Rate decision May 2022

At its meeting on 4 May 2022, the Committee decided to keep the policy rate unchanged at 0.75 percent.

Rate decision

Policy rate unchanged at 0.75 percent

Norges Bank’s Monetary Policy and Financial Stability Committee has unanimously decided to keep the policy rate unchanged at 0.75 percent.

The upswing in the Norwegian economy continued through winter. The labour market is tight, and unemployment is lower than projected. Global inflation has continued to rise. Domestic prices have recently increased somewhat less than expected, but rising wage growth and imported goods inflation are expected to push up underlying inflation ahead.

Monetary policy is expansionary. In the Committee’s assessment, the objective of stabilising inflation around the target somewhat further out suggests a further rise in the policy rate. Higher interest rates will ease the pressures in the Norwegian economy, but employment is expected to remain elevated. Uncertainties relating to the economic outlook and households’ response to higher interest rates warrant a gradual rise in the policy rate.

“Based on the Committee’s current assessment of the outlook and balance of risks, the policy rate will most likely be raised in June”, says Governor Ida Wolden Bache.

In its discussion of the balance of risks, the Committee noted that there is substantial uncertainty as to the potential economic impact of the war in Ukraine. There is a risk of a further acceleration in global inflation amid slowing growth. Policy rate expectations abroad have risen considerably, and it is uncertain how a rapid rise in policy rates will affect financial markets and trading partner activity. The Committee was also concerned with the risk of accelerating price and wage inflation in Norway. If there are prospects of persistently high inflation, the policy rate may be raised more quickly than indicated by the policy rate forecast in the March Report.

Rate effective from 6 May 2022:

- Policy rate: 0.75 %

- Overnight lending rate: 1.75 %

- Reserve rate: - 0.25 %

Contact:

Press telephone: +47 21 49 09 30

Email: presse@norges-bank.no

Monetary policy assessment

Monetary policy assessment

Norges Bank’s Monetary Policy and Financial Stability Committee has decided to keep the policy rate unchanged at 0.75 percent. The Committee’s current assessment of the outlook and balance of risks suggests that the policy rate will most likely be raised in June.

A new set of forecasts for the economy was not prepared for the monetary policy meeting on 4 May. New information was assessed against the projections in Monetary Policy Report 1/22, which was published on 24 March.

In the March Report, the Committee’s assessment was that the policy rate would most likely be raised further in June. The forecast implied a further rise to around 2.5 percent by the end of 2023. The war in Ukraine led to heightened uncertainty about the economic outlook, but there were prospects for a continued upturn in the Norwegian economy. Capacity utilisation was expected to remain above a normal level in the coming years. Higher wage growth and imported goods inflation were expected to push up underlying inflation ahead, although inflation was expected to be close to target somewhat further out.

Higher global inflation

Russia’s invasion of Ukraine is impacting the outlook for global economic growth and inflation. Energy and other commodity prices are high and have been very volatile since March. Futures prices for gas, coal and electricity have increased.

Headline consumer price inflation among Norway’s trading partners has risen further. Underlying inflation has been higher than projected, while inflation expectations have increased. Rising Covid-19 infection rates and stringent containment measures in China may aggravate supply chain disruptions and contribute to keeping inflation among trading partners high for longer than assumed in the March Report.

Consumer prices. Twelve-month change. Percent

Source: Refinitiv Datastream

Since the March Report, global policy rate expectations have increased substantially on the back of higher inflation and higher inflation expectations. In a number of countries, central banks have raised policy rates, and many have signalled a faster policy rate rise ahead. Long-term sovereign bond yields have risen since March, while global equity indexes have declined slightly.

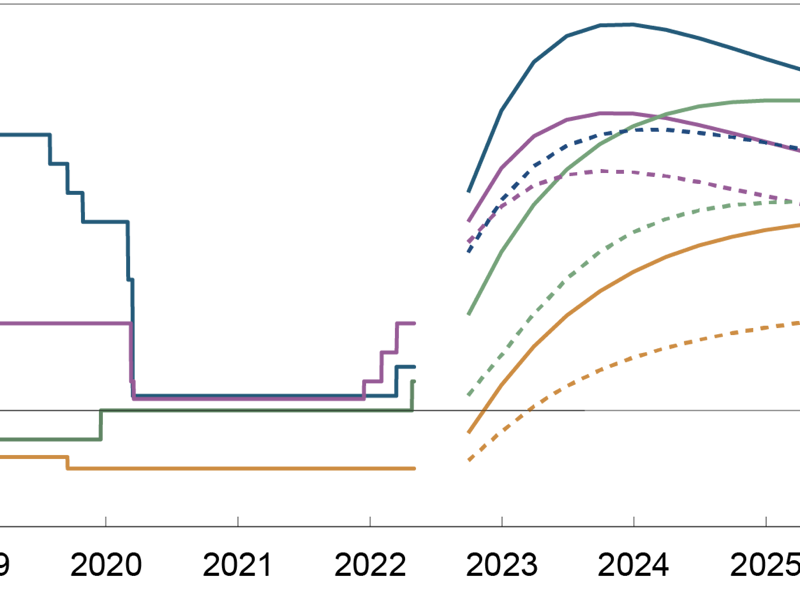

Policy rates and estimated forward rates in selected countries. Percent. 3 May 2022 (solid line) and Monetary Policy Report 1/22 (broken line).

