1. Introduction

The purpose of this handbook is to document the expert knowledge relevant for Norges Bank’s conduct of monetary policy. Its primary focus is to elaborate on the topics and policy challenges described in Norges Bank’s monetary policy strategy statement.1 We will cite international practice and relevant literature regarding these topics and give an account of Norges Bank’s interpretations and clarifications. We will also describe the analysis system and data basis on which monetary policy decisions are based. The handbook is intended as a living product, which will be updated as the strategy and modelling system evolve.

The starting point of monetary policy is Norges Bank’s mission – its mandate – laid down by the Storting (Norwegian parliament) in law and regulation. The monetary policy framework in Norway is flexible inflation targeting. In 2001, Norges Bank was given a formal inflation target for monetary policy. In March 2018, the mandate was revised in the form of a new Regulation on Monetary Policy, specifying that the operational target of monetary policy is annual consumer price inflation of close to 2 percent over time. Furthermore, inflation targeting shall be forward-looking and flexible so that it can contribute to high and stable output and employment and to counteracting the build-up of financial imbalances.

In monetary policy, a distinction can be made between (overriding) objectives and considerations. This distinction is often related to the objectives the central bank can assume responsibility for and the objectives it cannot assume responsibility for but can contribute to. Based on this distinction, “low and stable inflation” can be considered monetary policy’s overriding objective, whereas “high and stable output and employment” and “counteracting the build-up of financial imbalances” can be regarded as considerations. Such a ranking of tasks may be appropriate for the purpose of communication, for example when articulating the responsibilities of monetary policy. However, in the practical conduct of monetary policy, the distinction is less important, because the central bank must in any case strike a balance between the different objectives and considerations in the near and medium term. For the sake of simplicity, in what follows we have used the same term – objective – for both overriding objectives and considerations.

In translating the mandate into concrete decisions, a strategy is useful. A common definition of the term “strategy” is:

A plan of action designed to achieve a long-term or overall aim.2

A monetary policy strategy describes how monetary policy should be conducted in different situations that may occur. For the strategy to be as useful in practice as possible, it should be as operational and specific as possible. The monetary policy strategy serves as a bridge from the monetary policy objectives and considerations as formulated in the mandate (Regulation on Monetary Policy) to the actual conduct of monetary policy, primarily in the form of the policy rate decision and the policy rate forecast published in the Monetary Policy Report.

|

Objectives of monetary policy |

Strategy |

Implementation |

|

Low and stable inflation with annual consumer price inflation of close to 2 percent over time High and stable output and employment Counteract the build-up of financial imbalances |

How to conduct monetary policy for best possible attainment of policy objectives? How to deal with different types of challenges (shocks, uncertainty)? |

How should the policy rate/rate path be adjusted given the strategy and economic situation? How should the decision be communicated? |

Neither the objectives nor the strategy are carved in stone but can be changed over time. However, there are differences in the degree to which they are fixed. The objectives of monetary policy are changed relatively rarely. Frequently changing the objectives could weaken confidence in monetary policy. In Norway, the monetary policy objectives have been changed twice in the past 20 years (see “The objective of monetary policy from a historical perspective”). The inflation target was formally introduced in 2001. Before that, the objective was to maintain a stable exchange rate. In the new Regulation on Monetary Policy of 2018, the inflation target was reduced from 2.5 to 2 percent. At the same time, inflation targeting was to contribute to high and stable output and employment. The word “high” was new compared with the earlier regulation, as was the phrase that monetary policy should also counteract the build-up of financial imbalances.

The strategy will be somewhat less fixed than the objectives, since the strategy should be developed as new insights are gained from research, analyses and practical experience. But substantial and frequent changes in the strategy will not be appropriate either, whether with regard to the internal decision-making process or external communication.

However, the conduct of monetary policy will, by its nature, depend on the current economic situation and the outlook. Policy rate decisions are normally made at the announced monetary policy meetings of the Monetary Policy and Financial Stability Committee (hereinafter “the Committee”). As a rule, eight such meetings are scheduled each year. In conjunction with four of these meetings, the Monetary Policy Report is published, where the policy rate forecast is an important part of the conduct of monetary policy.

The monetary policy strategy can be roughly divided into the following elements: a. specification of objectives, b. trade-off between objectives and c. response pattern.

a. Specification of objectives

For the strategy to be of practical benefit, the objectives of monetary policy must be specified so that policy performance under different policy rate scenarios can be assessed. The different objectives laid down in the mandate vary in their degree of precision. The objective of low and stable inflation is relatively precisely formulated in the mandate as “close to 2 percent over time”. It may nevertheless be appropriate to further define the phrases “close to” and “over time”. The objective of high and stable output and employment is less precise. How is “high” defined? Central banks with similar objective formulations usually relate it to “the highest level that is consistent with price stability over time”. At the same time, it is far from obvious in practice what level this is. The strategy should therefore seek to operationalise “high” so that it is possible to quantify this level. Such a quantification is naturally associated with considerable uncertainty, and the strategy should also provide some guidance on how the central bank should take uncertainty into account in monetary policy. “Counteracting the build-up of financial imbalances” is perhaps even less precise. Financial imbalances are a challenge to define and not least to estimate. Nevertheless, a strategy should seek to operationalise this consideration as far as possible, with a view to striking a balance between the objectives with some degree of consistency.

b. Trade-offs between objectives

The economic situation will normally reflect shocks of varying magnitude that have resulted in deviations from the objectives. Very often there will be a conflict, at least in the near term, between certain objectives. Part of the strategy could be to formulate some principles or criteria for what can be described as an efficient trade-off between objectives. What characterises an efficient trade-off is that performance against one of the objectives cannot be better without performance against at least one of the other objectives being poorer. With appropriate trade-offs, the performance against the various objectives will generally reflect in part the shocks that have occurred, in part the objectives’ relative importance (weight) to the decision-makers and in part the strength of the effect of monetary policy on the target variables. In addition to providing criteria for an efficient trade-off, a strategy can also be a tool for ensuring a consistent approach to weighing up the objectives over time, unless the decision-makers deliberately chose to change it.

Central banks’ weighting of objectives other than inflation is usually reflected in the time horizon for seeking to bring inflation back to the target after a deviation. A more flexible inflation targeting regime generally implies a longer horizon. The relevant horizon depends on the shocks that have occurred and whether there are conflicts between the policy required to reach the inflation target and the other monetary policy considerations.

c. Response pattern

The strategy should describe how monetary policy should be formulated depending on the shocks that might occur. Of course, it is not possible to have a detailed action plan in advance for every possible type of shock. But most shocks can be categorised as either demand shocks or supply shocks, and as either transitory shocks or persistent/permanent shocks. A strategy for how to respond to different categories of shocks will be useful for the implementation of monetary policy in practice.

