketplaces for issuing and trading financial instruments. The properties of these instruments may vary with regard to return, risk, maturity, etc. In financial markets, savers can invest in corporate equity or in debt by lending directly to various borrowers. |

Institutions such as banks, mortgage companies, pension funds, insurance companies, mutual funds, etc. They act as intermediaries between economic agents and play important roles related to the financial system’s main tasks. |

Ensures that payments and trades in financial instruments are recorded and settled. The legislation and standard agreements governing these processes are part of the financial infrastructure, as are computer systems and systems of communication between financial system participants. |

The users of the system are more or less all the members of society: businesses, public undertakings and most private individuals.

The definition of the financial system can be expanded to include, for example, institutions and mechanisms that provide security for contracts that are entered into, supply reliable information for effective credit intermediation and risk management and perform other functions such as supervision, regulation, registration of ownership rights, accounting, auditing, or credit ratings and other financial analyses.

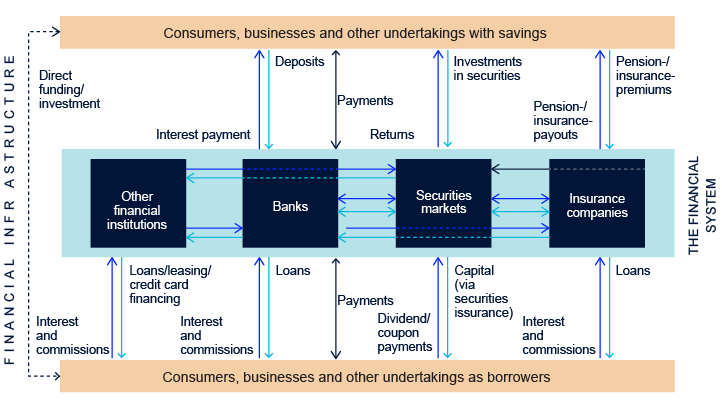

Chart 1 shows a simplified diagram of the financial system. Consumers, businesses and other undertakings with savings are shown in the box at the top. Consumers, businesses and other undertakings as borrowers are in the box at the bottom. The middle segment shows the financial system, where savings are channelled into investment through markets and undertakings. In practice, the participants are generally both savers and borrowers. Banks create money when they issue a new loan to a customer (see box: Money creation in Section 2). Payments and risk management also primarily take place in the financial system. The financial infrastructure makes all these transactions possible. A more detailed diagram of the financial system would include Norges Bank, which itself is a financial system participant and is also tasked with facilitating efficient and secure payments.

The primary tasks of the financial system

Providing consumers and businesses with borrowing and saving opportunities

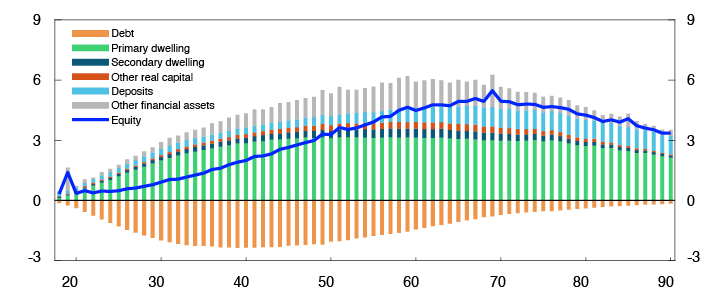

Most people need to borrow money. Private individuals borrow to finance an education, a house purchase or spending on large consumption items or to cover a temporary decline in income. Similarly, most people need to store their money at times when income exceeds expenditure, ie to save. For example, consumers might save in order to contribute to a pension scheme, to have a reserve for unforeseen expenses or to have enough equity to purchase a home. The financial system enables private individuals to borrow and save and thus to spread their consumption over a lifespan, irrespective of when income is accrued, as illustrated in Chart 2.

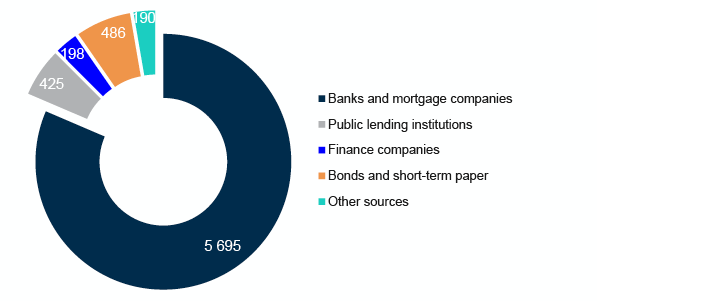

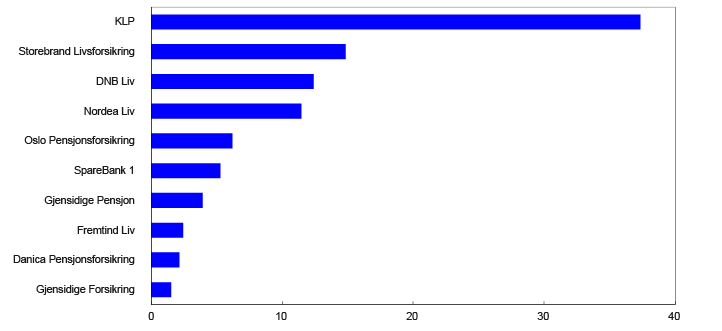

Mean in millions of NOK. 2020

Businesses might borrow to finance investments in property, equipment, development and production or to meet payment obligations in unprofitable periods. In profitable periods, businesses need investment opportunities in order to be better equipped to deal with leaner times or manage current payment obligations and finance future investment. The financial system is intended to provide opportunities for savings to be channelled to profitable investment projects.

Central and local governments might also borrow to fund investment and important expenditure during an economic downturn. Likewise, they need saving alternatives during upturns. Since 1990, the Norwegian government has saved a large portion of the government’s petroleum revenues through investment in the global financial market via the Government Pension Fund Global (GPFG).

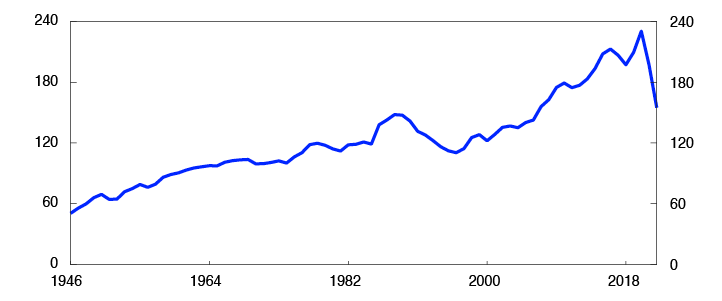

When a country’s GDP rises, the total value of both financial assets and liabilities tends to rise even more. In Norway, the ratio of total private sector and local government debt (C3) to GDP has approximately tripled since 1946 (Chart 3).

Percent

At any one point in time, some private individuals, businesses and governments will need to borrow while others will need to invest savings. In the financial system, savings are channelled to investment both across and within these groups. As it is possible to borrow and save abroad, total savings are not necessarily equal to total investment. A well-functioning financial system channels financing efficiently, thereby promoting economic stability.

Financial institutions and financial markets are intermediaries between savers and investors. Savers seek saving options with different lock-in periods and risk. Financial institutions and securities markets offer an extensive range of savings products. This is an area in continuous evolution, with new products emerging and existing ones being discontinued.

Banks accept and hold savings in the form of deposits and they provide loans. Only banks are permitted to accept ordinary deposits from the public. Banks distribute these savings across a large number of investments (borrowers), which reduces the risk that banks will incur losses. Banks have also specialised in credit risk assessment of borrowers. The government authorities have initiated various measures to protect customers’ deposits in Norwegian banks, including deposit insurance (see Section 2.3.7 Deposit guarantees in Norway). Savers can therefore make deposits without needing to assess how these deposits are invested by banks.

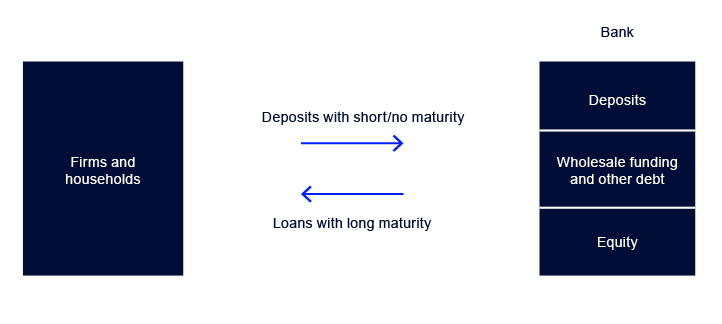

Saving in a bank is a special form of saving because bank deposits are also used to make payments and therefore function as money. Today, bank deposits are the dominant means of payment in advanced economies. Most people with savings in banks therefore want their funds to be available quickly, ie they should be liquid. (For further details, see box: Liquidity in Section 1.) At the same time, people that take out a mortgage usually want the option of a long repayment period. In this regard, banks play an important role by converting short-term deposits into long-term loans. This is called maturity transformation. (Read more about maturity transformation in Section 2.3.1 Banks’ tasks.)

Insurance companies and pension funds also act as intermediaries and accept savings that are earmarked for pensions. This capital is usually invested for the long term in Norwegian and international financial markets.

Large businesses and central and local governments can borrow or raise share capital in securities markets, where they receive saved funds directly from savers without having to go through financial institutions. Nevertheless, banks function as intermediaries by facilitating these transactions. Such investments generally require more research and monitoring by savers.

Providing payment services

Most of us make payments on a daily basis. We pay our bills using an online or mobile banking service and pay for goods in shops. We can pay using cash or using bank deposits, referred to as deposit money. Norges Bank issues cash based on user demand (see Section 3.1.1 Cash). Factors determining the quantity of deposit money are described in Section 2.3.1 Banks’ tasks. Deposit money can be used for making payments using, for example, an online banking service, payment cards or a mobile phone.

In a barter economy, both participants in a transaction must agree upon a medium of exchange. In a monetary economy, there is a universally acknowledged medium of exchange, money. Money can be in the form of banknotes or coins that are a universally acknowledged medium of exchange because they are defined as such by law. But money can also be in the form of deposit money, which is universally acknowledged to the extent it can be withdrawn in the form of banknotes and coins in the same amount. For the payment system to function efficiently, the value of money in its different forms must be identical (a 1:1 ratio). This would also apply to a central bank digital currency if it is introduced (see box: Central bank digital currencies in Section 3.2). Most transactions in the economy are settled using deposit money. For deposit money to be a universally acknowledged medium of exchange, confidence in the banking system is essential. (Read more about money in the box: What is money?)

What is money?

