Capacity constraints and high inflation dampen growth outlook

According to Regional Network contacts, activity rose through spring following the removal of containment measures earlier this year. Contacts expect growth to decline over the next six months. High inflation, shortages of both intermediate goods and labour are weakening the outlook. Moreover, a number of contacts expect that higher interest rates will have a dampening effect on demand. The war in Ukraine is leading to heightened uncertainty about the economic outlook. Many contacts report capacity constraints and this share increased in the course of spring. More than half of enterprises are facing recruitment difficulties. The rise in prices has picked up and contacts expect an even stronger rise ahead. Contacts have revised up their estimate for annual wage growth in 2022 to 3.9% from 3.7% in February.

Shortage of labour and intermediate goods among enterprises

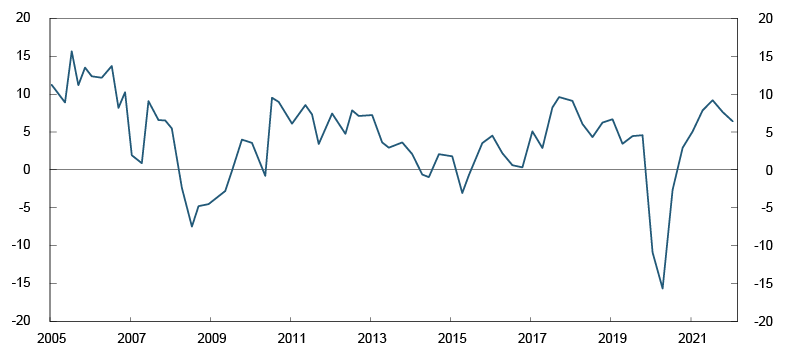

The share of enterprises reporting capacity constraints has moved up over the past year and risen further through spring (Chart 1). In May, more than six in ten enterprises reported full capacity utilisation, the highest share since autumn 2007. Constraints have become increasingly widespread across all sectors In the course of spring, except retail trade where somewhat more enterprises now have spare capacity.

Chart 1. Capacity utilisation1 and labour supply constraints2 Percentage shares

A large number of enterprises are being affected by a decline in the flow of goods in the economy. Nearly six in ten contacts report increasing shortages of intermediate goods since the turn of the year, while just below 5% report that the supply of intermediate goods has improved (Chart 2 in the special topic). Approximately one-third of enterprises expect that shortages of intermediate goods will have a dampening effect on turnover volume over the next six months (Chart 4 in the special topic). This share is particularly high for construction and manufacturing contacts. The war in Ukraine appears to be amplifying both logistical challenges and goods shortages, and about half of all contacts report that the war has exacerbated their access to goods (Chart 7 in the special topic).