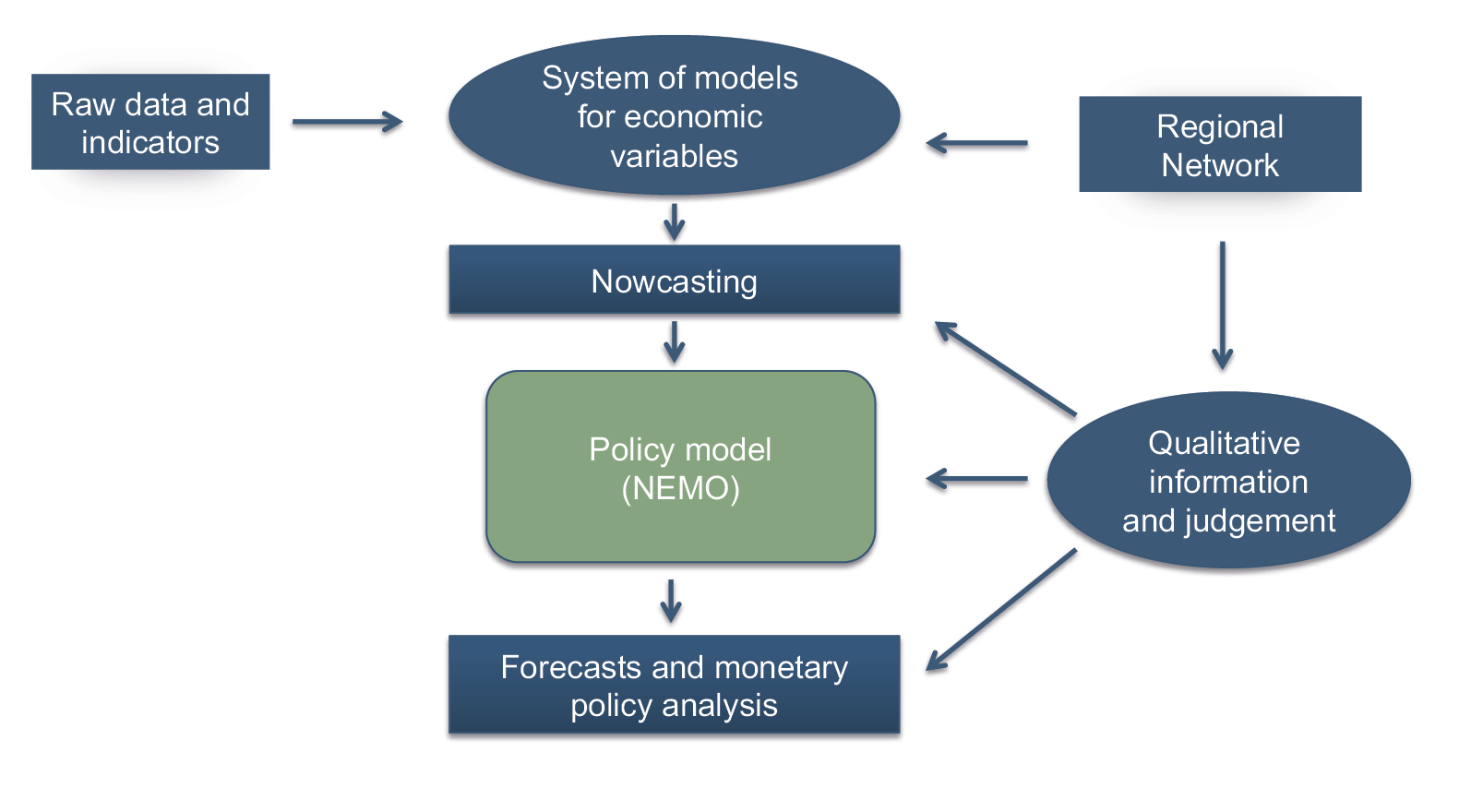

Monetary policy responses to various shocks depend on how the shocks are interpreted and how they are estimated to influence future economic developments. The decision basis, which comprises different kinds of data and the modelling and analysis system, is therefore key to the monetary policy response pattern.

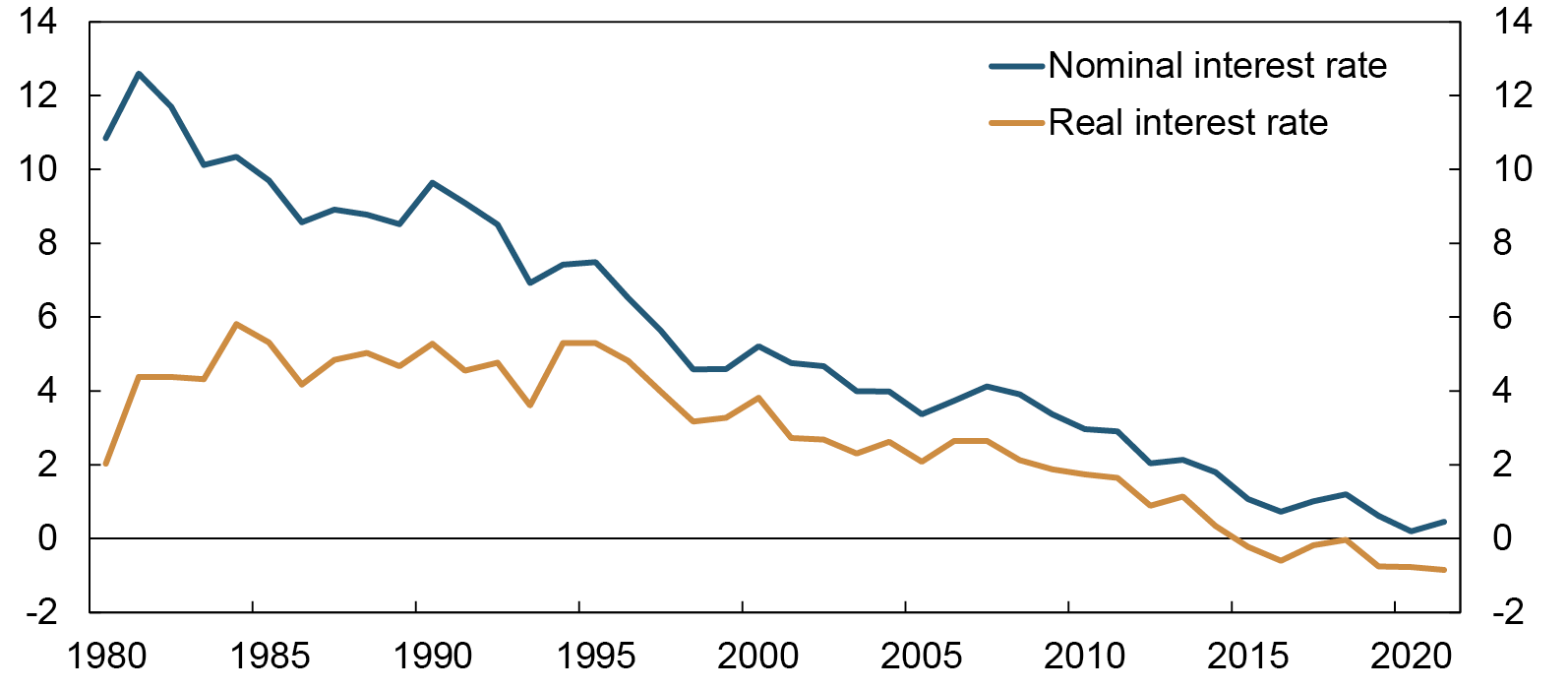

To assess how tight or expansionary monetary policy should be, it is necessary to have an idea of what a neutral monetary policy is, ie when monetary policy contributes to neither an increased nor decreased activity level. A key concept in this connection is the neutral real interest rate3. The neutral real interest rate changes over time, and estimates of this rate are uncertain.

The implications of uncertainty are an important part of the strategy that describes the response pattern. Uncertainty surrounds the current economic situation, the outlook and economic relationships, including the effects of monetary policy. Some types of uncertainty are not of material importance for the response pattern, while other types may imply that the policy rate should respond to shocks either more cautiously or more aggressively than otherwise. The monetary policy strategy should provide a measure of guidance on how monetary policy should relate to different types of uncertainty.

Now and then, extraordinary shocks may occur, of which the Covid pandemic and the global financial crisis (GFC) are examples. It is difficult to have a very precise strategy for such shocks since they may be very different in nature and difficult to describe in advance. Nevertheless, the strategy can contain some general guidelines for what may be a relevant response. The interaction between monetary and fiscal policy is also a relevant topic when large extraordinary shocks occur.

Section 2 contains a further specification of objectives (point a above) and trade-offs (point b), while Section 3 addresses the response pattern (point c).

Norges Bank’s Monetary Policy and Financial Stability Committee1

The Monetary Policy and Financial Stability Committee is responsible for Norges Bank’s role as the executive and advisory monetary policy authority and is responsible for the use of policy instruments to attain the monetary policy objectives. The Committee shall contribute to the promotion of financial stability by providing advice and using the policy instruments at its disposal.

The Committee consists of the governor, the two deputy governors and two external members. The external committee members are appointed by the King in Council for a term of four years. The governor chairs the Committee, and the two deputy governors are the first deputy chair and second deputy chair, respectively. The Committee became operative on 1 January 2020.

The Committee normally holds eight scheduled meetings a year, where policy rate decisions are made. Four of the meetings coincide with the publication of the Monetary Policy Report. The level of the countercyclical capital buffer is also set at these meetings.

The Committee’s meeting schedule is primarily determined by the dates of the eight monetary policy meetings. Prior to the meetings that coincide with the publication of the Monetary Policy Report, the Committee meets three times. Prior to the meetings without a report, the Committee meets once.

In 2021, the Committee held 21 meetings and two one-day seminars not directly related to the monetary policy meetings. The Committee discussed the monetary policy strategy, the strategy for the countercyclical capital buffer, the Financial Stability Report and liquidity management, among other things.

Bank staff prepare and present relevant analyses and projections that provide the basis for the Committee’s discussions and advises the Committee on policy decisions. To ensure that the discussion basis is as far as possible the same for all the Committee members, all have access to the same information and analyses provided by Bank staff.

The Committee is committed to transparent and clear external communication and seeks consensus on its assessments and decisions through in-depth discussion. The “Monetary policy assessment”, published in connection with policy rate decisions, and the “Assessment of the countercyclical capital buffer requirement”, published in connection with the buffer decisions, reflect the view of the majority. Topics of particular concern to the members in the discussions are highlighted in the assessment. Members that disagree with the assessment of the majority may dissent, and dissenting views are published together with a brief written explanation in the minutes and in the assessment published at the same time as the rate decision. All of the Committee’s decisions were unanimous in 2021. To underpin the Committee’s form as a collegial committee, the Committee chair, the governor, normally speaks on behalf of the Committee. Other Committee members may issue statements by agreement with the Committee chair.