Money is a generally accepted means of payment. This means that money may be used as payment for goods and services and financial assets such as equities and bonds and for repaying loans. Money also has a function as a measure of value, for example the value of a good, and as a store of value. Banknotes and coins (cash), bank deposits (deposit money) and e-money are defined as money, although most of the money we use to pay is deposit money. The different forms of money must be interchangeable at a 1:1 ratio (parity) in order for the monetary system to function properly. An amount in the form of bank deposits can be converted to the same amount in cash and conversely. This is important if bank deposits are to be generally accepted as a means of payment.

Norwegian banknotes and coins are issued by Norges Bank, and the holder of Norwegian money has a claim on Norges Bank. Cash is legal tender in Norway for consumer transactions and is thus a generally accepted means of payment (see more in Section 3.1.1 Cash). Bank deposits refer to money issued by private banks and are liabilities on banks. Bank deposits are also generally accepted but are not legal tender.

Finanstilsynet is responsible for ensuring that issuers of bank deposits – banks – are solvent and are able to meet public demand. Norges Bank’s task is to promote an efficient payment system, and thus oversee the entire financial system, and be able to take the actions normally expected of a central bank. In addition, the Norwegian Banks’ Guarantee Fund guarantees bank deposits of up to NOK 2m per depositor per Norwegian bank (see Section 2.3.7 Deposit guarantees in Norway). Account holders, ie owners of bank deposits, gain access to their bank deposits using such payment instruments as bank cards and online or mobile banking solutions. Bank deposits are converted to cash by withdrawing cash from an ATM or over the counter.

The authorities do not determine the total volume of bank deposits or the quantity of banknotes and coins in circulation. The volume of bank deposits depends, among other things, on the volume of bank lending (see box: Money creation in Section 2). Norges Bank issues cash on the basis of public demand (see Section 3.1.1 Cash).

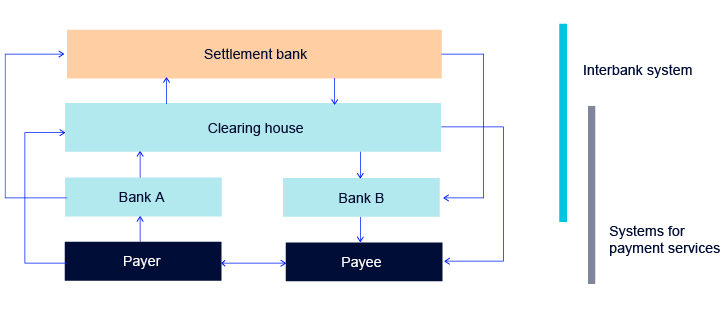

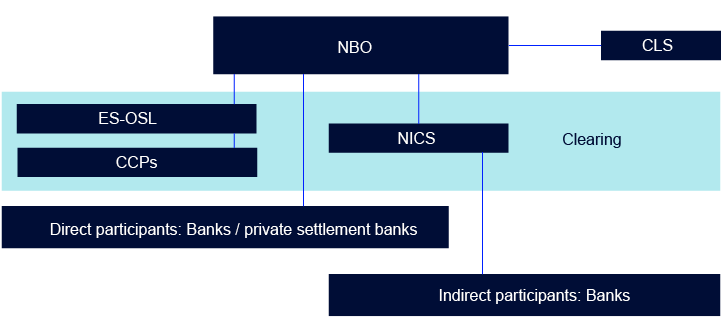

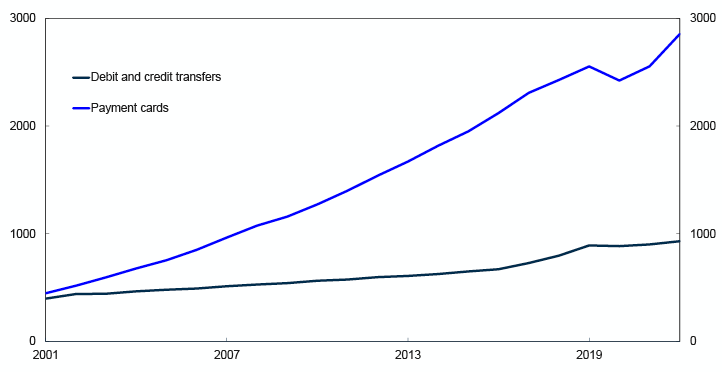

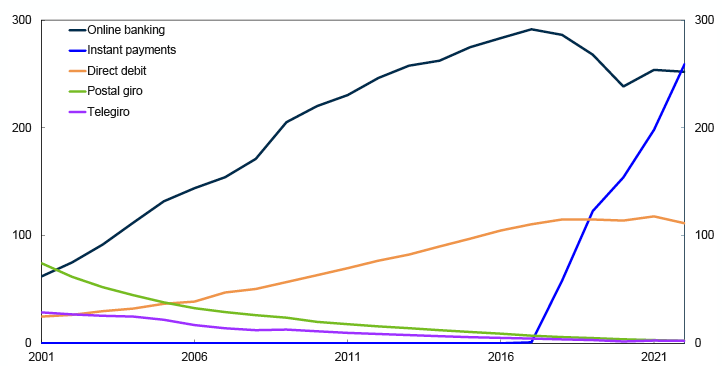

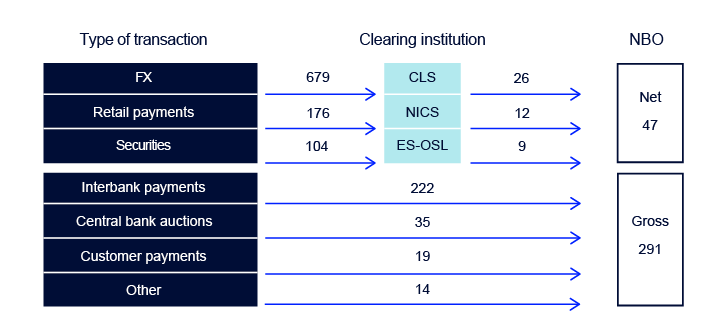

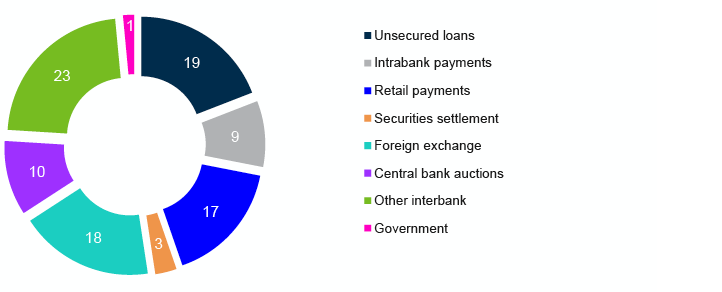

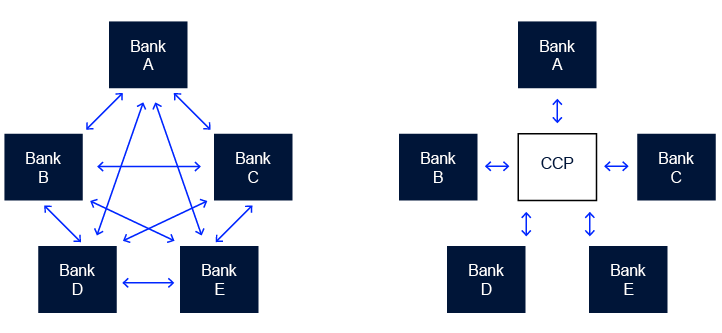

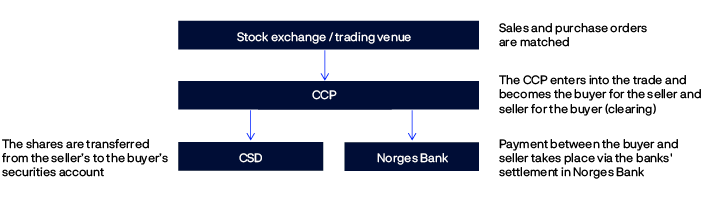

There are a large number of banks and a very high number of payment transactions, including interbank transactions. Transactions using deposit money must be settled. Settlement is conducted in a settlement system, where, for example, 1000 payments between Bank A and Bank B can be collected together (netted) (Chart 4). All 1000 payments are settled and are acknowledged when B (or A) pays A (or B) the netted amount. Most interbank payments are settled in Norges Bank with what is referred to as central bank reserves, which are banks’ deposits in Norges Bank. This means that banks settle payments to each other by transferring funds between their accounts at Norges Bank. Norges Bank manages the quantity of central bank reserves by offering lending and deposit facilities to banks, referred to as market operations. The most common market operations are F-loans and F-deposits (see Norges Bank’s website).

A system based on money simplifies exchange considerably. It reduces transaction costs in the economy and facilitates a more effective division of labour in society. In a well-functioning payment system, money transfers are conducted securely, in a timely manner and at a low cost. The payment system is a central part of a country’s infrastructure and important for the stability of the domestic currency, the financial system and the economy in general.

Risk management

Both private individuals and businesses want to insure themselves against risk. Fire, theft and auto insurance, for example, can be purchased from a non-life insurance undertaking. Life insurance companies and pension funds sell insurance that guarantees payment in the event of disability or premature death of the insured. They also offer individual private pensions and group occupational pensions as a supplement to state pensions from the National Insurance Scheme.

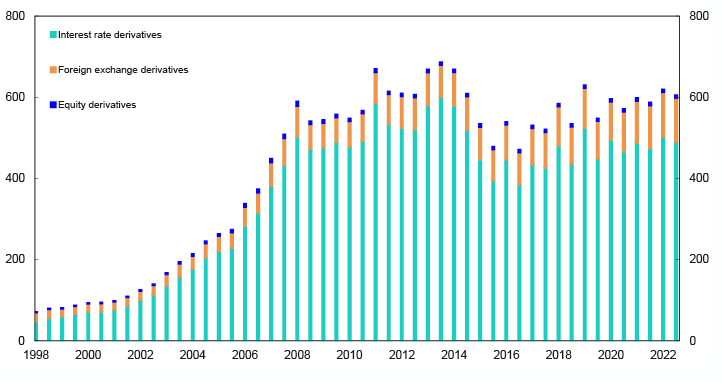

Businesses may also seek insurance against various economic risks associated with their activities. There may be risks associated with future prices of both intermediate goods and final products. Exchange rate risk and the risk of a change in interest rates are other examples. Businesses can eliminate or mitigate such risks by means of financial instruments and derivatives. The sellers of derivatives can insure against, or hedge, their own risk by offering derivatives contracts to buyers with opposite needs, cover risk by owning the underlying instruments or resell risk to others. Capital markets also help to diversify and redistribute risk associated with investments. Investors can manage risk by owning securities with different types of desired risk. Diversification also reduces risk for those who invest their savings in mutual funds or asset management companies.