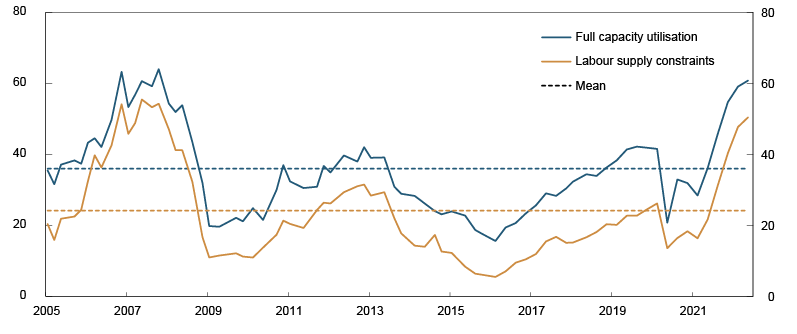

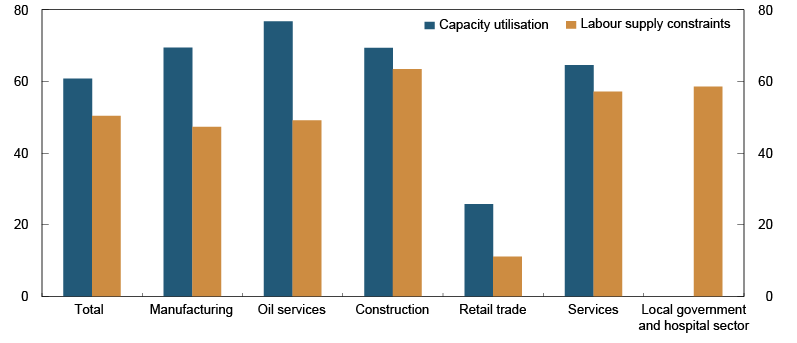

Over the past three months, contacts increased their workforces by less than planned. The shortage of qualified labour is holding back increases in staffing for many enterprises. Contacts have nevertheless increased their workforces more during spring than through winter and they expect employment to increase at approximately the same pace through summer (Chart 3). Qualified labour shortages are most pronounced among enterprises with a high share of foreign labour and most widespread in construction and services, in addition to local governments and hospitals (Chart 2). Shortages are reported in a wide range of specialised occupational categories, for example chefs, drivers, skilled tradespersons and health workers. The shortage of engineers and IT skills has also become even more pronounced. More than 40 per cent of enterprises report increasing recruitment difficulties since the beginning of 2022, while only a few enterprises report an improvement (Chart 3 in the special topic).

Chart 2. Capacity utilisation3 and labour supply constraints4 Percentage shares

Chart 3. Employment growth Vekst siste tre måneder og forventet vekst neste tre måneder. Sesongjustert. Prosent

1 Share of contacts that will face some or considerable difficulty increasing output/sales without committing additional resources such as labour or machinery

2 Share of contacts citing shortage of labour as a constraint on production/sales. The question about labour is asked only of the enterprises reporting full capacity utilisation, but the series shows the share of all contacts included in the interview period. The local government and hospital sector is omitted from the capacity utilisation series, but is, however, included in the labour force series..

3 Share of contacts that will face some or considerable difficulty increasing output/sales without committing additional resources such as labour or machinery

4 Share of contacts citing shortage of labour as a constraint on production/sales. The question about labour is asked only of the enterprises reporting full capacity utilisation, but the series shows the share of all contacts included in the interview period. The local government and hospital sector is omitted from the capacity utilisation series, but is, however, included in the labour force series.

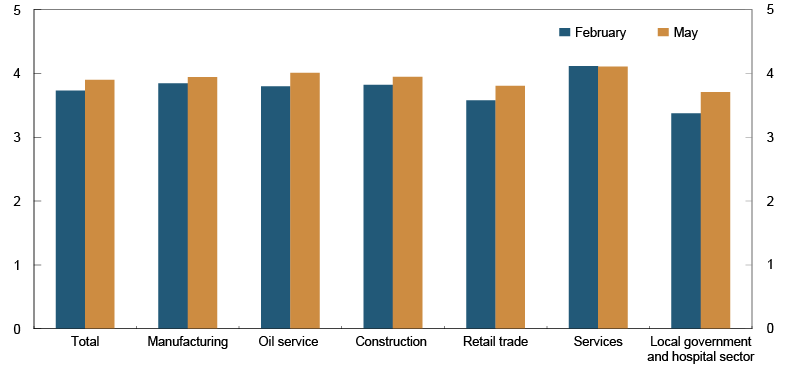

Upward revision of wage expectations and accelerating rise in prices

Contacts expect annual wage growth in 2022 to be 3.9% (Chart 4). The estimate has been revised up from 3.7% in the previous survey and is the highest since January 2013. The local government and hospital sector reports the lowest growth estimate, 3.7%, while services contacts report the strongest growth estimate, 4.1%. The other sectors estimate wage growth of between 3.8% and 4.0%. Many contacts follow the wage norm set in the annual wage settlement, but for a large share of contacts, the tight labour market pulls up wage growth further.

Chart 4. Annual wage growth Expected annual wage growth. Percent

The rise in prices has picked up and is the strongest measured since the start of the Regional Network survey in 2002. The rise is strong in all sectors, but strongest in sectors that are heavily reliant on inputs. Prices have increased the most in construction. For nine in ten contacts, cost levels are higher than normal and more than half expect that costs will increase further (Chart 1 in the special topic). Thus, a majority of contacts expect the rise in prices to further accelerate in the coming year. At the same time, many contacts fear that higher prices will result in lower demand. About half of the contacts in construction and retail trade expect that increased costs will have a dampening effect on turnover volume over the next six months (Chart 5 in the special topic).

Profitability this spring was marginally better than a year ago, driven primarily by higher order levels in services. On the other hand, substantial price rises for intermediate goods have had a dampening effect on profitability among a large number of enterprises, particularly in retail trade and construction.