1 The Committee’s rules of procedure contain rules for organising the work of the Monetary Policy and Financial Stability Committee and cover inter alia the Committee’s duties, the conduct of meetings and of business and the keeping of minutes (see Rules of procedure for Norges Bank’s Monetary Policy and Financial Stability Committee (norges-bank.no)).

2. Objectives and trade-offs

In most countries, the purpose of the central bank is laid down by the political authorities in a central bank act (Table 2.1). The act normally includes a primary objective to maintain monetary value or price stability. The purpose of Norges Bank’s activities is laid down by the Storting in the Central Bank Act. A new central bank act was adopted in Norway on 1 January 2020. In many countries, the purpose is more specifically defined in operational objectives, in Norway in the 2018 Regulation on Monetary Policy. In some countries, the objectives are specified in periodically reviewed agreements between the government and the central bank governor (eg Canada and Australia), or in a letter from the government to the central bank (UK and New Zealand). In others, such as the European Central Bank (ECB), the Swedish central bank (Sveriges Riksbank) and the US Federal Reserve, the central bank itself defines the operational objective. However, for these central banks too, the operational objective defined by the bank must be within the limits set by the act.

In Norway, Section 1-2 of the Central Bank Act states that the purpose of the central bank’s activities is to maintain monetary stability, promote the stability of the financial system and an efficient and secure payment system and contribute to high and stable output and employment.

The Government sets an inflation target for monetary policy through a regulation laid down pursuant to the Central Bank Act.4 Norway has had an inflation target for monetary policy since 2001. (See “The objective of monetary policy from a historical perspective” for a review of monetary policy from Norway in a historical perspective). The March 2018 Regulation on Monetary Policy reads:

Monetary policy shall maintain monetary stability by keeping inflation low and stable.

The operational target of monetary policy shall be annual consumer price inflation of close to 2 percent over time.

Inflation targeting shall be forward-looking and flexible so that it can contribute to high and stable output and employment and to counteracting the build-up of financial imbalances.

Even though the authorities have set monetary policy objectives, most central banks are free to determine the instruments they use. When we speak of central bank independence, we primarily mean instrument independence and not goal independence.

The difference between instrument independence and goal independence is not as big in practice as in principle. The objectives are often not formulated in specific detail in the monetary policy mandates. In addition, trade-offs must be made between the different objectives. This means that the central bank itself must specify, or operationalise, the objectives and make the trade-offs. The less specific the monetary policy objectives are, or the more objectives the central bank has, the more it can be said that the central bank is goal independent. An inflation target for monetary policy implies a greater degree of goal independence for the central bank than for example an exchange rate target, because inflation targeting largely entails judgement-based trade-offs between various considerations, while the policy rate under a fixed exchange rate regime is primarily given by foreign interest rates and conditions in the foreign exchange market.

In addition to the traditional monetary policy objectives – price stability and real economic stability – some central banks in recent years have given more weight to other considerations, such as climate change and income and wealth distribution. Such considerations are ordinarily not directly specified in central bank mandates, but many central bank mandates include elements supporting other government policies. The box “Climate change, the macroeconomy and monetary policy” contains a description of how central banks include climate change considerations in their monetary policy frameworks.

Central bank independence requires democratic accountability. This requirement has also been laid down in the Regulation on Monetary Policy, Section 4 of which states that Norges Bank shall regularly publish the assessments that form the basis of the implementation of monetary policy. How the central bank specifies the objectives and the trade-offs is an important part of such accountability. It is also important to the internal decision-making process and to improve the effectiveness of monetary policy. This section explores how the monetary policy objectives and considerations laid down in the mandate can be specified and how the trade-offs between them can be made in practice.

Table 2.1 Monetary policy objectives in selected countries

|

Country |

Purpose of central bank |

Operationalisation |

Monetary policy mandate |

|

Australia |

“… contribute to: - the stability of the currency of Australia; - the maintenance of full employment in Australia; and - the economic prosperity and welfare of the people of Australia.” Reserve Bank of Australia Act (1959) |

The monetary policy objective is defined in collaboration between the government and the central bank and documented in the joint agreement “Statement on the Conduct of Monetary Policy”. |

The latest agreement of September 2016 states: “They agree that an appropriate goal is to keep consumer price inflation between 2 and 3 per cent, on average over time”. It continues that this formulation provides the flexibility “to set its policy so as best to achieve its broad objectives, including financial stability”. |

|

Canada |

“… to promote the economic and financial welfare of Canada.”1 Bank of Canada Act (1934) |

The operational inflation target is defined in collaboration between the government and the central bank in a joint agreement. The inflation target is evaluated and the agreement renewed every five years. |

The latest agreement of December 2021 renewed the inflation target of 2%, measured as the mid-point of the 1–3% inflation control range. The agreement will be renewed at end-2026. |

|

Euro area |

“… to maintain price stability. Without prejudice to the objective of price stability, it shall support the general economic policies in the Union with a view to contributing to the achievement of the objectives of the Union as laid down in Article 3 of the TEU2.” |

The European Central Bank (ECB) defines the inflation target. The current strategy was adopted in July 20213. The next assessment of the strategy is expected in 2025. |

A symmetric inflation target of 2%. In July 2021 the ECB also presented a climate-related action plan. The ECB will take climate-related factors into account in its monetary policy analyses. |

|

Iceland |

“… shall promote price stability, financial stability and sound and secure financial activities.” Act on the Central Bank of Iceland (2019) |

With the approval of the government, the central bank can issue a declaration on a quantitative inflation target. |

The target is defined as a 12-month change in the consumer price index of 2½%. |

|

Japan |

“… aimed at price stability, thereby contributing to the sound development of the national economy.” Bank of Japan Act (1997) |

The BoJ specified a price stability target in January 2013. |

The inflation target is an annual rise in the CPI of 2%. |

|

New Zealand |

“…- achieving and maintaining stability in the general level of prices over the medium term; and supporting maximum sustainable employment; and … protecting and promoting the stability of New Zealand’s financial system ...”. Reserve Bank of New Zealand Act (2021) |

The finance minister issues an operational definition of the dual mandate in the form of a remit for the central bank, normally every five years. |

The latest remit came into force in March 2021. The inflation target was maintained. A new element was added requiring the central bank to assess the effect of its monetary policy decisions on government policy to support sustainable house prices. |

|

Norway |

"... to maintain monetary stability and to promote the stability of the financial system and an efficient and secure payment system. ... to promote high and stable output and employment." Central Bank Act (2019) |

The operationalisation of a stable value of money is laid down in a separate Regulation on Monetary Policy dated March 2018. |

“The operational target of monetary policy shall be annual consumer price inflation of close to 2 percent over time. Inflation targeting shall be forward-looking and flexible so that it can contribute to high and stable output and employment and to counteracting the build-up of financial imbalances.” Regulation on Monetary Policy (2018) |

|

UK |

“… – to maintain price stability, and - subject to that, support the economic policy of her Majesty’s Government, including its objectives for growth and employment.” Bank of England Act (1998) |

The price stability target and the government’s economic policy is defined in an annual remit issued by the finance minister. |

The latest remit is from March 2021. The Inflation target was reconfirmed as 2%. The mandate was also updated “to reflect the government’s economic strategy for achieving strong, sustainable and balanced growth that is also environmentally sustainable and consistent with the transition to a net zero economy”. |

|

Switzerland |

“… shall ensure price stability. In so doing, it shall take due account of economic developments.” Swiss National Bank (2003) |

The price stability target is set by the Swiss National Bank (SNB). |

The SNB lay down its monetary policy strategy in December 1999. The price stability target is annual CPI inflation of less than 2%. |

|

Sweden |

“… to maintain price stability. The Riksbank shall also promote a safe and efficient payments system.” Sveriges Riksbank Act (1988) |

The Riksbank decides how the formulations in the central bank act should be interpreted. |

The Riksbank has defined the inflation target as an annual change in the consumer price index with a fixed interest rate (CPIF) of 2%. |

|

US |

“… so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” Federal Reserve Act (1977) |

The Federal Reserve defines its dual mandate. The first time was in 2012.4 The FOMC stated then that they assessed a long-term target of 2% inflation as consistent with the price stability objective. The Fed launched its first review of the monetary policy framework in 2019. The FOMC plans to conduct a review of the framework roughly every five years. |

After the review of the framework, two important changes were made in August 2020. The Fed now regards the inflation target of 2% as an average. Previously, the Fed reacted to deviations in employment from the Bank’s estimated maximum level of employment. The Fed will now only react to shortfalls in this level of employment. |

1 The Bank of Canada Act contains an introductory section about how the central bank was established, but the act has no objects clause.