Banks are also experts at assessing the risk associated with the various investment projects for which they provide loans. Bank depositors can therefore entrust such assessments to the banks. The depositors’ risk is also reduced because banks spread, or diversify, their lending across a large number of borrowers and, not least, because deposits are insured through a deposit insurance scheme. The current scheme in Norway covers deposits up to NOK 2m per depositor per bank. Banks are also subject to special government regulation.

Supervision and regulation of the financial system

A well-functioning financial system is crucial to a modern economy. If making payments or obtaining loans became impossible, this could quickly have wide-reaching consequences for the entire economy. The financial system is therefore subject to more regulation and supervision by the authorities than most other sectors of the economy, see also Appendix 3: Important financial system legislation. Read more about the most important types of risk in the financial system in box: Risks in the financial system.

Risks in the financial system

The financial system contributes to more effective risk management in the economy. One element of risk management is identifying the nature of a risk and how it can be prevented. Pricing of risk is an important part of this work. There are different kinds of risk:

Credit risk is the risk of losses when a counterparty cannot settle its accounts. For example, the counterparty may be the issuer of a security, a counterparty in a derivative contract or a borrower with a bank loan. For corporate loans, credit risk can be associated with a sector’s ability to service debt (for example construction) or with individual borrowers.

Liquidity risk is the risk that an undertaking cannot meet its payment obligations when due without incurring substantial additional costs. Liquidity risk may arise, for example, from the difference in terms to maturity between banks’ assets and liabilities. Deposits in banks are typically open-ended with no prior notice of termination required, while bank loans have longer maturities. Liquidity risk is also used to refer to the risk of prices being influenced when securities or other assets are traded and is then referred to as market liquidity risk (see box: Liquidity in Section 1).

Market risk is a collective term for the risk of losses due to movements in market prices such as interest rates, exchange rates, commodity prices or share prices. These types of risk are often referred to as interest rate risk, foreign exchange risk, commodity price risk and equity risk.

Operational risk is the risk of losses associated with technical malfunctions, human error and inadequate control systems, such as faulty procedures, errors in or attacks on IT systems, regulatory violations, fraud, fire, terror attacks, etc. Operational risk can cause or amplify other kinds of risk.

Legal risk can be defined as the risk of losses when a contract cannot be enforced as planned, or because collateral cannot be realised as envisaged. Legal risk can arise in international business transactions as the legal basis often varies across countries.

If one or more of these risks reaches a high enough level, the efficiency and security of the financial system may be jeopardised. Systemic risk may then arise. Systemic risk in the area of financial stability is the risk that the financial system cannot perform its functions and thereby contributes to a severe downturn in the real economy. Systemic risk takes into account the resilience of the financial system and the wider economy. Systemic risk can vary over time or be more structural in nature. Time-varying systemic risk is especially associated with developments in debt, asset prices and the mismatch between the maturities of banks’ assets and liabilities. Structural systemic risk is particularly associated with the degree of concentration in the financial system, the number and size of systemically important institutions and weaknesses in the financial infrastructure.

The financial system is primarily regulated through legislation. A licence issued by the authorities is required to establish a financial institution or to perform specific services within the financial system. Under the terms of the licence, an institution must meet extensive requirements and is supervised by the authorities to ensure compliance. In the event of non-compliance, the licence can be revoked.

An institution may be required to hold a specific quantity of equity capital, hold liquid assets or be run by an appropriate board and management. Regulation may be direct in that certain activities are prohibited, for example, or indirect, in the form of risk-based capital requirements. Financial market regulation often applies to the marketplace itself, for example restricting the groups that may participate. There are also requirements for disclosure to the general public, market participants and the authorities.

The purpose of regulation is to ensure that the financial system is stable and efficient. The Ministry of Finance is responsible for submitting draft legislation relating to the financial system to the Storting (Norwegian parliament). The establishment of new institutions or other undertakings is also primarily authorised by the Ministry of Finance. Interbank systems, for the settlement of interbank payments, are an exception. Norges Bank is the licensing authority for interbank systems, owing to its key role in, and responsibility for, the payment system.

Finanstilsynet (Financial Supervisory Authority of Norway) is primarily responsible for supervising institutions in the financial system to ensure that they comply with current legislation. Finanstilsynet can also impose new regulations on or issue recommendations on practices in the financial system. The aim of supervision is partly to ensure that the financial system’s main tasks are performed in a sound manner and partly to protect user interests.

For the payment system to be efficient and secure, banks must also be efficient and secure. Finanstilsynet has a particular responsibility for supervision related to banks’ solvency, management and control. Norges Bank has a particular responsibility for clearing and settlement systems. Both institutions are responsible for ensuring that the system as a whole functions as intended.

As a disruption in the financial system can have severe consequences, it is important for institutions and the authorities to be prepared to handle adverse scenarios. This can mitigate negative consequences. The Ministry of Finance has an important coordinating role should a financial crisis arise. Norges Bank can contribute if there is a liquidity shortage by lending funds to banks against approved collateral.

International cooperation

The financial system operates to a great extent across national borders and there is broad international cooperation on regulation and supervision to promote financial stability. The Financial Stability Board (FSB) was established during the global financial crisis in 2008. The FSB is a collaborative body that monitors and makes policy recommendations for the global financial system. The FSB comprises the G20 countries and the most important international organisations and committees in this area.

The Basel Committee on Banking Supervision (BCBS) is the most important international body for the regulation and supervision of banks. Originally, the BCBS focused on raising the standards of banking supervision and improving the exchange of information between regulators in different countries regarding international banks. After a period, the Committee recognised that there was also a need for a common regulatory framework governing the level of banks’ equity capital, and the so-called Basel framework was developed. Subsequently, the BCBS has proposed regulation relating to many aspects of banks’ activities (see Appendix 2: Capital and liquidity regulation).

Similar collaborative bodies have now been established for insurance, the International Association of Insurance Supervisors (IAIS); securities markets, the International Organization of Securities Commissions (IOSCO); and for the payment system and other financial infrastructure, the Committee on Payments and Market Infrastructures (CPMI). These organisations all draft proposals for international rules applicable to their respective areas. In addition, important market participants have established collaborative bodies that draw up key market standards, eg the International Swaps and Derivatives Association (ISDA).

Several of the above-mentioned institutions are referred to as international standard-setters. They draft proposals for minimum standards for international rules in their fields. These rules can be incorporated into national legislation or they can remain a market standard that market participants must adhere to in practice in order to do business in the relevant area. The proposed rules are often introduced for both small and large banks in most countries. The EU regulatory framework also largely reflects international standards.

The framework conditions for Norway’s financial system are determined based on the Agreement on the European Economic Area (EEA), which regulates Norway’s relationship with the EU. Norway is a part of the EU single market for financial services through the EEA Agreement. This means that Norway has virtually the same financial legislation as EU countries.

The International Monetary Fund (IMF) conducts regular reviews under its Financial Sector Assessment Program (FSAP) of countries’ compliance with financial sector standards. Norway’s most recent FSAP assessment was conducted in 2020 (see IMF).

For more information on the evolution of international regulations, see “Endringer i bankreguleringen etter finanskrisen i 2008” [Changes in banking regulations following the financial crisis in 2008], Economic Commentaries 5/2017, Norges Bank (in Norwegian only).

1 Period: 1946 –2022.

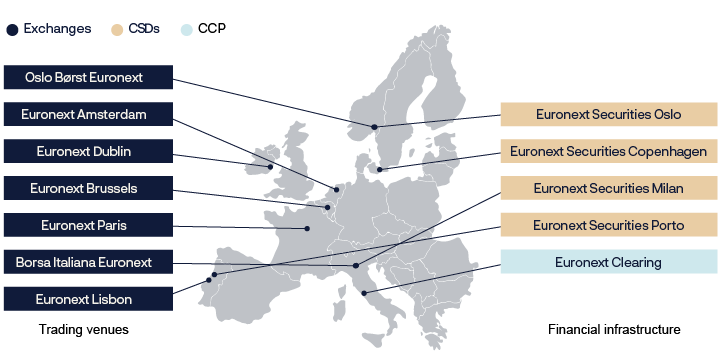

1. Financial markets

Financial markets are markets in which financial instruments are issued and traded, where savers can invest in corporate equity and lend directly to various borrowers. The main groups of financial instruments are debt instruments (bond and short-term paper markets), equity (stock markets), foreign exchange (FX) and derivatives. For debt and equity there is both a primary market, where equity securities, or stocks, and bonds are sold to investors, and a secondary market for the purchase and sale of existing bonds and stocks. The marketplace, or trading venue, may be a stock exchange where bid (buying) and ask (selling) prices are submitted and cleared. This means that the buyer accepts the seller’s ask price and the seller accepts the buyer’s bid price. Once the trade is cleared, it can be executed. Most standardised instruments such as equities or government bonds are traded on a stock exchange. Many other instruments are not primarily traded on a stock exchange but are traded either via alternative trading venues or bilaterally between buyers and sellers, called “over-the-counter” (OTC) trading. Corporate bonds, foreign exchange and derivatives are primarily traded OTC. (For further details, see box: Turnover in securities: Exchange-traded and OTC.)

Turnover in securities: Exchange-traded and OTC

Financial instrument trades can take place on organised trading platforms or through bilateral agreements, referred to as “over-the-counter” (OTC). A stock exchange is the form of organised trading platform that is regulated most extensively to ensure that relevant information is available to investors. Norway’s stock exchange, Oslo Børs Euronext, is regulated by Finanstilsynet. Securities that are expected to be widely traded will usually be accepted for trading on a stock exchange. For a company to be listed, ie for its shares to be traded on a stock exchange, detailed information about the company and, if a bond is to be issued, information on the bond agreement, must be submitted. Once a company has been listed, it has an obligation to regularly provide updated information. This ensures that relevant information about all the securities traded on the stock exchange is available to investors. Securities listed on Oslo Børs Euronext can be traded through the exchange’s electronic trading system, which shows updated bid and offer prices with the associated trading volumes. Securities prices are continuously updated based on actual trades. Although the great majority of trades on Oslo Børs Euronext are in equities, bonds are also issued and traded on the exchange. Listed securities may also be traded off-exchange.

There are electronic trading platforms that are not stock exchanges and that are subject to less stringent information and transparency requirements. These are often referred to as Multilateral Trading Facilities (MTFs). MTFs are generally owned and operated by banks or brokers to avoid paying transaction fees to a stock exchange. Some MTFs are almost as open about their operations as stock exchanges, while others provide little information regarding prices and trading volumes. MTFs that only provide minimal information are called “dark pools”. MTFs primarily offer trading in equities that are also usually listed on an exchange. Parties to a trade will often agree to trade at the same price as the listed equity on the exchange. As a result, large trades can be executed on an MTF without affecting prices on the exchange. Incentives for trading in an MTF rather than on a stock exchange may include lower transaction costs or the desire to avoid showing one’s hand by displaying an order in the market. The introduction of MiFID II has limited the volume of equities that can be traded in “dark pools”.