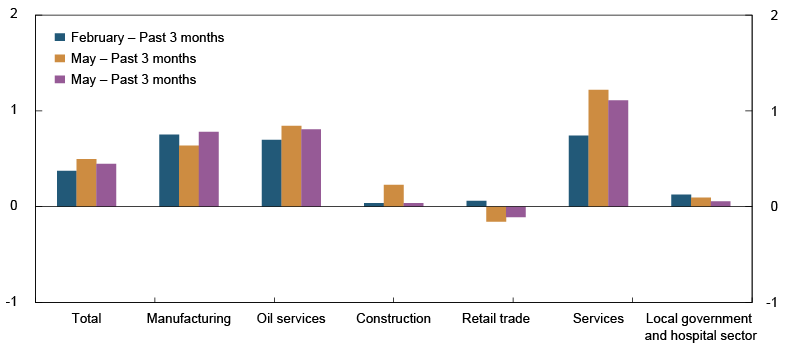

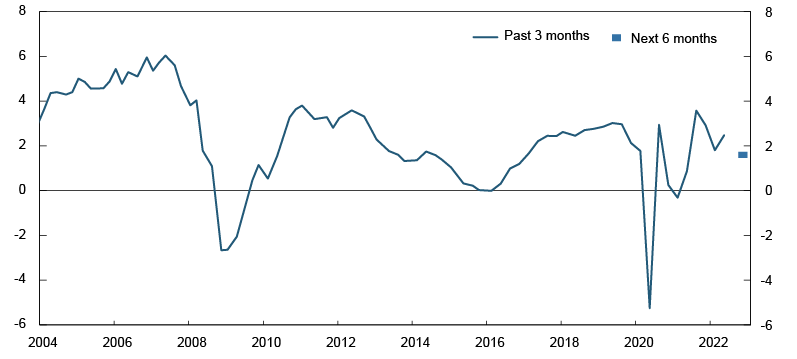

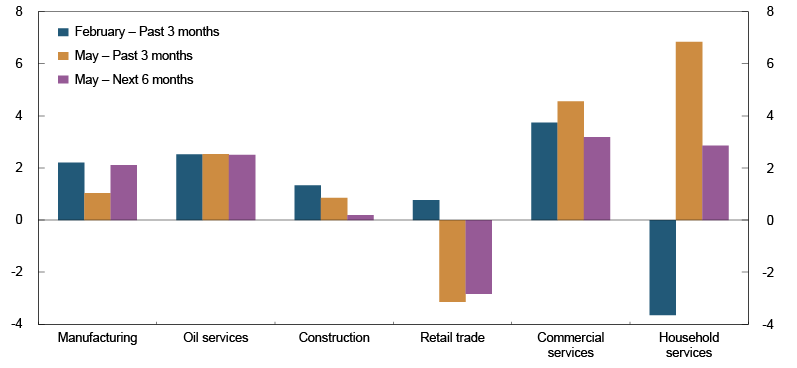

Higher growth in activity through spring

Over the past three months, growth in activity has picked up (Chart 5), with strong growth among household services contacts following a decline in the previous survey (Chart 6). Growth in the latest period has also been driven by solid developments for commercial services and oil service contacts. On the other hand, growth has declined in manufacturing and construction, while retail trade turnover has fallen considerably.

Chart 5. Total output growth Growth past three months and expected growth next six months. Seasonally adjusted. Annualised. Percent

Chart 6. Output growth. All sectors Growth past three months and expected growth next six months. Seasonally adjusted. Annualised. Percent

Contacts expect growth to slow through summer and autumn. Retail trade contacts expect sales volumes to fall further, and construction contacts expect growth to level off. Services contacts expect slower growth ahead, while manufacturing contacts expect slightly stronger growth. Contacts are no longer concerned about Covid-related restrictions and the evolution of the pandemic. On the other hand, contacts are more concerned than previously about the rapid rise in prices, bottlenecks for some intermediate goods and unrest abroad. In addition, labour constraints are limiting further growth for a large number of enterprises.

Just over 15% of contacts expect the war in Ukraine to have a dampening effect on turnover volume. Some contacts have Russian customers that they are no longer able to supply. Other contacts report that customers have become more cautious owing to heightened uncertainty and growing disruptions to global supply chains. Nevertheless, just under 5% of contacts expect higher activity as a result of the war.