Sources: Bloomberg, Refinitiv Datastream and Norges Bank

Overall economic activity among trading partners appears to have risen slightly less than projected. Looking ahead, higher inflation and prospects for a faster rise in policy rates may lead to lower growth than assumed in the March Report. Lockdowns in China pull in the same direction.

In Norway, money market premiums have fallen and have led to a decline in short-term money market rates. Market rates with longer maturities have increased and indicate expectations of a further rise in the policy rate. Residential mortgage rates have moved up broadly as expected following the policy rate hikes in 2021 and in March 2022. The krone has recently depreciated and is now weaker than projected.

High activity and low unemployment in the Norwegian economy

Activity in the Norwegian economy has picked up following the unwinding of Covid-19 containment measures in February. The rebound in activity has been strongest in fisheries and services, the latter having been hard hit by the pandemic. Norwegian mainland GDP was nevertheless somewhat lower in February than projected. Household consumption picked up further in March and was higher than expected.

GDP for mainland Norway. Monthly and three-month growth. Seasonally adjusted. Percent

Sources: Statistics Norway and Norges Bank

The labour market is tight. Registered unemployment has declined to 1.9 percent and is lower than projected. Employment has evolved broadly as projected. The number of new vacancies registered with the Norwegian Labour and Welfare Administration (NAV) has remained at a high level. Statistics Norway’s business sentiment survey indicates that many manufacturing firms are experiencing production constraints owing to labour shortages.

Share of labour force. Seasonally adjusted. Percent

Sources: Norwegian Labour and Welfare Administration (NAV) and Norges Bank

House prices have continued to rise and have been stronger than projected. Sales of both new and existing homes remain high. Household credit growth has been broadly as expected.

In this year’s wage settlement, agreement was reached on a wage norm of 3.7 percent for manufacturing. So far, wage settlements appear to be consistent with the projection for overall wage growth in the March Report.

The 12-month rise in the consumer price index adjusted for tax changes and excluding energy products (CPI-ATE) was 2.1 percent in March, unchanged from February and lower than projected. As expected, the rise in prices for domestically produced goods and services rose further, while the rise in prices for imported goods declined and was lower than expected. The average of indicators of underlying inflation increased to 2.7 percent in March.

High energy prices are continuing to drive up the overall consumer price index (CPI). In the period between March 2021 and March 2022, CPI inflation was 4.5 percent, following a 12-month rise of 3.7 percent in February. CPI inflation in March was lower than expected.

Consumer prices. Twelve-month change. Percent

Sources: Statistics Norway and Norges Bank

Need for higher interest rates ahead

The operational target of monetary policy is annual consumer price inflation of close to 2 percent over time. Inflation targeting shall be forward-looking and flexible so that it can contribute to high and stable output and employment and to counteracting the build-up of financial imbalances.

The upswing in the Norwegian economy continued through winter. The labour market is tight, and unemployment is lower than projected. Global inflation has continued to rise. Domestic prices have recently increased somewhat less than expected, but rising wage growth and imported goods inflation are expected to push up underlying inflation ahead.

Monetary policy is expansionary. In the Committee’s assessment, the objective of stabilising inflation around the target somewhat further out suggests a further rise in the policy rate. Higher interest rates will ease the pressures in the Norwegian economy, but employment is expected to remain elevated. Uncertainties relating to the economic outlook and households’ response to higher interest rates warrant a gradual rise in the policy rate.

In its discussion of the balance of risks, the Committee noted that there is substantial uncertainty as to the potential economic impact of the war in Ukraine. There is a risk of a further acceleration in global inflation amid slowing growth. Policy rate expectations abroad have risen considerably, and it is uncertain how a rapid rise in policy rates will affect financial markets and trading partner activity. The Committee was also concerned with the risk of accelerating price and wage inflation in Norway. If there are prospects of persistently high inflation, the policy rate may be raised more quickly than indicated by the policy rate forecast in the March Report.

The Committee decided unanimously to keep the policy rate unchanged at 0.75 percent. Based on the Committee’s current assessment of the outlook and balance of risks, the policy rate will most likely be raised in June.

Ida Wolden Bache

Øystein Børsum

Ingvild Almås

Jeanette Fjære-Lindkjenn

4 May 2022