2 Treaty on European Union

4 Statement on Longer-Run Goals and Monetary Policy Strategy. Federal Open Market Committee (FOMC). Update at the FOMC meeting in January each year. From 2019, the "statement" was reaffirmed each year in January with only minor revisions.

4 In Norway, acts are normally supplemented by regulations.

The objective of monetary policy from a historical perspective

How monetary policy has helped to maintain monetary stability has changed over time. Today, Norway has a floating exchange rate, but historically, Norwegian monetary policy has been pegged to one form or another of fixed exchange rate.1

After the fixed exchange rate regime broke down in December 1992, Norway continued to operate a more flexible exchange rate targeting regime. Even though there was not an exchange rate corridor for the krone, the orientation of monetary policy up until 1999 was primarily determined by current movements in the krone. When Svein Gjedrem became Governor in 1999, Norges Bank altered its response pattern. Instead of focusing on current movements in the krone, the key policy rate would be set so that more long-term preconditions for a stable exchange rate would be met: “Price and wage inflation which over time is on a par with euro countries is a precondition for a stable exchange rate against the euro. Moreover, monetary policy must not contribute to a downturn which undermines confidence in the krone”.2 In practice, monetary policy became oriented towards an inflation targeting regime.

An inflation target as the operational target of monetary policy was laid down in a mandate of 29 March 2001. The new regulation did not entail any material change in the monetary policy response pattern compared with the policy pursued over the two preceding years.3

Section 1 of the Regulation on Monetary Policy of 29 March

“Monetary policy shall be aimed at stability in the Norwegian krone’s national and international value, contributing to stable expectations concerning exchange rate developments. At the same time, monetary policy shall underpin fiscal policy by contributing to stable developments in output and employment.

Norges Bank is responsible for the implementation of monetary policy.

Norges Bank’s implementation of monetary policy shall, in accordance with the first paragraph, be oriented towards low and stable inflation. The operational target of monetary policy shall be annual consumer price inflation of approximately 2.5 per cent over time.

In general, the direct effects on consumer prices resulting from changes in interest rates, taxes, excise duties and extraordinary temporary disturbances shall not be taken into account.”

Although an objective of maintaining monetary stability was clearly stated in the Regulation on Monetary Policy of 2001, it had not been mentioned in the Norges Bank Act of 1985. The Regulation provided a more explicit formal and institutional anchor for monetary policy, which contributed to a greater degree of accountability. Norges Bank commented on the draft Regulation and on the consequences for the conduct of monetary policy in a letter to the Ministry of Finance on 27 March 2001.4 In the letter, Norges Bank wrote that

“[t]here has been confidence in the conduct of monetary policy. The communication of Norwegian monetary policy may nevertheless be facilitated with the Government now quantifying an inflation target, in line with international practice.”

The inflation target was set at 2.5 percent in the Regulation, while the implicit inflation target that the Bank previously followed was the level aimed for by euro area countries, ie approximately 2 percent.5 Regarding the actual numerical target, in the letter to the Ministry of Finance, Norges Bank wrote: “The inflation target of 2.5 per cent is slightly higher than similar objectives for Sweden, Canada and the euro area, but corresponds roughly to targets in the United Kingdom and Australia. The target is also approximately in line with the average inflation rate in Norway in the 1990s.”

The choice of 2.5 percent must be viewed in the context of the phasing-in of petroleum revenues, which would result in a real appreciation of the krone. The reason for choosing a slightly higher inflation target than the average rate applied by trading partners was for the real appreciation to take place gradually in the form of a widening gap in the price and cost level between Norway and its trading partners, and not in the form of a nominal appreciation of the krone.6

In the Financial Markets Report presented in spring 2016, the Ministry of Finance announced plans to assess the need to modernise the monetary policy mandate.7 The Ministry was of the opinion that the wording of the 2001 Regulation reflected the challenges that were relevant at the time.8 In the intervening period, monetary policy thinking and practice had changed. There was a desire to bring the mandate into alignment with the current conduct of monetary policy.9 10

The new mandate entered into force on 2 March 2018:

Regulation on Monetary Policy11

“Section 1 Monetary policy shall maintain monetary stability by keeping inflation low and stable.

Section 2 Norges Bank is responsible for the implementation of monetary policy.

Section 3 The operational target of monetary policy shall be annual consumer price inflation of close to 2 percent over time. Inflation targeting shall be forward-looking and flexible so that it can contribute to high and stable output and employment and to counteracting the build-up of financial imbalances.”

The most important changes comprised a downward revision of the inflation target to 2 percent from the previous 2.5 percent. The formulation contribute to high and stable output and employment replaced the formulation from the regulation from 2001 contributing to stable developments in output and employment. The word “high” is new compared with the regulation from 2001.

Also new was the inclusion of the consideration of counteracting the build-up of financial imbalances. From time to time, Norges Bank had been giving weight to this in its conduct of monetary policy within the framework of the regulation from 2001.

Stability in the krone’s value and stable expectations concerning exchange rate developments was a key element of the regulation from 2001 and helped to build a bridge from the earlier fixed exchange rate regime. However, the Ministry of Finance was of the opinion that there are good arguments to de-emphasise the krone exchange rate and exchange rate expectations as objectives per se.12 Experience has shown that the krone can be a useful shock absorber when the economy is affected by shocks. There is no reference to the krone in the new regulation.

The new Central Bank Act, which was passed by the Storting on 17 June 2019 and entered into force on 1 January 2020, confirmed the Regulation on Monetary Policy. The Act superseded the Norges Bank Act of 1985. The new Central Bank Act contains the following provision:

Section 1-2. Purpose of the central banking activities

(1) The purpose of the central banking activities is to maintain monetary stability and to promote the stability of the financial system and an efficient and secure payment system.

(2) The central bank shall contribute to high and stable output and employment.

1 See, for example, Alstadheim (2016).

2 See Gjedrem (1999).

3 See Kleivset (2012), page 40: “For the actual setting of the key policy rate, the formal policy change was less important, ‘since a monetary policy response pattern was already in place that was consistent with an inflation targeting regime’, as Gjedrem subsequently put it.”

5 The European Central Bank defined “price stability” as a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2 percent. This was subsequently clarified to “below, but close to 2 percent”.

6 See Torvik (2003) for a discussion of the argument and references to statements.

7 See Meld. St. 29 (2015–2016) Financial Markets Report 2015 (in Norwegian only).

8 See Ministry of Finance for more background on the most important changes (2018).

9 See Meld. St. 8 (2017–2018) New regulation on monetary policy (in Norwegian only).

10 See Norges Bank (2017) for a detailed account of the experience with the monetary policy framework in Norway since 2001.

11 On 1 January 2020, the Regulation on Monetary Policy from 2 March 2018 was reissued as a bestemmelse instead of a forskrift without entailing any change in the formulation. Since English does not formally distinguish between these two types of statutory instrument, this instrument is still translated as “Regulation on Monetary Policy”.

12 See Ministry of Finance (2018).

2.1 “Low and stable inflation”

2.1.1 Literature and international practice

There is a strong academic basis for the view that low and stable inflation is important for a well-functioning economy. High and unstable inflation leads to inefficient resource allocation as a result of undesirable changes in relative prices, difficulties with financial planning and inflation-induced tax distortions. Very low or negative inflation can also involve costs. Wages tend to move downwards less easily than upwards, so that some degree of inflation can make adjustments to relative wages less costly. When inflation is very low, monetary policy is also more likely to be constrained by the lower bound5 on the policy rate. There is no broad academic consensus on what defines the optimal level of inflation, but the inflation targets that are common among advanced economies are within the interval suggested in much of the literature.

Around the turn of the year 2021/22, inflation rose in most countries, owing to supply-side problems in the form of production and transport bottlenecks and to high energy prices, among other reasons. There is a discussion among economists about whether the increase in inflation is transitory or may persist. But prior to the recent rise, inflation has tended for a long time to be lower than central bank inflation targets. Many central banks have been concerned about this. The main reason for this concern is the decrease in the equilibrium real interest rate, which has reduced monetary policy space because of the policy rate’s lower bound. If inflation is too low, the challenges posed by a low equilibrium interest rate will be amplified.