Weak prospects for construction

Construction enterprises expect stable developments ahead. A number of contacts, in both residential and commercial building construction, made it clear that sales of new projects have declined sharply, and that they now face considerable uncertainty ahead. A number of contacts expect the level of orders in construction to fall in the slightly longer term. Among construction enterprises, the impression is that the largest will cope well but that order intakes are weaker among smaller enterprises.

There are several reasons for the weakened prospects in construction, but the most important is the pronounced rise in prices for intermediate goods such as wood, concrete and steel. In addition, enterprises report that higher interest rates are dampening demand. Some contacts also report that approved projects are being postponed. Nevertheless, many of the contacts have substantial order backlogs and believe that activity will not decline until towards the end of the year. The weakened prospects are largely confirmed by banks and technical consultancies.

Commercial services report increased demand. Growth has picked up since the previous survey, but enterprises expect it to slow in the period ahead. The shortage of qualified labour is having a particular dampening effect on expectations. Contacts report higher demand for services in a number of different specialised occupational categories, for example communications, strategic and legal consultancy, staffing and digitalisation.

Hotel, restaurant and travel and tourism contacts report that business sector demand has increased substantially over the past three months, pointing to pent-up demand for travel and professional and social events. Most contacts therefore expect demand to continue to increase ahead.

Households are buying fewer goods and more services

The unwinding of Covid-related restrictions this winter has led to sharp growth among household service enterprises. Hotels, restaurants and travel companies reported the strongest growth, a number of which have reported more bookings than normal. Enterprises expect growth to slow through summer, owing in part to the high level of capacity utilisation, but also to expectations that many Norwegians will holiday abroad. In residential real estate, agents report declining activity. Some of the decline is related to the reduced stock of homes for sale resulting from the new Sale of Real Property Act, which entered into force on 1 January 2022. As a result of the Act, house surveys take longer to prepare, particularly in an initial phase, and fewer dwellings are thus listed on the market. In addition, new house surveys must be prepared for dwellings that have been listed for sale since 2021.

While the reopening has led to strong growth for household services, turnover volume in large segments of retail trade has dampened. Online shopping has also declined recently, which is being felt by transport companies that are now making fewer deliveries to households than during the pandemic. On the other hand, turnover of products such as clothing and footwear has increased owing to more social interaction. Enterprises expect that more travel abroad, higher interest rates and stronger inflation will lead to reduced demand and lower sales volumes in retail trade over the next six months. However, car dealers expect the supply of new cars to improve, which will boost sales ahead.

Energy transition is boosting manufacturing output

In manufacturing, output growth in both domestic and export markets has slowed through spring. Contacts expect slightly stronger growth over the next six months, but this presupposes that the supply of intermediate goods improves for a number of enterprises.

Substantial focus on renewable energy and emission reduction measures are pulling up growth among manufacturing enterprises. For a number of contacts, shortages of components are dampening growth, but enterprises nevertheless expect strong growth ahead. During the pandemic, large segments of the food industry reported unusually high turnover, although this is now reversing. In the building materials industry, growth has slowed and enterprises expect substantial price rises to dampen demand in the period ahead. Low ocean temperatures, disease and difficulty accessing raw materials have dampened output volumes in the fisheries and aquaculture sector. Contacts nevertheless expect improved conditions over the next six months.

Activity among oil service enterprises has recently increased. Growth is approximately at the same level as in February and enterprises expect that growth will also remain fairly stable over the next six months. The tax changes for the oil industry are in part supporting this but will have an even clearer impact in the period beyond the next six months. Enterprises also report that higher oil prices are an important factor in addition to the fact that the war in Ukraine has contributed to increased interest in Norwegian oil and gas production.

Enterprises are investing more

Through 2021, contacts revised up their investment plans (Chart 7). Enterprises continue to plan for higher investment levels in the next 12 months, compared with the preceding 12-month period. Many investment projects are well underway and planned growth is therefore slightly lower than in the two previous surveys. At the same time, certain contacts are considering postponing some investments on account of high price levels and uncertainty as to whether suppliers will be able to deliver as planned.

Chart 7. Investment growth Expected growth next 12 months. percent