In the simplest form of OTC trades, the buyer and seller contact each other directly to agree on a transaction. Since it can be difficult to find a counterparty, brokers are often used as intermediaries in these transactions. For securities with fairly high turnover, brokers provide indicative bid and offer prices. As a rule, trades cannot be made at these prices, and transactions are agreed upon by phone or instant messaging via a computer network. Most bonds are traded in this manner.

Financial markets are also important for distributing risk in the economy. When projects and businesses are funded by raising capital in equity and bond markets, risk is spread over many investors and lenders. This improves access to capital and the distribution of risk. Participants also use financial markets to manage risk through the purchase and sale of instruments featuring different kinds of risk. Money, FX and derivatives markets have important functions in that they redistribute liquidity and various forms of risk. These markets are also used for speculation in developments in macroeconomic variables and financial assets. This contributes to price formation in the market and is an element in the redistribution of risk. In markets with substantial turnover, new information is quickly reflected in prices for financial instruments. This gives important information to both savers and borrowers and can improve resource utilisation in the economy.

Activity in the markets and at trading venues is regulated by the authorities, albeit to a somewhat lesser extent than is the case for financial institutions such as banks and insurance companies. (Read more in Appendix 1: Regulation of financial markets and trading venues. See also Appendix 3 Important financial system legislation.)

1.1 Money markets

The money market comprises several types of financial markets in which participants can invest or borrow funds using financial instruments with maturities of up to one year. Participants use money markets primarily to manage their funding liquidity, ie the degree to which participants have the means to meet their payment obligations as they fall due (see box: Liquidity). The banking sector is the largest participant in the money market. The market for borrowing and lending between banks is called the interbank market and is a substantial part of the money market. Other participants, such as central and local governments and other businesses, also utilise money markets, primarily to issue Treasury bills and short-term paper. Norges Bank is a key participant in the money market.

Liquidity

The term liquidity is used differently in different contexts.

The liquidity of an asset means the ease with which it can be converted into money for the purchase of goods, services and other assets. Cash and bank deposits are money and thus the most liquid form of liquidity, while fixed capital such as housing is an asset that is relatively illiquid.

Funding liquidity means the degree to which a person or business has sufficient funds available to pay for goods and services or to service debt as it falls due. In practice, it is a question of the amount of cash and bank deposits, which for banks includes their deposits in Norges Bank, that is or can easily be made available. Funding liquidity is most often used to describe the possibility of obtaining funding at an acceptable price so that a business has sufficient funds to make payments and service debt.

Market liquidity means the degree to which it is possible to trade assets, such as securities, in the market without substantially influencing market prices. A market is considered liquid if it is possible to trade large volumes in a short period of time without causing substantial movements in market prices. Some markets are more liquid than others, but in most markets, liquidity varies over time. During financial crises, liquidity in many markets can dry up.

Central bank liquidity means banks’ deposits in the central bank (central bank reserves). Central bank liquidity plays a key role in the setting of short-term market rates and the execution of payments in the economy.

The banking sector’s most important instruments in the money market are unsecured interbank loans, primarily overnight loans, and secured loans in the form of FX swaps. There are also markets for unsecured loans in the form of Treasury bills and short-term paper and secured loans in the form of repurchase agreements (repos).

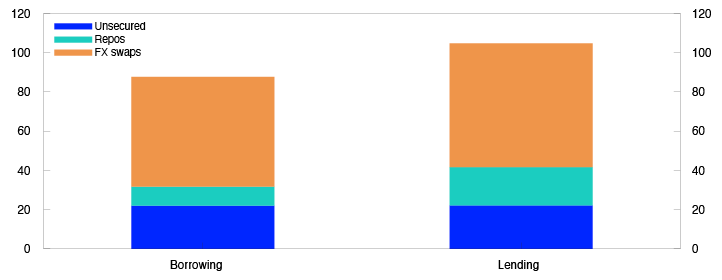

Chart 1.1 is taken from money market data (RPD) reported to and compiled by Norges Bank and shows daily borrowing and lending by instrument in 20221.

1.1.1 Money market participants

Banks are the largest participants in the money market. Fluctuations in banks’ liquidity (funding liquidity, including central bank liquidity, see box: Liquidity) are primarily related to payment services, loan origination and maturity transformation (see Section 2.3.1 Banks’ tasks). Assume that a bank customer transfers an amount from his or her own account to the account of a recipient in another bank. The payer bank’s liquidity will then be reduced as its deposit in Norges Bank is reduced. Conversely, the liquidity of the bank receiving the transfer will increase as its deposit in Norges Bank is increased. Banks use the money market to manage such liquidity fluctuations. Interbank loans comprise not only unsecured loans, but also secured loans such as repurchase agreements (repos) and FX swaps.

Insurance companies, finance companies, mortgage companies and local governments also trade in the money market when they need to borrow or invest funds for short periods. Insurance companies invest most of their funds in long-term securities, but they also make short-term investments in the money market in order to have the means to cover upcoming payments. In the private sector, money markets are primarily used by the largest companies, whose resources are large enough to utilise this market, at least as borrowers. Smaller participants can save in the money market by, for example, purchasing mutual fund units. The government is another major participant and uses the money market to meet its short-term funding needs by issuing Treasury bills. As the government holds its liquidity in its account at Norges Bank, the government only participates in the money market as a borrower.

Norges Bank is a key participant in the money market. It uses market operations to control the total quantity of central bank reserves in the banking system (central bank liquidity). Norges Bank offers standing deposit and lending facilities to banks as part of its liquidity management (see box: Norges Bank’s liquidity management and overnight lending rate).

Norges Bank’s liquidity management and overnight lending rate

The aim of liquidity policy is to keep the shortest money market rates close to the policy rate. Norges Bank makes changes to the policy rate by adjusting the terms for banks’ loans and deposits in the central bank and keeps the shortest money market rates close to the policy rate on a day-to-day basis by controlling the size of banks’ total deposits in Norges Bank (central bank reserves).

Liquidity management systems referred to as corridor systems are very common internationally. In such a system, the central bank’s lending and deposit rates form a corridor for the shortest money market rates in the interbank market. The policy rate is normally in the middle of this corridor, and the central bank manages the reserves in the banking system (banks’ deposits in the central bank) to keep them at zero (or slightly above zero). A bank that has received a net inflow from other banks over the course of the day and has a positive account balance in the central bank lends reserves to banks that have had a net outflow over the course of the day and thereby have a negative account balance in the central bank. By the end of the day, (most) banks have account balances at zero and claims on other banks in the interbank market. A corridor system incentivises banks to trade reserves with other banks and not with the central bank.

In a so-called floor system, the central bank seeks to maintain an oversupply of central bank reserves in the banking system. This system drives the shortest money market rates down to banks’ marginal deposit rate at the central bank, which then forms a “floor” for the shortest rates. (For more details on liquidity management systems in general, see “Liquidity management system: Floor or corridor?” Staff Memo 4/2010, Norges Bank, “Systemer for likviditetsstyring: Oppbygging og egenskaper” [Liquidity management systems: structure and characteristics], Staff Memo 5/2011, Norges Bank (in Norwegian only) and “Penger, sentralbankreserver og Norges Banks likviditetsstyringssystem” [Money, central bank reserves and Norges Bank’s liquidity management system], Staff Memo 5/2016, Norges Bank (in Norwegian only).)

Norway’s liquidity management system is a cross between a floor and a corridor system. Norges Bank seeks to maintain reserves at a given level within a target range. Each bank has a sight deposit quota at Norges Bank. Deposits below the quota are remunerated at the sight deposit rate (which is equal to the policy rate), while deposits in excess of the quota are remunerated at a lower rate, known as the reserve rate.

In Norway, as in many other countries, the government has an account at the central bank. Government outflows increase banks’ deposits at the central bank. On Norges Bank’s balance sheet, the government’s deposits are reduced while banks’ deposits increase. Correspondingly, government inflows reduce banks’ deposits at Norges Bank. Thus, transactions over the government’s account alter the quantity of reserves in the banking system and Norges Bank restores the balance using market operations, the most common of which are F-loans and F-deposits. F-loans are loans against collateral in fixed-rate securities with a given maturity. F-deposits are fixed-rate deposits with a given maturity. If the sight deposit rate is changed during the maturity of the operation, the bank’s allotment rate will be changed accordingly from the same date as the change in the sight deposit rate. Market operations are necessary when government account transactions would otherwise have moved banks’ deposits outside the target range.

Norwegian banks also borrow reserves from other banks overnight through the interbank market. A bank that has been a net recipient of reserves through the day and exceeds its quota will normally lend reserves to banks with negative account balances or deposits below the quota. The alternative is to deposit the reserves in excess of the quota at the lower reserve rate. Banks with net outflows of reserves through the day, and with negative account balances at the central bank, will want to borrow reserves from other banks. Otherwise, banks’ negative account balances in the central bank will be made into overnight loans (called D-loans) and charged at Norges Bank’s overnight lending rate for banks, the D-loan rate, which is 1 percentage point higher than the sight deposit rate.

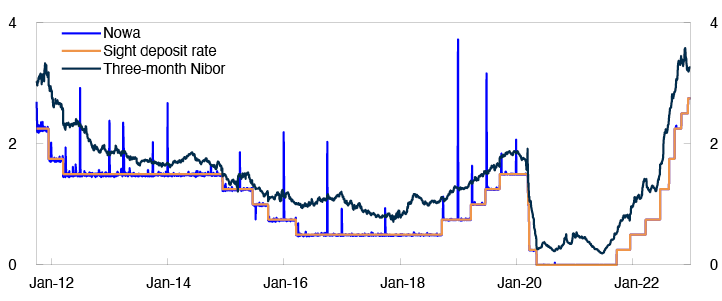

As in a corridor system, banks have an incentive to redistribute reserves among themselves. The interest rate that banks pay each other overnight is referred to as the Norwegian Overnight Weighted Average (Nowa), which is normally close to the policy rate (Chart 1.3). The Nowa rate is the first point on the “yield curve” and the very first part of the “transmission mechanism”, ie how the central bank’s policy rate affects longer-term interest rates: short-term money market rates influence the interest rates facing households and businesses, which in turn affect decisions concerning consumption, investment and saving.