A number of central banks have considered a variety of strategies to counteract the risk of inflation becoming too low and inflation expectations becoming entrenched at a below-target level. The US Federal Reserve (Fed) is the central bank that has gone furthest in its strategy, revising it in August 2020 and adopting average inflation targeting. With average inflation targeting, the central bank will, after inflation has been below target for a period, seek to subsequently bring inflation somewhat above target to “make up for” inflation that has been too low.6 By overshooting the target in this way, average inflation will be closer to the target, and this strategy may in principle better anchor inflation expectations.7

No other central bank has institutionalised an overshooting strategy such as the Fed’s, but both the European Central Bank (ECB) and the Bank of Canada (BoC) are open to the possibility of some degree of overshooting. In its Strategy Statement, the ECB writes8: “To maintain the symmetry of its inflation target, the Governing Council recognises the importance of taking into account the implications of the effective lower bound. […] This may also imply a transitory period in which inflation is moderately above target.” The BoC is a little more vague on the subject, but the following statement from their renewed monetary policy framework in December 2021 can be interpreted to mean that they are open to the possibility of some degree of overshooting as long as inflation is kept inside a tolerance band around the target9: “The Bank will also continue to leverage the flexibility of the 1–3 percent range to help address the challenges of structurally low interest rates by using a broad set of tools, including sometimes holding its policy interest rate at a low level for longer than usual.”

As for which prices, or what kind of price index, should be stabilised, theories differ somewhat. According to New Keynesian theory, which has had a strong influence on modern monetary policy thinking, monetary policy should stabilise the prices that are most rigid, ie prices that do not often change even though market conditions and costs can vary.10 In models where the exchange rate passes through fully to prices for imported goods, monetary policy should, according to New Keynesian theory, stabilise prices for domestic goods and services and not the consumer price index (CPI).11 If prices for imported goods are also rigid (gradual exchange rate pass-through), prices for imported goods should also be stabilised. In general, the prices with the highest degree of rigidity should, according to the theory, be assigned the highest weight in the price index the central bank seeks to stabilise.12

On the basis of purely theoretical considerations, the CPI may not be the optimal price index to stabilise. Nevertheless, virtually all the inflation-targeting countries target CPI inflation (Table 2.2). The main reason for this is that the CPI is an index that is well-established and understood by the general public and widely used in contracts. It is also an advantage that this index is produced by an institution outside the central bank (in Norway’s case, Statistics Norway (SSB)). Independence can underpin confidence in the inflation target.

Tabell 2.2 Inflation targeting in selected countries

|

Country |

Dual mandate |

Target |

Horizon |

|

Australia |

No |

CPI 2–3% |

Medium term |

|

Canada |

No |

CPI 2%1 |

Medium term |

|

Euro area |

No |

HCPI2 2% |

Medium term |

|

Iceland |

No |

CPI 2½% |

Average |

|

Japan |

No |

CPI 2% |

Medium to long term |

|

New Zealand |

Yes |

CPI 2%1 |

Medium term |

|

Norway |

No |

CPI 2% |

Will depend on the shocks to which the economy is exposed.3 |

|

UK |

No |

CPI 2% |

At all times, but depends on the shocks to which the economy is exposed. |

|

Switzerland |

No |

CPI, below 2% |

Medium term |

|

Sweden |

No |

CPIF4 2%1 |

Normally two years |

|

US |

Yes |

PCE5 on average 2 % over time |

Medium term |

1 Point target with a tolerance interval of ± 1 percentage point.

2 Harmonised consumer price index.

3 How quickly Norges Bank seeks to reach the target will depend on the shocks to which the economy is exposed and whether there is a conflict between the policy required to reach the inflation target and the other monetary policy considerations..

4 CPI with fixed interest rates (effects of changes in mortgage rates not included).

5 Personal Consumption Expenditure deflator.

Even though the target variable is the CPI, it may be appropriate in the operational conduct of monetary policy to focus on indicators of underlying inflation. This is because the CPI often shows short-term fluctuations that do not, or only to a limited extent, affect inflation further ahead and that the central bank therefore prefers to ‘look through’ to avoid causing unnecessary fluctuations in output and employment.

An indicator of underlying inflation can also be useful in the monetary policy trade-offs to distinguish signal from noise in inflation. Measures of underlying inflation are therefore used by many central banks as an operational guideline for monetary policy. Central banks usually use indicators that exclude the most volatile goods prices, such as prices for energy and food.

Most central banks monitor several indicators of underlying inflation. The BoC uses three measures.13 The Reserve Bank of Australia presents developments in underlying inflation using several measures in its monetary policy report.14 Some central banks have changed the indicators they give weight to without explicitly announcing the change.15

2.1.2 Norges Bank’s interpretation and assessment

The Regulation on Monetary Policy states that “[t]he operational target of monetary policy shall be annual consumer price inflation of close to 2 percent over time.” Thus, the target variable is the CPI and the target is 2 percent.16 The words “over time” and “close to” are not specifically defined in the Regulation, but reflect two conditions:

(i) Monetary policy cannot control inflation perfectly, and there is a considerable lag between changes in the policy rate and the impact on inflation.

(ii) Different types of shocks will generally occur and different objectives will have to be assessed against each other in the short term. Even if the central bank had been able to control inflation perfectly, it would not have been appropriate to keep inflation at target at all times.

As long as there is confidence that inflation will be low and stable, it is unlikely, in Norges Bank’s assessment, that fluctuations in inflation around the target will involve substantial economic costs. At the same time, the Bank will give weight in interest rate setting to avoiding large and persistent deviations from the inflation target, whether above or below the target.

Norges Bank has no specific strategy, for example overshooting, to prevent inflation from becoming too low as a result of the combination of a low equilibrium real interest rate and a lower bound on the policy rate. The Bank’s assessment is that this likely poses less of a challenge for Norway in terms of policy space than for most other countries. First, the krone has a tendency to depreciate when a global economic downturn occurs and there is substantial uncertainty. The krone depreciation pushes up inflation, thereby reducing the real interest rate for a given level of the policy rate. Second, Norway has considerable fiscal space. See Section 3.6 for a more detailed discussion of the interplay between monetary and fiscal policy.

Most central banks choose an inflation target horizon, for example two years (Table 2.2). However, the optimal horizon will generally depend on the type of shock to the economy and its size and duration. Norges Bank therefore applies a flexible horizon. The specific horizon at any one time will reflect the monetary policy trade-offs (see Section 2.4).

Norges Bank uses several indicators of underlying inflation (see “Indicators of underlying inflation”). However, the Bank’s main indicator is the CPI-ATE, which is the CPI adjusted for tax changes and excluding energy products17. It is the main indicator because energy prices in Norway, and electricity prices in particular, are highly volatile. It is also an advantage that the CPI-ATE is calculated and published by an independent institution, Statistics Norway (SSB). It has become a well-established element in Norges Bank’s monetary policy communication. However, one disadvantage of the CPI-ATE is that this indicator can include transitory price shocks that the Bank chooses to look through in monetary policy and that an indicator of underlying inflation should ideally correct for. The CPI-ATE includes volatile food prices (particularly fruit and vegetables) and volatile air travel prices, which it can often be appropriate to disregard. At the same time, changes in energy price trends can occur that the CPI-ATE does not capture, but that the Bank wishes to take into account.18 No single indicator of underlying inflation is ideal, suggesting that the Bank should look at several indicators and use judgement. For communication purposes, however, it may be appropriate to choose one main indicator.

5 Where the level of the policy rate is so low that it no longer provides stimulus to the economy.

6 In its “Statement on Longer-Run Goals and Monetary Policy Strategy”, the Fed writes: “[T]he Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.” Federal Reserve Board – 2020 Statement on Longer-Run Goals and Monetary Policy Strategy

7 See Røisland (2017) for a more detailed description of average inflation.

8 https://www.ecb.europa.eu/home/search/review/html/ecb.strategyreview_monpol_strategy_statement.en.htm

9 Joint Statement of the Government of Canada and the Bank of Canada on the Renewal of the Monetary Policy Framework – Bank of Canada.

10 For international studies, see: Bils and Klenow (2004), Nakamura and Steinsson (2008). For Norwegian studies, see: Erlandsen (2014) and Wulfsberg (2016).

11 See Galì and Monacelli (2005).

12 See Aoki (2001).

13 See Bank of Canada (2016).

14 See Reserve Bank of Australia (2019).

15 See Fay and Hess (2016).

16 In the period between the introduction of the inflation target in 2001 to 2018, the target was 2.5 percent.

17 The main indicator of underlying inflation used between 2008 and 2013 was the CPIXE.

18 An indicator intended to capture this is the CPIXE, which is the CPI adjusted for tax changes and excluding temporary changes in energy prices. This indicator is constructed in the same way as the CPI-ATE but takes account of trends in energy prices instead of excluding energy prices completely, as is the case for the CPI-ATE.

Indicators of underlying inflation1

The purpose of indicators of underlying inflation is to strip out transient volatility in inflation and provide a real-time measure of trend consumer price (CPI) inflation. Some price components of the CPI tend to vary considerably from period to period. These include energy prices, which can rise sharply in one period and then fall the next. A good indicator of underlying inflation must have certain statistical properties.2 It should not deviate systematically from the CPI, be less volatile than the CPI and be able to predict future CPI inflation), it must be published at the same time as the CPI, must not be subject to revision and should be easy to understand. In addition, it is an advantage for it to be published by an independent institution.

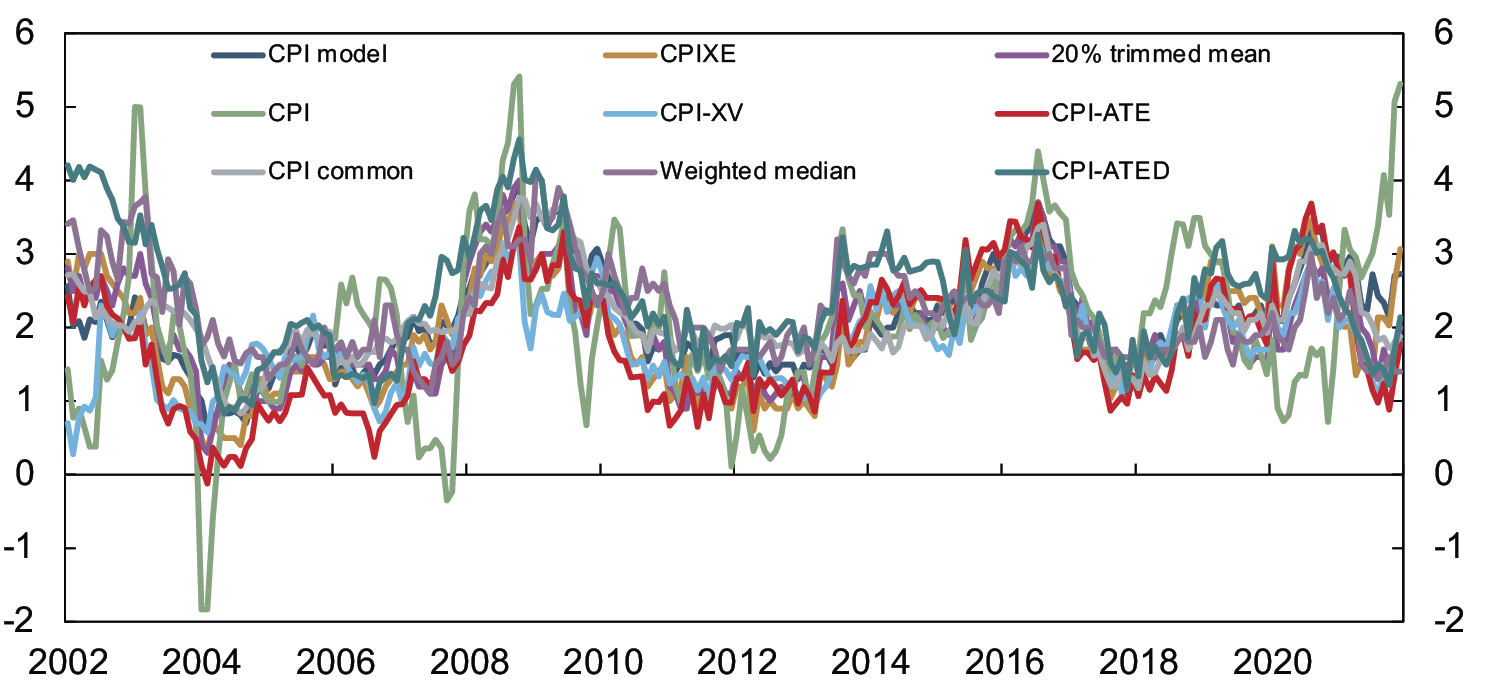

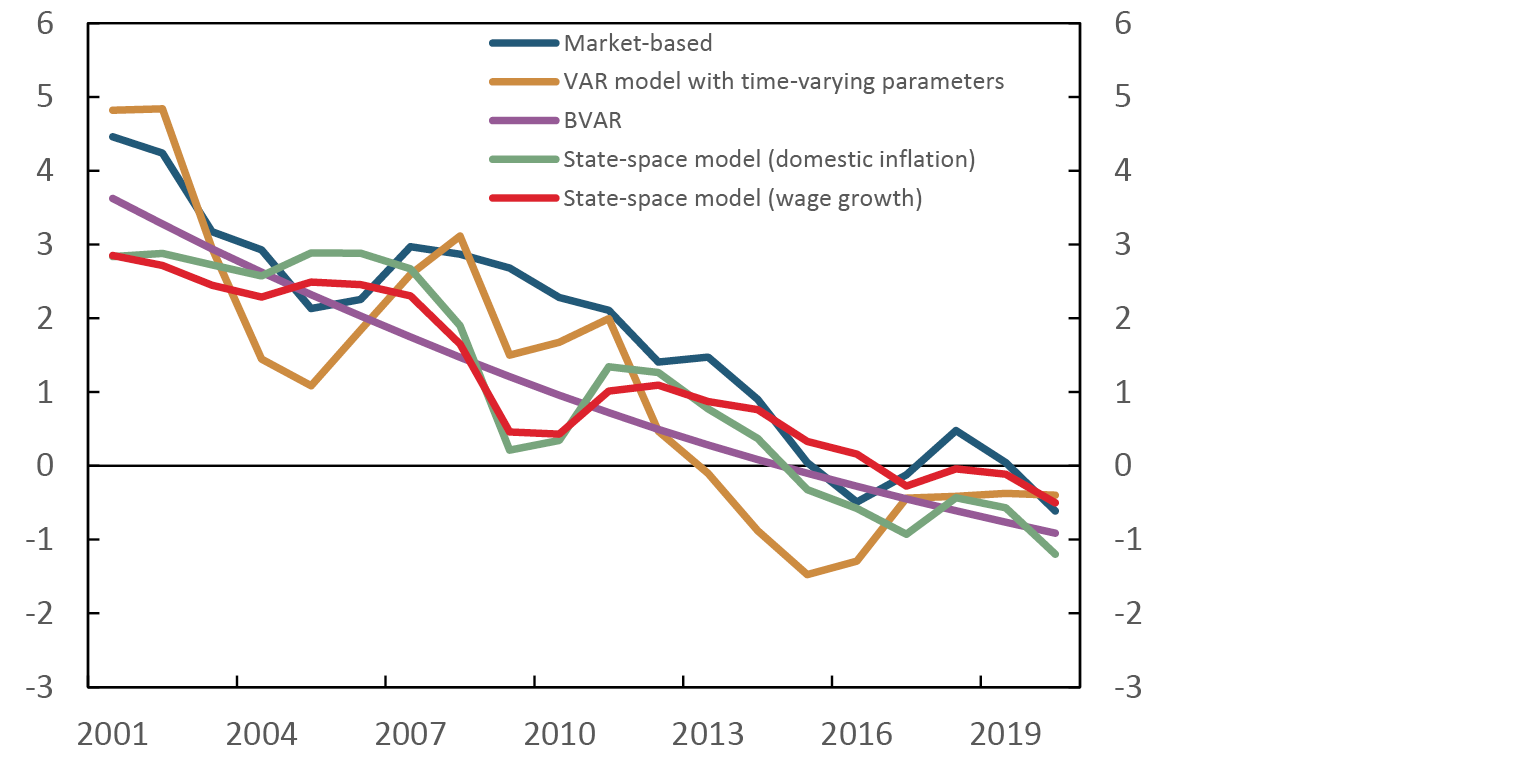

Norges Bank uses a range of indicators of underlying inflation (Chart 1). The most important for Norges Bank’s analyses is the CPI adjusted for tax changes and excluding energy products (CPI-ATE). CPI-ATE inflation is included in the Bank’s main macroeconomic model NEMO, but other indicators are used in the Bank's inflation assessments and may influence the Bank's short-term inflation projections.

Chart 1 Indicators of underlying inflation. Twelve-month change. Percent. January 2002 – December 2021

Sources: Statistics Norway and Norges Bank

- CPI-ATE: CPI adjusted for tax changes and excluding energy products. Published by Statistics Norway.

- CPIXE: CPI adjusted for tax changes and excluding temporary changes in energy prices. Based on data from Statistics Norway but produced and published by Norges Bank.3

- CPI-XV: CPI adjusted for developments in the eight most volatile price series at group level4. Energy prices are excluded in toto. For the remaining seven5 the average change over the past six or 12 months is included. Based on data from Statistics Norway but produced by Norges Bank.6

- Trimmed mean (20%): Various sub-groups are excluded from month to month. The twelve-month change at sub-group level in the CPI is sorted in ascending order. Then the price series corresponding to 10 percent of the CPI weights at both the top and bottom of the distribution are removed. Produced by Statistics Norway and published by Norges Bank.