1.1.2 Unsecured money market instruments

Unsecured money market instruments are unsecured interbank loans, Treasury bills and other short-term paper. Trades in unsecured interbank loans and deposits are concentrated around the shortest maturities, while Treasury bills and short-term paper can vary in maturity up to a maximum of one year.

1.1.2.1 Interbank loans and deposits

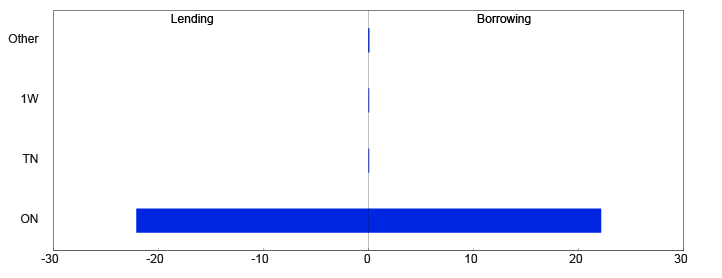

Banks can borrow from and invest with each other in the unsecured interbank market. Most trades take place at very short maturities, particularly overnight (Chart 1.2).

Daily average. In billions of NOK. 2022

If a bank has large net outgoing payments one day, but large net incoming payments the next, it can cover its short-term liquidity shortfall by borrowing in the interbank market. The bank will normally cover its more permanent financing needs with longer-term funding. This use of the interbank market explains why trades are concentrated around the shortest maturities. The interbank market is primarily used for banks’ daily liquidity management. Its main function is as a safety valve, allowing banks to cover unexpected or short-term liquidity shortfalls at short notice.

1.1.3 Short-term paper and Treasury bills

Short-term paper refers to liquid debt securities with maturities of up to one year. The short-term paper market consists of a primary market where short-term paper is issued and a secondary market, where existing short-term paper can be resold. The government is the largest issuer in the short-term paper market, but banks, municipalities, regional businesses, mortgage companies and other private businesses also obtain short-term funding by issuing short-term paper. Local governments are the second largest issuers of short-term paper in NOK after the central government. Norwegian banks’ issuance of short-term paper in NOK is limited because their short-term NOK needs can largely be met at lower cost in the FX swap market (see Section 1.1.4 Secured money market instruments).

Short-term paper issued by the government is referred to as Treasury bills, which are short-term government debt instruments. Treasury bills are issued as zero coupon securities with a maturity of up to one year. This means that these bills do not pay any interest (coupon payments), but they are issued at a discount, ie the offer price is lower than the face value and are redeemed at par at maturity. The difference between the issue price and the redemption price is the “interest payment”. They are only issued in NOK and are listed on Oslo Børs. Norges Bank sells Treasury bills on behalf of the government in the primary market. The Treasury bills are sold by auction on Bloomberg’s Auction System, where all the allotted bidders in the auction pay the same price (uniform price auction). Only selected banks, so-called primary dealers, are authorised to participate directly in the auctions. Trades in the secondary market for Treasury bills can take place either on electronic trading platforms, or when an investor contacts a primary dealer or other broker that deals in these securities. The primary dealers are obliged to quote binding bid and ask prices on the Bloomberg E-Bond trading system for a given minimum amount.

New Treasury bills are introduced on international money market (IMM) dates and mature on IMM dates in the same month a year later. Over the course of that year, the Treasury bill can be reopened to increase the volume outstanding. The maturity date will nevertheless always be a year after the bill was initially sold in the market. IMM dates are commonly used maturity dates for standardised money market products. IMM dates are the third Wednesday of March, June, September and December.

1.1.4 Secured money market instruments

FX swaps are the most commonly used secured money market instruments in Norway. Although significantly smaller, the market for repurchase agreements (the repo market) seems to be growing.

1.1.4.1 Repurchase agreements (repos)

In a repurchase agreement (repo), two parties agree to exchange securities for money for a given period. The agreement consists of two transactions with different settlement dates – one sale date and one repurchase date – which are agreed upon simultaneously. Upon entering into the agreement, one party relinquishes the securities in exchange for money (the sale). Once the agreement has reached maturity, the securities are returned to the initial seller, who simultaneously relinquishes a predetermined amount of money (the repurchase). The buyer pays an implicit rate determined by the difference between the sale and repurchase price of the security.

Since repurchase agreements are loans where the lender receives securities as collateral, lenders are exposed to very limited risk. If the buyer, or borrower, should default when the agreement matures, lenders have access to the securities that were posted as collateral. In principle, all securities that can be traded in the fixed income market can be used in repurchase agreements. The amount that can be borrowed, however, depends on the quality and marketability of the security. An important difference between a repurchase agreement and an ordinary loan with collateral in the form of securities is that in a repurchase agreement the lender is the legal owner of the security in the period to the loan’s maturity. The lender can make use of the collateral in the period until the repurchase agreement matures.

Although relatively small, the Norwegian repo market is growing. The largest banks are the primary participants. Most repurchase agreements are made with Norwegian Treasury bills, government bonds, and covered bonds as collateral (see box: Secured funding). Repurchase agreements are also made with foreign securities as collateral and so-called tri-party repos, in which the two parties entering an agreement allow a third party to manage the exchanges between them. Repurchase agreements with listed securities as collateral, such as Treasury bills, government bonds, and covered bonds, are registered on the stock exchange if one of the parties in the transaction is a member of the exchange. The trades themselves take place OTC.

Secured funding

Some issuers offer guaranteed bonds. These bonds are considered particularly safe because the guarantor must pay the debt should the issuer default. The safest guaranteed bonds are backed by the government. Other bonds can include provisions whereby bondholders have a security interest in the assets of the issuer or priority over holders of other bonds from the same issuer in the event of bankruptcy.

Covered bonds (OMFs): OMFs are the Norwegian version of bonds referred to internationally as covered bonds. Covered bonds have for many years played an important role in residential mortgage funding in a number of European countries, including Sweden, Denmark and Germany. Covered bonds (OMFs) were introduced in Norway in 2007. (For a further discussion of Norwegian covered bond regulations and the covered bond market in Norway, see “Norwegian covered bonds – a rapidly growing market”, Economic Bulletin 1/2010, Norges Bank.)

A covered bond provides an investor with a preferred claim on a defined pool of high-quality assets on an issuer’s balance sheet. Norwegian covered bonds are subject to regulations with strict requirements as to who can issue such bonds and the quality of the underlying collateral. Only mortgage companies with special authorisation can issue covered bonds, and these companies are primarily owned and controlled by banks. Approved collateral includes residential mortgages with a maximum loan-to-value (LTV) ratio of 75%, loans for commercial real estate and holiday homes that are within 60% of the property’s value, loans to or guaranteed by certain governments and authorities, and certain derivatives. The cover pool for Norwegian covered bonds mostly comprises residential mortgage loans. Under the so-called balance sheet requirement, the value of the cover pool must always equal 102% the value of the covered bonds outstanding, also referred to as overcollateralisation. The individual mortgage company is responsible for ensuring that its cover pool always meets the requirements. Mortgage companies commonly over-comply with the balance sheet requirement by posting more collateral than the value of outstanding covered bonds. Overcollateralisation provides investors with an additional buffer against a reduction in the value of the cover pool, for example in the event of a fall in house prices.

Securitised bonds (asset-backed securities (ABSs): Securitisation means that the issuer sells certain assets to a legally separate special purpose vehicle (SPV), which funds the purchase by issuing ABSs in the market. Unlike covered bonds, ABSs are normally not subject to regulations defining the kind of assets that are eligible as collateral. The types of assets included in the cover pool will vary and are specified in the contract. In contrast to issuers of Norwegian covered bonds, ABS issuers are normally not required to maintain the value of the cover pool. The credit risk of the cover pool is therefore fully transferred to the investors. Nor are SPVs subject to supervision or capital requirements as is common for financial sector undertakings. ABSs are divided up based on quality and maturity into so-called tranches with different risk profiles. The tranches with the highest risk, but also the highest interest rates, must absorb losses first. Investors can adjust their risk profiles by the tranches they select. Securitisation is widespread in mortgage financing in countries such as the US and the UK, while covered bonds are more prevalent in most European countries.

Before covered bonds were introduced in Norway in 2007, senior bonds were banks’ most important source of long-term wholesale funding. The volume outstanding of senior bonds has fallen since 2007, in pace with the emergence of covered bonds in mortgage financing. Senior bonds are, however, still an important source of funding for lending that does not qualify for the issue of covered bonds. Senior bonds are primarily bullet bonds with floating interest rates.

1.1.4.2 Foreign exchange (FX) swaps

In an FX swap, two parties agree to exchange one currency for another for a given period (see box: Derivatives). This is done through an actual exchange of the underlying instrument, where the parties swap bank deposits in the relevant currencies. By entering into an FX swap, a bank holding foreign currency and needing liquidity in NOK can swap the currency for NOK for a given period. An FX swap between two banks can also be regarded as a secured interbank loan. The FX swap market is different from the repo market in that the collateral received by the lender is in the form of another currency rather than in the form of securities. The parties to an FX swap exchange currency at the current FX market spot rate and agree to reverse the swap on an agreed date in the future at a rate agreed on today. This future rate is called the forward rate. The difference between the spot rate and the forward rate, known as the forward premium, expresses the interest rate differential between the two currencies during the life of the swap.

Derivatives

Derivatives are contracts that derive their value from an underlying asset. Derivatives can thus be used to reduce or increase exposure to an underlying asset and are therefore useful in risk management. The basic types of financial derivative are forward contracts and options.

A forward contract is an agreement to buy or sell an asset at a specified future time at a price agreed on today. The two parties to a forward contract have symmetrical rights and obligations. No payments normally accrue upon entering into a forward contract. The forward price is the future delivery price, making the value of the contract equal to zero for both parties at the time the contract is entered into. Once the forward contract has been entered into, its value can be changed. The buyer of a forward contract will make a profit on the settlement date if the price of the underlying asset is higher than the contract price and will take a loss if it is lower. The selling party will have the opposite exposure. If a forward contract is used to hedge an underlying position for the risk of losses due to price changes, the value of the forward contract will move in the opposite direction from the value of the underlying position, resulting in neither loss nor profit.

A future is a standardised forward contract traded on a commodity exchange.

A Forward Rate Agreement (FRA) is a forward contract with an agreed future rate of interest, for example the six-month interest rate in three months’ time. FRAs are settled on the same day the future interest rate period begins, on the basis of the difference between the agreed interest rate and a selected reference rate. As a rule, the contracts start on IMM dates.

A swap is a contract in which two parties exchange cash flows. The two most common types are interest rate swaps and FX swaps. Parties to interest rate swaps usually exchange a fixed interest rate for a floating exchange rate. For example, a bank can use interest rate swaps to exchange fixed rate interest payments on bonds for floating rate payments. Its counterparty in the swap pays the bank’s fixed rate interest payments to its bondholders, while the bank pays the floating rate to the counterparty. In an FX swap, the parties agree to exchange specified amounts of two different currencies at the current rate (the spot rate) and exchange these amounts back at a pre-agreed rate (the forward rate) when the agreement expires. The difference between the spot rate and the forward rate, the so-called forward premium, expresses the interest rate differential between the two currencies over the life of the contract. FX swaps are used, for example, by banks to exchange bond funding in foreign currencies for NOK. There are also combined foreign exchange and interest rate swaps, referred to as “cross-currency basis swaps”.

An option is a contract that gives one party the right, but not the obligation, to buy (call option) or sell (put option) an asset at an agreed price (the strike price) on or before an agreed future date. The other party is obligated to fulfil the transaction if the option is exercised. The buyer pays the party selling the option a remuneration, or premium. The premium expresses the option’s market value when the contract is entered into, which reflects its market value today and the value of potential future gains. The value of the option will vary according to the value of the underlying asset. The option will be exercised if this is profitable for its owner. A call option is exercised when the value of the underlying asset is higher than the strike price, while the put option is exercised when the value of the underlying asset is lower than the strike price. In both instances, the option is said to be “in the money”. By buying an option, the investor’s potential loss on the investment in the underlying asset is limited to the option premium paid to the party selling the option, while fully preserving the potential for profit. A distinction is made between options that can be exercised at any time during the life of the option (American options) and options that can only be exercised at maturity (European options).

A credit default swap (CDS) is a financial contract to insure the issuer of a bond or a bond index against default. The seller of a CDS will compensate the buyer if the underlying bond defaults. The price of a CDS contract thus provides some indication of how the market assesses the likelihood of default.

The FX swap market is the segment of the Norwegian money market with the highest turnover. It is an OTC market, and its participants are largely major banks that rely heavily on foreign credit. Smaller banks largely use the unsecured interbank market to manage short-term liquidity fluctuations.

1.1.5 Money market reference rates

A reference rate is an interest rate that is used as a starting point for the pricing of other financial instruments. Reference rates play a critical role in the global financial system. These interest rates are linked to large sums of money through various financial products and financial contracts. Money market rates are frequently used as reference rates.

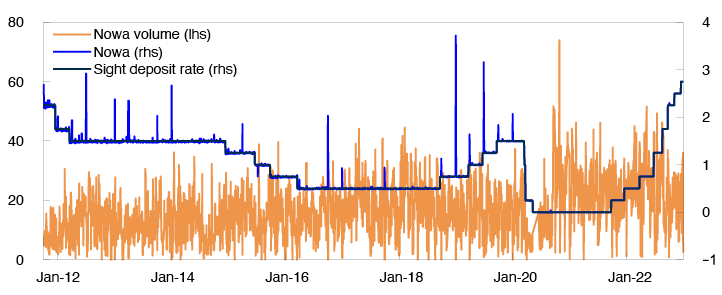

In 2011, in collaboration with Finance Norway, Norges Bank began gathering and registering data on unsecured interbank lending in the overnight market. Chart 1.3 shows daily transaction volumes. The weighted average of interest rates on these trades is called the Nowa rate (Norwegian Overnight Weighted Average). On 1 January 2020, Norges Bank took over as administrator of Nowa. It is published daily on the Norges Bank website. Nowa has on average been the same as the interest rate on banks’ deposits in Norges Bank (sight deposit rate) since it was established (Chart 1.4).

Yield in percent. Volume in billions of NOK

Percent

The most used reference rate in Norway is Nibor (Norwegian interbank offered rate). Under the Nibor framework from 1 January 2020, the rates submitted by each panel bank shall reflect the interest rates the bank would charge for loans in NOK to a leading bank that is active in the Norwegian money and foreign exchange market. Six banks are panel banks and they provide a daily quotation of the rate for maturities from one to six months. Based on the six banks’ submitted rates, Nibor is calculated as an average of the middle four observations for each maturity (see the Norske Finansielle Referanser AS website). (For more details on Nibor, see “Nibor, Libor and Euribor – all IBORs, but different”, Staff Memo 2/2019, Norges Bank, “A Decomposition of Nibor”, Economic Commentaries 3/2015, Norges Bank, and “What drives the risk premium in Nibor?”, Economic Commentaries 10/2016, Norges Bank.)

Three-month and six-month Nibor are the most commonly used reference rates for other financial products. Very few actual unsecured trades between banks are made at these tenors. In the unsecured interbank market in Norway, most of the activity is at tenors of no more than a few days. The Ibor rates in other countries, such as Euribor for EUR, are also indicative rates. Setting reference rates for unsecured loans therefore entails judgement on the part of the banks.

The G20 countries, via the Financial Stability Board (FSB), launched an initiative to reform interest rate benchmarks when attempts to manipulate global reference rates were uncovered and there was a decline in activity in the unsecured interbank market following the financial crisis. Libor for GBP, CHF, EUR, JPY and for some certain USD tenors was phased out on 1 January 2022 and replaced with near risk-free overnight rates as reference rates. After consultation with the financial industry, Norges Bank has established a working group on alternative reference rates for the Norwegian krone. (For more details, see Working group on alternative reference rates (ARR).) In 2019, the group published a recommendation to use a reformed version of Nowa as an alternative reference rate for the Norwegian krone. In 2020, the working group made recommendations for market conventions for Nowa and fallback solutions in the event Nibor ceases and for market conventions for financial products using Nowa as a reference. In addition, the group has successfully established an OIS market linked to Nowa. The publication of indicative prices for Nowa derivatives and bilateral trading in Nowa-linked products started in autumn 2021. Clearing of Nowa derivatives has been possible since April 2022 and turnover in such derivatives has gradually increased over the past year. According to LCH, outstanding volume in May 2023 was approximately NOK 1 700 bn.

1.1.6 Interest rate derivatives market

Interest rate derivatives are widely used to hedge the risk of interest rate fluctuations. Banks are important participants in this market. One reason is that banks often pay a fixed interest rate on their bond debt, while interest rates on bank lending to households and businesses are primarily floating rates, which may, for example, be linked to Nibor, which is also a floating interest rate. If the Nibor rate falls, there is a risk that interest income will be lower than interest expense. Banks can hedge the effects of such interest rate changes by entering into an interest rate swap with Nibor as the reference rate (see box: Derivatives). Under the terms of the swap, banks make interest payments at the Nibor rate and receive interest payments at a fixed interest rate (the swap rate), thereby hedging the risk of fluctuations in the Nibor rate.

Interest rate derivatives can also be used for speculation in the fixed income market. The fixed rate (swap rate) reflects market expectations of the average Nibor over the life of the swap. A participant who expects Nibor to rise by more than the increase priced into the fixed rate can buy an interest rate swap in order to pay the fixed rate (swap rate) and receive payments at the Nibor rate. If the participant’s expectations are realised, the trade will be profitable.

Forward rate agreements (FRAs) are entered into primarily to take positions based on the expected three-month Nibor rate on a future date. A buyer of an FRA contract with three-month Nibor as the reference rate commits to paying the fixed FRA rate in exchange for three-month Nibor on a given future date (often an IMM date). If three-month Nibor rises by more than the increase priced into the FRA rate, parties that have agreed to pay the FRA rate stand to profit in the same way as if they had entered into an interest rate swap.

1.1.6.1 Participants in interest rate derivatives markets

Participants in interest rate derivative markets can be divided into two groups: market makers and end-users. Market makers are investment firms, including banks, offering to buy from or sell derivatives to end-users. Market makers make their profit from the difference between bid and ask prices. The difference between bid and ask prices reflects the risk taken on by market makers in setting binding prices.

End-users include financial institutions, businesses, the public sector, private individuals and institutional investors. An institution can be both market maker and end-user. This is the case for many of the banks that, in addition to setting prices, use derivatives to manage their risk or to take positions based on their perception of interest rate developments.

The government can use interest rate swaps as a part of government debt management. The average time to refixing of the government’s debt portfolio (ie when an instrument is subject to a new interest rate) is reduced if the government enters into agreements to receive payments at a fixed interest rate and pay a floating interest rate. One of the reasons for using interest rate swaps is that reducing the average time to refixing can result in lower interest costs.

1.1.6.2 Trading venues and turnover

Interest rate derivatives can be traded both over-the-counter (OTC) and on a stock exchange, but in Norway the majority are OTC trades. OTC derivative can be tailored or standardised. Standardised contracts, which are often tied to IMM dates, generate the largest turnover.

The most recent triennial survey of derivatives and FX market activity conducted by the Bank for International Settlements (BIS) shows that total turnover in OTC interest rate derivatives in the Norwegian market in terms of underlying nominal value in April 2022 was USD 114bn. Interest rate swaps and forward rate agreements (FRAs) accounted for USD 50bn and USD 63bn, respectively, of the total, while interest rate options accounted for under USD 1bn. (For more information on the BIS survey, see the Norges Bank website.)

1 Aggregated data is published on Norges Bank’s website.

2 Reporting also contains transactions with counterparties that are not reporting banks. This may result in discrepancies between lending and borrowing. “Unsecured” only refers to unsecured loans and deposits, not short-term paper.

3 Maturities are ON (overnight), TN (tomorrow-next: from tomorrow to the following trading day), 1W (one week), Other (1W up to 12 months).

4 Period: 30 September 2011 – 30 December 2022.

5 Period: 30 September 2011 – 30 December 2022.

1.2 Bond market

Bonds are standardised loans with original maturities of more than one year. A bondholder is entitled to repayment of the amount paid for the bond (face value, or principal), as well as interest at a predetermined fixed rate (coupon rate). The principal may be repaid in instalments on the coupon payment dates or, more commonly, at a predetermined time (the bond’s maturity date).

The bond market is an organised market for issuing and trading bonds and can be divided into a primary and a secondary market. The primary market is a marketplace for participants needing long-term loans and investors seeking a vehicle for long-term saving. Bond issuers borrow money in the primary market by issuing bonds, which are bought by investors. Banks, mortgage companies, the government and businesses are the largest issuers in the bond market. The largest investor categories include life insurance companies, pension funds, mutual funds and banks. Bonds are marketable, and previously issued bonds can be resold between investors in the secondary market. The pricing of bonds that are regularly traded in the secondary market is an important source of information about the risk associated with the issuer. (For further details, see box: Bond yields and bond risk premiums.)