- Weighted median: Special case of trimmed mean. The underlying rise in prices in a given month is specified by the price change located at the fiftieth percentile ranked by the sub-groups’ CPI weights. Produced by Statistics Norway and published by Norges Bank.

- CPIM: Constructed by changing the weights in the CPI at group level. Each product group is weighted based on how well it has historically forecast total CPI one month ahead. Better forecasts result in a higher weight. Based on data from Statistics Norway but produced by Norges Bank.7

- CPI common: A measure of the common trend in the rise in prices across price series in the CPI at group level. A factor model is used to filter out price movements caused by sector-specific factors and find the trend that is common to all goods and service groups. Based on data from Statistics Norway but produced by Norges Bank.8

- Domestic CPI-ATE: A measure of the rise in prices for domestically produced goods and services. In principle, it is not an indicator of underlying inflation, but in theory and practice, it correlates more closely with domestic resource use than the total CPI. It is thus able to capture price pressures stemming from domestic factors. Based on data from Statistics Norway but produced and published by Norges Bank.

1 The box is based on Husabø (2017a).

2 See Husabø (2017a), Jonassen and Nordbø (2007), Roger (1998) and Wynne (1999).

3 See Hov (2009).

4 At group level, the CPI is divided into 39 product and service groups. At sub-group level, the CPI is divided into 93 product and service sub-groups.

5 Air fares, household textiles, fruit, coffee, tea and cocoa, vegetables, fish, newspapers, books and stationery.

6 Not published regularly.

7 See Hov (2005).

8 See Husabø (2017b).

2.2 “High and stable output and employment”

2.2.1 Literature and international practice

Setting monetary policy to achieve an inflation target does not mean that monetary policy only focuses on inflation. The mandates of inflation-targeting central banks usually include formulations indicating that real economic stability should also be considered. In the short term, conflicts can arise between stabilising inflation and stabilising the real economy, and central banks must then make a trade-off between the two.

There is a sound theoretical basis for assuming that a large share of business fluctuations involves welfare costs and should be dampened using countercyclical monetary policy.19 This is because consumers may prefer high and stable consumption, and fluctuations lead to inefficient resource allocation. The usual theoretical models assume that there is a representative household. These models do not capture all of the costs from variations in output and employment, for example that involuntary unemployment will normally involve substantial costs for an individual, and for the household. In models based on a representative household, a downturn will only entail that the household spends a little less time working. In more realistic models, which assume imperfect risk sharing and labour market frictions, for example that time and costs are associated with finding a new job, there are substantial welfare costs associated with variations in employment. Monetary policy should then stabilise employment/unemployment in addition to inflation.20

There will normally be no conflict between stabilising output and stabilising employment. Only if there are substantial fluctuations in productivity, can a conflict arise in the short term.

Both the supply and demand for labour will vary as a result of business cycle fluctuations. During downturns, when labour demand is low and job prospects are poor, labour supply will be lower than its underlying trend. For example, young people may choose to continue their education rather than seek work. Conversely, labour supply will periodically be higher than the underlying trend when labour demand is high and job prospects are favourable.

Over time, employment is limited by the underlying labour supply trend. At the same time, there will always be some unemployment in the economy. This is partly because there will always be some people who are temporarily between jobs, and because employers’ needs do not fully match the qualifications and wage expectations of those seeking work. In the literature, this is referred to as natural unemployment or equilibrium unemployment. This unemployment can change over time in response to structural changes in the labour market. The underlying labour supply trend minus equilibrium unemployment can be referred to as potential employment. This may be interpreted as the level of employment sustainable over time. If employment remains above potential, pressures normally arise that accelerate wage growth and bring inflation above target. However, there may be temporary fluctuations in labour supply for cyclical reasons. How much a given deviation in employment from potential employment affects wage growth may therefore vary.

New Keynesian literature often assumes that potential employment is lower than the socially optimal level of employment. The reasons are that firms have market power and limit output to earn higher profits by keeping price margins high, and that wage earners have market power and drive wages above a level consistent with full employment.

There is broad consensus among economists that an expansionary monetary policy can increase output and employment in the short term, but that it cannot raise these levels permanently. Attempting to keep employment permanently above potential employment will only lead to high price and wage inflation.21 To ensure price stability, the level of ambition for monetary policy should be to stabilise employment close to the highest level consistent with price stability over time.

In standard models, it is usually assumed that economic shocks are symmetric around a trend. In these models, monetary policy can only affect variations in output and employment around these trends. Stabilisation policy only affects the variance of real economic variables – not the average.

Some of the literature assumes instead that economic fluctuations are asymmetric. A pure example of asymmetric fluctuations is the “plucking” model, developed by Milton Friedman.22 In this model, negative shocks generate cyclical fluctuations, bringing output and employment below potential. Thus, potential output and employment are ceiling levels and not average levels as in standard models. If the plucking model is correct, traditional ways of estimating potential output and employment will systematically underestimate their potential levels.

Another example of asymmetry is when the occurrence of economic crises (for example financial crises) can result in downturns that are deeper and more protracted than upturns, owing to hysteresis effects in the labour market23, for example, and because high debt levels can dampen demand for a long period and reduce investment.24 If economic policy can counteract such sharp downturns, this would raise the average level of output and employment. Much of the research on this topic has focused on the role of monetary policy in counteracting crises. We will come back to this in Section 2.3.

Once a sharp downturn has occurred, monetary policy should in principle attempt to bring employment back to its pre-crisis level. A challenge with this approach is that such a policy could lead to sharply accelerating wage inflation if hysteresis effects are present in the labour market. As long as any hysteresis effects are not permanent, it may be appropriate for policymakers to accept that inflation will be above target for a period until labour market conditions normalise. More jobs could then be created, bringing back some of those who have withdrawn from the labour market.25 However, the risk of such a policy is that hysteresis effects can prove to be very prolonged or permanent. Monetary policy would then have to be tightened considerably at a later stage to bring inflation back to target.

To the extent that such asymmetries as described above exist, monetary policy can in principle not only reduce the variation in output and employment, but also, coupled with an active stabilisation policy, contribute to higher average output and employment.

Internationally, only central banks with what are referred to as dual mandates explicitly pursue the objective of high employment. The US Federal Reserve (the Fed) and the Reserve Bank of New Zealand (RBNZ) have such dual mandates, where the objectives of high employment and price stability are of equal importance. In the US, the mandate is formulated as “maximum employment26, stable prices and moderate long-term interest rates”. In 2020, the Fed affirmed that it may be necessary to target inflation of somewhat above 2 percent after a period of below-target inflation. The objective is to achieve inflation that averages 2 percent over time. At the same time, the Fed clarified that while it previously reacted to “deviations” in employment from the Fed’s estimated “employment’s maximum level”, it would now only react to “shortfalls” in employment from this level. The Fed’s strategy attempts to prevent employment falling below a maximum level. The consequence of this is that the Fed will not tighten monetary policy solely in response to what appears to be a tight labour market.

In New Zealand, a new operational monetary policy objective was added to the price stability objective for the RNBZ in 2018. The RBNZ was now to also “contribute to supporting maximum sustainable employment”27, defined as as “the highest utilisation of labour resources that can be maintained over time without generating an acceleration in inflation”.28 In 2018, maximum sustainable employment and price stability were given equal status, thereby formally instituting a dual mandate for the RBNZ.29

2.2.2 Norges Bank’s interpretation and clarification

In Norway, price stability is the primary objective of monetary policy. Even though there are similarities between the formulation “high and stable output and employment” in the Norwegian Regulation on Monetary Policy and the formulations in the dual mandates of the Fed and the RBNZ, the two objectives, price stability and high and stable output and employment, do not have equal status. In practice, however, it is not obvious that a central bank with a dual mandate would pursue a different monetary policy from a central bank with a flexible inflation target. A central bank with a flexible inflation target will also be concerned about the level of employment.

The Regulation on Monetary Policy does not itself provide guidelines on how much weight monetary policy can attach to high and stable output and employment, given that inflation expectations are firmly anchored.

In the conduct of monetary policy, the word “high” is given an operational interpretation that takes into account what monetary policy can and cannot affect. The level of ambition for monetary policy must be realistic. In line with other central banks with similar objective formulations, Norges Bank has interpreted “high” as the highest level consistent with price stability over time. If Norges Bank systematically seeks to bring employment above this level by means of an expansionary monetary policy, a period of tighter monetary policy and higher unemployment may be necessary at a later stage in order to restore price stability. The highest level of employment that is consistent with price stability over time is primarily determined by structural conditions such as the tax and social security system, wage formation and labour force composition. For example, changes in the pension system since 2011 have contributed to an increase in labour supply, while a larger proportion of elderly in the population has reduced labour supply. Monetary policy can probably have very limited impact on how high employment can become before wages and prices rise considerably, but it can contribute to stabilising employment around this level.