Bond yields and bond risk premiums

A bond yield is the compensation an investor demands to lend money to the issuer. In addition to expectations of future yields, the yield can contain risk premiums to compensate investors for various types of risk. The risk premium will usually be divided into maturity, credit and liquidity risk premiums. The size of the risk premiums reflects the level of uncertainty and how much compensation investors will demand to take on such uncertainty. (For more information on risk premiums in the Norwegian bond market, see also “Renteforventninger og betydningen av løpetidspremier” [Yield expectations and the importance of maturity premiums], Penger og Kreditt 1/2003, Norges Bank (in Norwegian only) and “Risikopremier i det norske rentemarkedet” [Risk premiums in the Norwegian bond market], Penger og Kreditt 3/2005, Norges Bank (in Norwegian only).)

A maturity premium compensates the investor for the risk of unfavourable developments in interest rates while he or she holds the bond. For example, an investor who has purchased a two-year fixed-rate bond would be exposed to price risk/interest rate risk if the bond has to be sold in a year’s time. A maturity premium can also arise because investors tie up liquidity over long periods when they invest in fixed-income securities with long maturities. To compensate for this, investors demand a positive liquidity premium to invest in fixed income instruments with longer maturities. A rising yield curve does not therefore necessarily reflect market expectations of higher short-term yields in the future. There are also other theories seeking to explain maturity premiums in the bond market. If investors have clear preferences for certain maturities, maturity premiums can vary in the different maturity segments.

A credit/default premium compensates the investor for losses on a bond if the issuer fails to make the agreed interest or principal payments.

A liquidity premium compensates the investor for the risk that selling a bond prior to maturity without reducing the price may prove to be more difficult than expected.

Since uncertainty concerning future developments normally tracks the rise in bond maturities, bonds with longer residual maturities normally have higher maturity, credit and liquidity premiums than corresponding bonds with shorter maturities.

Government bond yields and money market rates are widely used as reference rates for other bonds. In the Norwegian market, the most commonly used reference rate is the three-month money market rate Nibor. (For more information on reference rates, see “Om langsiktige referanserenter i det norske obligasjonsmarkedet” [On long-term reference rates in the Norwegian bond market], Penger og kreditt 3/2004, Norges Bank (in Norwegian only).) If the reference rate is a risk-free rate, the risk premium will be the investor’s compensation for choosing a high-risk investment rather than a risk-free alternative.

A regularly traded bond provides an ongoing pricing of the risk associated with the bond, and bond yields are therefore an important indicator of risk and required rates of return in the market.

In Norway, standardised loans with maturities shorter than one year are called short-term paper or Treasury bills. The short-term paper market is discussed in greater detail in Section 1.1 Money markets.

1.2.1 Key concepts in the bond market

There are many different types of bond with varying maturity, yield and priority in the event of bankruptcy. This section provides a short review of some key concepts in the classification of bonds.

1.2.1.1 Maturity

Most bonds have maturities of one to ten years, but some have up to 20 to 30 years. Outside Norway, so-called “ultra-long” government bonds, with maturities of 40 to 100 years, have become somewhat more common. The term to maturity is decided by the lender based on the demand for financing. In determining a bond’s maturity, the issuer will also take account of the investor’s desired maturity. Bonds with redemption rights contain clauses that provide either the issuer or the investor with the right to require the bond to be redeemed before the maturity date. An issuer with the right to redeem the bond can choose to repurchase the bond from the investor at an agreed price. The redemption right for the bondholder provides a corresponding right to sell the bond back to the issuer at a price agreed upon in advance.

1.2.1.2 Interest rate

Bonds that regularly pay interest on their face value are called coupon bonds. Bonds that do not pay interest over the life of the bond are called zero-coupon bonds. When issued, the price of a zero-coupon bond is lower than the face value of the bond if the level of interest rates in the economy is positive, while the bondholder receives the bond’s face value at maturity. Zero-coupon bonds are common internationally but less so in Norway. The most common bonds in Norway are a type of coupon bond called bullet bonds. Bullet bonds pay regular interest on fixed dates in the period to maturity and repay the entire principal at maturity.

The coupon rate that is paid during the life of a bond can be either fixed or floating. Floating rate bonds, referred to as floating rate notes, pay a short reference rate (typically three-month Nibor) plus a fixed risk premium (see box: Bond yields and bond risk premiums). Coupon rates on such bonds vary in line with the level of interest rates in the economy. A fixed rate bond pays a fixed nominal rate throughout its term. For such bonds, the interest rate at the time of issue will reflect issuer and bondholder expectations of the general level of interest rates and their compensation for the risk associated with the specific bond. Floating rate bonds are more common than fixed rate bonds in Norway, but all government bonds are fixed rate. Some bonds feature coupons that can be refixed over the life of the bond according to specified rules.

1.2.1.3 Priority

A bond is a liability item on the issuer’s balance sheet. In the event of bankruptcy, different bonds have different priority for repayment. A bond’s priority influences the degree of compensation investors will demand to invest in the bond.

Secured bonds are bonds backed by collateral in, or preferred claims to, specified asset items on the issuer’s balance sheet. In Norway, for example, covered bonds have a preferred claim on a defined selection of high-quality assets. Covered bonds are used extensively in the banking system to finance residential mortgages (see box: Secured funding). Preferred claims or collateral in the form of specific assets reduce the risk that investors will not be repaid.

Unsecured bonds are called senior bonds. These are not backed by collateral in the form of specific assets but represent a general claim on the issuer.

Bonds with lower priority than senior bonds can be described as subordinated loan capital. Subordinated loan capital comprises various kinds of bonds. Non-preferred senior debt has the highest priority, followed by subordinated debt and finally preferred capital securities, including contingent convertible bonds (CoCos). Equity capital must absorb losses first if the borrower becomes insolvent, after which subordinated loan capital follows in the priority ranking above.

Convertible bonds allow or require bondholders to convert bonds into shares in the same company at an agreed price. The criteria for when conversion can take place vary for different bonds. In recent years, CoCos have been widely discussed. These are bonds issued by banks that are contractually written down or converted into equity if the issuer’s capital levels fall below a predetermined level. With these kinds of bonds, bondholders risk incurring losses before equity capital is fully depleted. (Read more about CoCos in Staff Memo 19/2014, Norges Bank.)

Bonds can also be categorised according to the projects they finance. Green bonds are an example of loans that finance environmentally friendly projects. Oslo Børs has a separate list for green bonds. Projects are subject to an independent assessment before they can be listed on Oslo Børs’ green bonds list. Globally, there are a number of different frameworks for classifying green bonds.

1.2.2 Norwegian bond issuers

The Norwegian bond market consists of bonds issued under Norwegian legislation. Issuers in the bond market are generally the same as in the money market. The largest issuers in the Norwegian bond market are the government, the banking sector and non-financial institutions (businesses) (Table 1.1). Local governments also obtain funding to some degree by issuing bonds.

1.2.2.1 The central government

The central government is the largest single issuer in the Norwegian bond market. The bonds it issues are called government bonds. The government also has Treasury bills outstanding, which are described in greater detail in Section 1.1 Money markets. Government bonds are issued in NOK with a fixed coupon rate paid annually. The bonds are bullet bonds, ie the principal is repaid at maturity.

By comparison with other countries, the Norwegian government bond market is small. Governments normally borrow money to cover budget deficits and to strengthen their foreign exchange reserves. However, the Norwegian government has a positive net foreign asset position and also has a NOK liquidity reserve for daily payments. Nevertheless, the Norwegian government does borrow a certain amount, to fund lending and provide capital injections for state banks and other government lending schemes. The government lending schemes that are funded by issuing government debt include the Norwegian State Education Loan Fund, the Norwegian State Housing Bank, the Norwegian Public Service Pension Fund residential mortgage programme and Export Credit Norway.

Government bonds are claims on the government, and the credit risk associated with these bonds is considered to be very low. Government bonds are also typically liquid, ie they can easily be sold without substantially affecting the market price. Government bonds therefore offer lower yields than corporate bonds. In many countries, government bond yields play an important role in the economy as reference rates for the valuation of other bonds and financial instruments (see box: Bond yields and bond risk premiums in Section 2). In Norway, the government seeks to distribute bonds across different maturities to provide reference rates for government bonds with maturities up to twenty years, thereby contributing to the efficiency of the financial market.

1.2.2.2 Local governments

Norwegian municipalities and counties are a smaller issuer category in the Norwegian bond market. The municipalities also borrow substantially through Kommunalbanken, which primarily obtains funding in bond markets abroad.

1.2.2.3 Banks and mortgage companies

The banking sector is comprised of banks and bank-owned mortgage companies and is the largest issuer category in the Norwegian bond market. The volume of bonds out standing from this sector was around half of the total volume outstanding in the market. A distinction is usually made between bonds that are secured on banks’ assets and those that are not. Bonds that are not secured can be further classified based on their prioritisation (subordination) in the event the bank must be wound up or otherwise becomes subject to recovery or resolution by the authorities. Norwegian banks and mortgage companies also raise substantial funding in foreign bond markets (see box: Norwegian banks’ and mortgage companies’ bond funding abroad).

Norwegian banks’ and mortgage companies’ bond funding abroad

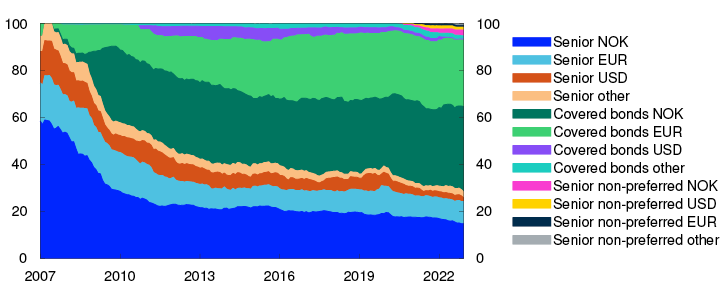

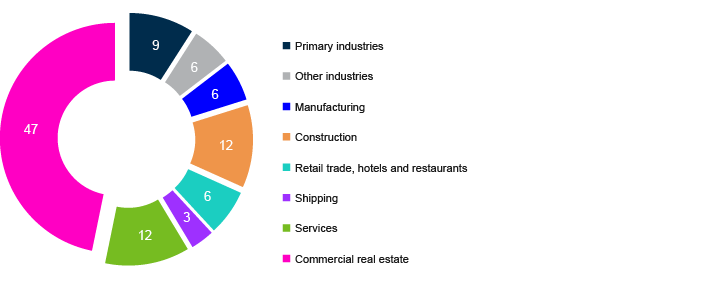

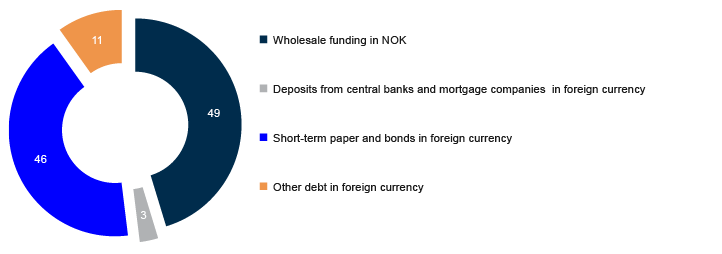

Norwegian banks and mortgage companies obtain a substantial share of their bond funding in foreign currency. At end-2022, approximately 50% of bond funding in Norway was issued in a foreign currency (Chart 1.A). Most of the bonds are issued in EUR, but the banks also issue bonds in a large number of other currencies, primarily USD, SEK, CHF and GBP. Mortgage companies sell large volumes of covered bonds in foreign markets (see box: Secured funding).

By currency and type of bond. Percent

Some of the foreign currency funding obtained by Norwegian banks is used to finance assets in the same currency. The remainder is converted and primarily used to finance lending in NOK. To conduct this conversion, banks utilise derivatives called foreign exchange (FX) swaps and interest rate swaps (see box: Derivatives). Banks use FX swaps to exchange FX funding for NOK today, while agreeing to reverse the transaction at an agreed time in the future. This provides banks with the NOK they require and ensures that the FX will be returned in time to pay back the bondholder at maturity. Banks use interest rate swaps to exchange the interest payments on fixed rate bonds for floating interest rate payments. Floating interest rates on funding reduces banks’ risk, as most loans offered by banks carry floating interest rates.

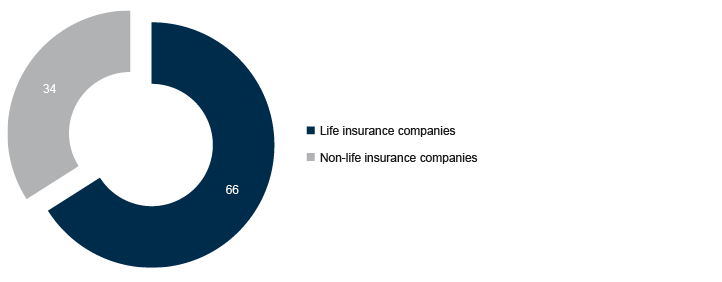

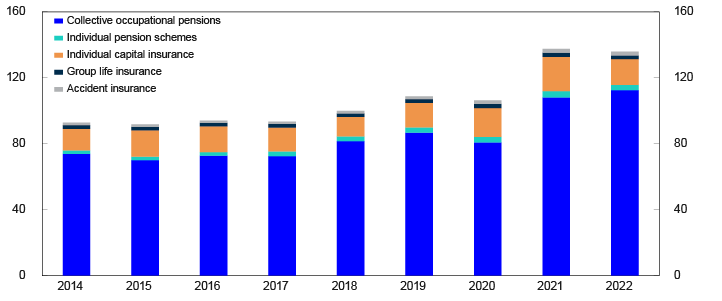

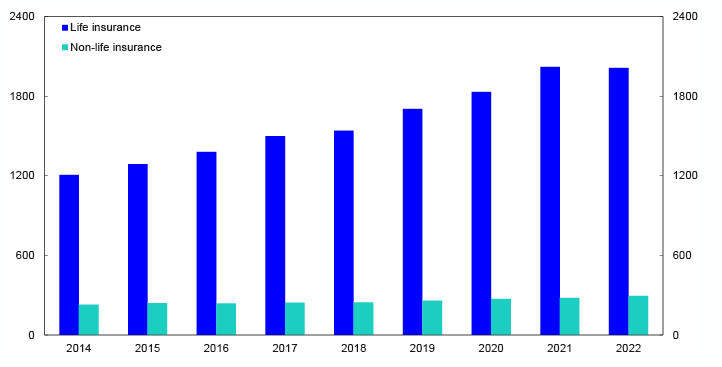

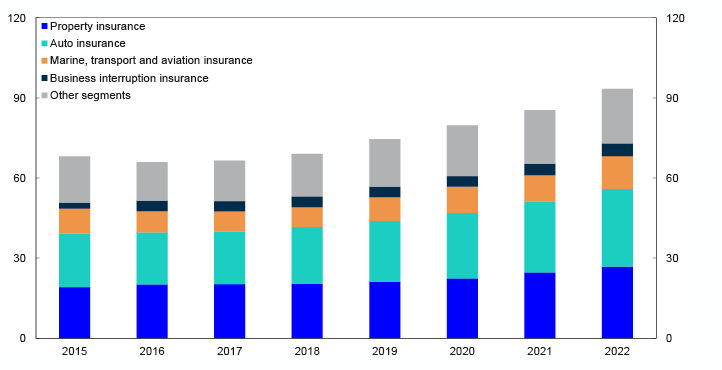

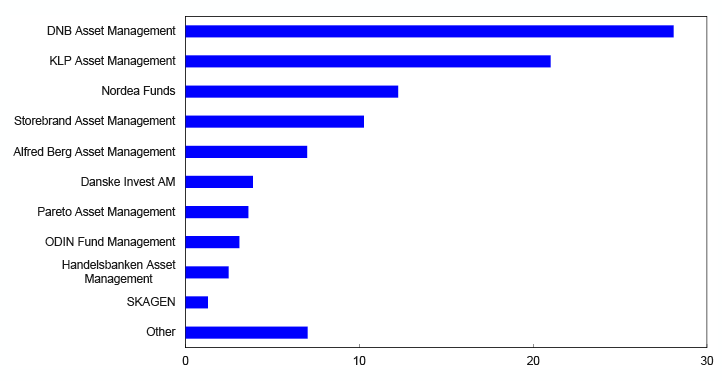

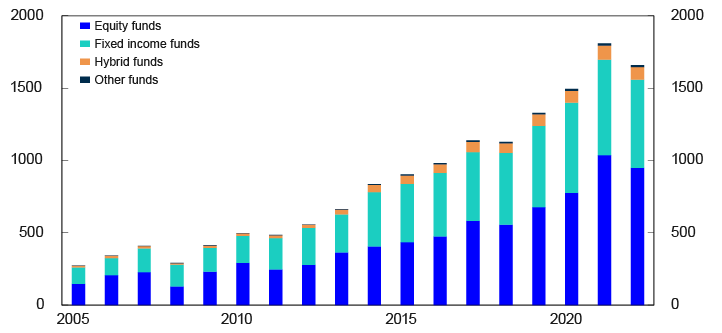

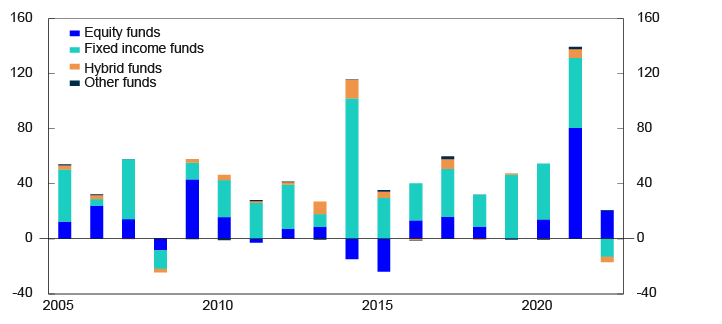

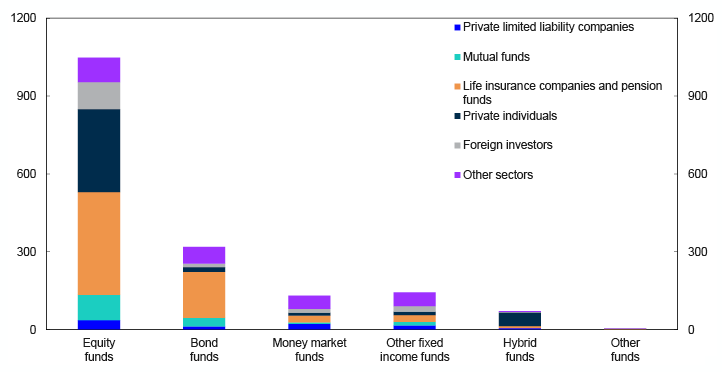

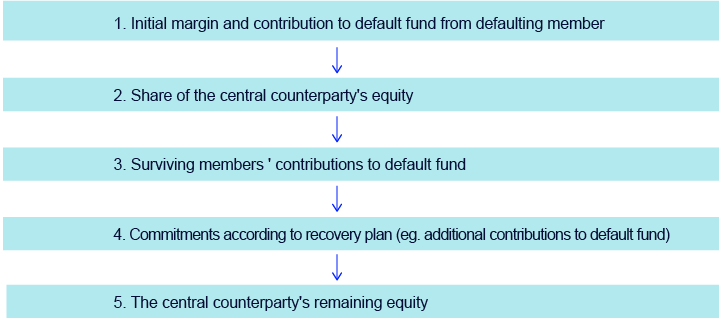

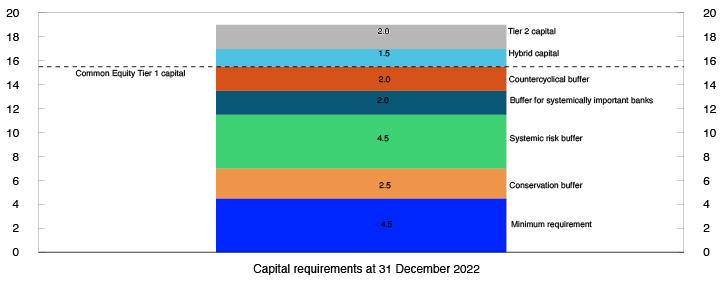

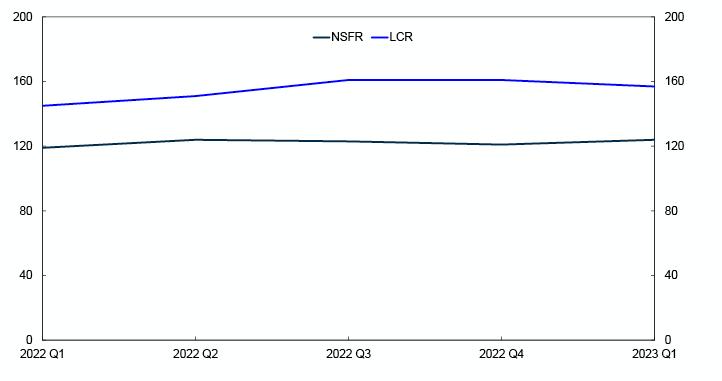

Such FX and interest rate swaps can either last for the life of the bond or banks can roll over a series of shorter swaps. Covered bond mortgage companies utilise combined interest rate and FX swaps, called cross-currency basis swaps, which last for the life of the bond and are thus fully secured until maturity.