Norges Bank estimates an output gap, which is used as an indicator in assessing output and employment relative to the highest level that is consistent with price stability over time (see “Norges Bank’s estimates of the output gap”). When estimating the output gap, particular weight is given to labour market developments, while short-term fluctuations in labour productivity are normally disregarded. There is therefore no conflict between high and stable output and high and stable employment in the Bank’s operational interpretation of the mandate.

The economic costs of cyclical fluctuations are asymmetrical, which Norges Bank’s monetary policy response pattern seeks to take into account. Normally, an increase in employment beyond what is estimated to be the highest level consistent with price stability involves no direct costs. Only the indirect costs – wage and price inflation becoming too high – will normally prompt the Bank to seek to counteract such an increase. As long as inflation is expected to remain within a range close to 2 percent, the Bank will not normally aim to quickly close a positive output gap by tightening monetary policy unless there are signs that financial imbalances are building up. Lower employment, on the other hand, involves direct costs both in the form of losses in aggregate income and output and in the form of economic and health consequences for those unable to find employment. When the Bank estimates a negative output gap, this implies in isolation that the Bank will pursue an expansionary monetary policy to stimulate employment.

Possible hysteresis effects can also contribute to asymmetry in the costs of cyclical fluctuations. When downturns are deep and protracted, unemployment can become entrenched at a high level, with many job seekers eventually withdrawing from the labour market. Wage and price inflation can then accelerate at a lower level of employment than before the downturn. To prevent a sharp downturn from resulting in long-term or permanent falls in employment, it may be appropriate to accept that inflation will temporarily overshoot the target while labour market conditions normalise. By preventing downturns from becoming deep and protracted, monetary policy can contribute to keeping the average level of employment over time as high as possible.

19 See Galí, Gertler and Lopèz-Salido (2007). In certain models, fluctuations are efficient and should not be counteracted, but such models are based on strict and to some extent unrealistic assumptions, for example that all prices and wages are flexible.

20 See Blanchard and Galí (2010).

21 See Kydland and Prescott (1977) and Clarida, Gali and Gertler (1999).

22 See Friedman (1964, 1993). See also Dupraz, Nakamura and Steinsson (2019) for empirical support and the microfoundations of the “plucking” model.

23 Hysteresis refers to persistent unemployment that rises with every swing in the economic cycle. One explanation for this phenomenon is that in an upturn demand in the labour market is for different or a higher level of skills than the skills that became redundant in the preceding downturn.

24 See Blanchard, Cerutti and Summers (2015).

25 Such a strategy is proposed by Rudebush and Williams (2016) and Ball (2015), among others.

26 “Maximum employment” is specified as the highest employment level of employment that is sustainable over time, see Williams (2012).

27 See Monetary Policy Statement, May 2018 (Reserve Bank of New Zealand’s monetary policy report).

28 See Monetary Policy Statement, November 2018 (Reserve Bank of New Zealand’s monetary policy report).

29 See Williams (2019).

Norges Bank’s estimates of the output gap1

Norges Bank bases its assessments of the output gap on a broad set of indicators and models that are revised and expanded over time. The output gap is defined as the difference between actual and potential output. Potential output means the highest level of output and employment compatible with price stability over time. The methods used to estimate and analyse the output gap in the Bank’s analysis system are based on an assumption that cyclical fluctuations do not affect output and that the output gap will normally be close to zero in the estimates within a five-to-10-year horizon. Theories about hysteresis and about whether cyclical fluctuations can affect potential output challenge this assumption and imply that there may be other measures of potential output that take into account hysteresis effects. There are established methods for estimating this level, but this is an area that we are continuing to explore.

The output gap is not observable, and there is no widely agreed best method for estimating it. No method is without its drawbacks and all methods involve the use of judgement. As the output gap is unobservable, it is also challenging to evaluate the different methods for estimating it.

A good measure of the output gap should nevertheless satisfy certain criteria. The estimate of the output gap should have good real-time properties, ie the historical estimates of the output gap should show little change as a result of new information. Moreover, a common interpretation of potential output is output consistent with stable price and wage inflation. In periods when capacity utilisation is high and employment is growing rapidly relative to the labour force, price and wage pressures tend to increase. A good measure of the output gap should therefore provide information about future developments in inflation and wage growth. A positive output gap implies that the economy is operating above potential and that growth will eventually slow. A good estimate of the output gap should therefore provide an indication of future output growth, as well as some indication of developments in unemployment, since unemployment has historically tracked the output gap with a lag.2

Many methods can be used to measure the output gap.3 The most widely used methods are simple univariate methods (statistical filters). These methods are simple in practice and characteristically only use GDP data. The so-called Hodrick-Prescott (HP) filter is an example of a univariate method.4 There are also a number of multivariate models which, in addition to GDP data, use data on other variables. Such models have much better real-time properties and also have better real-time forecasting properties compared with simple univariate methods such as the HP filter.

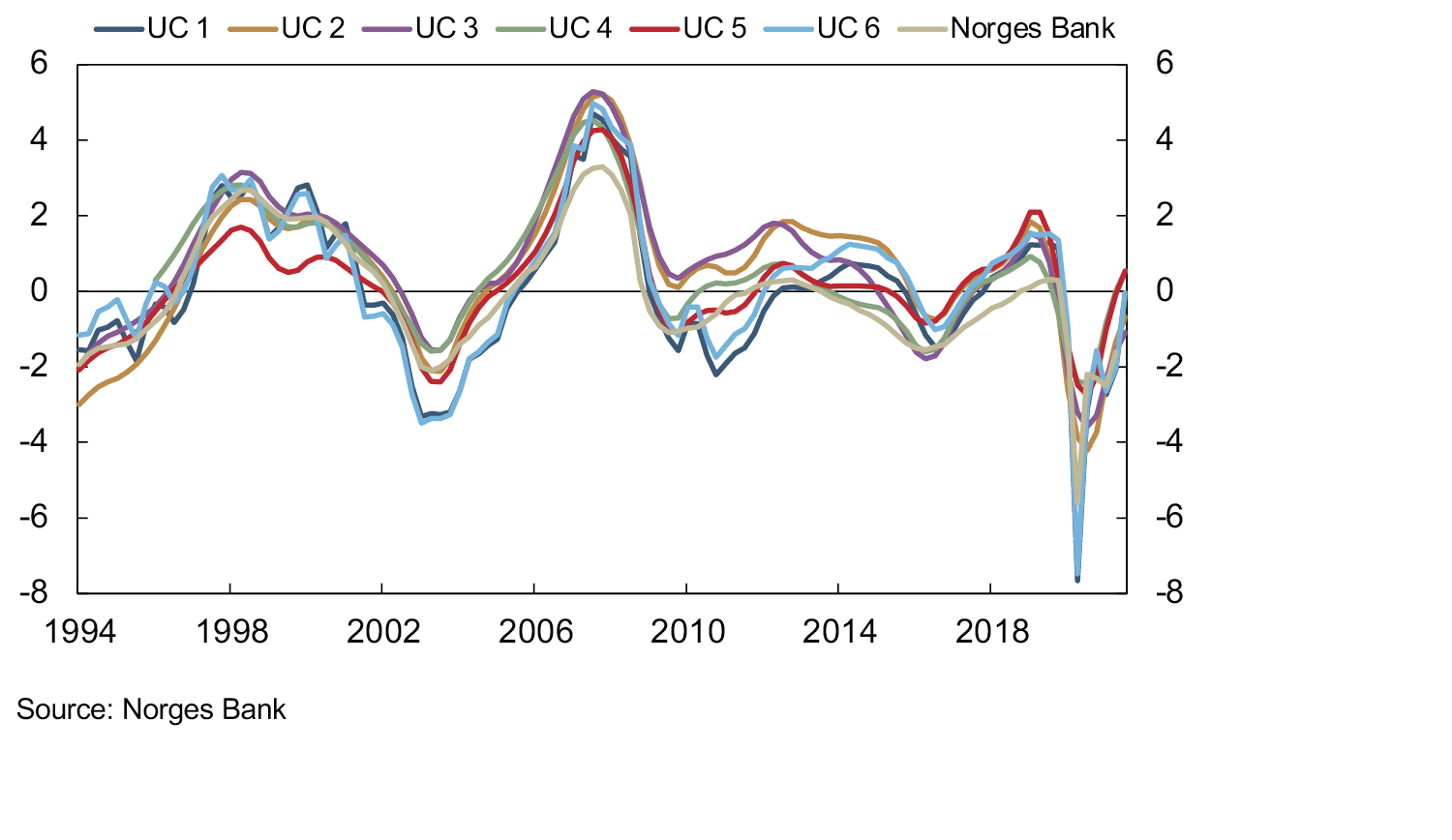

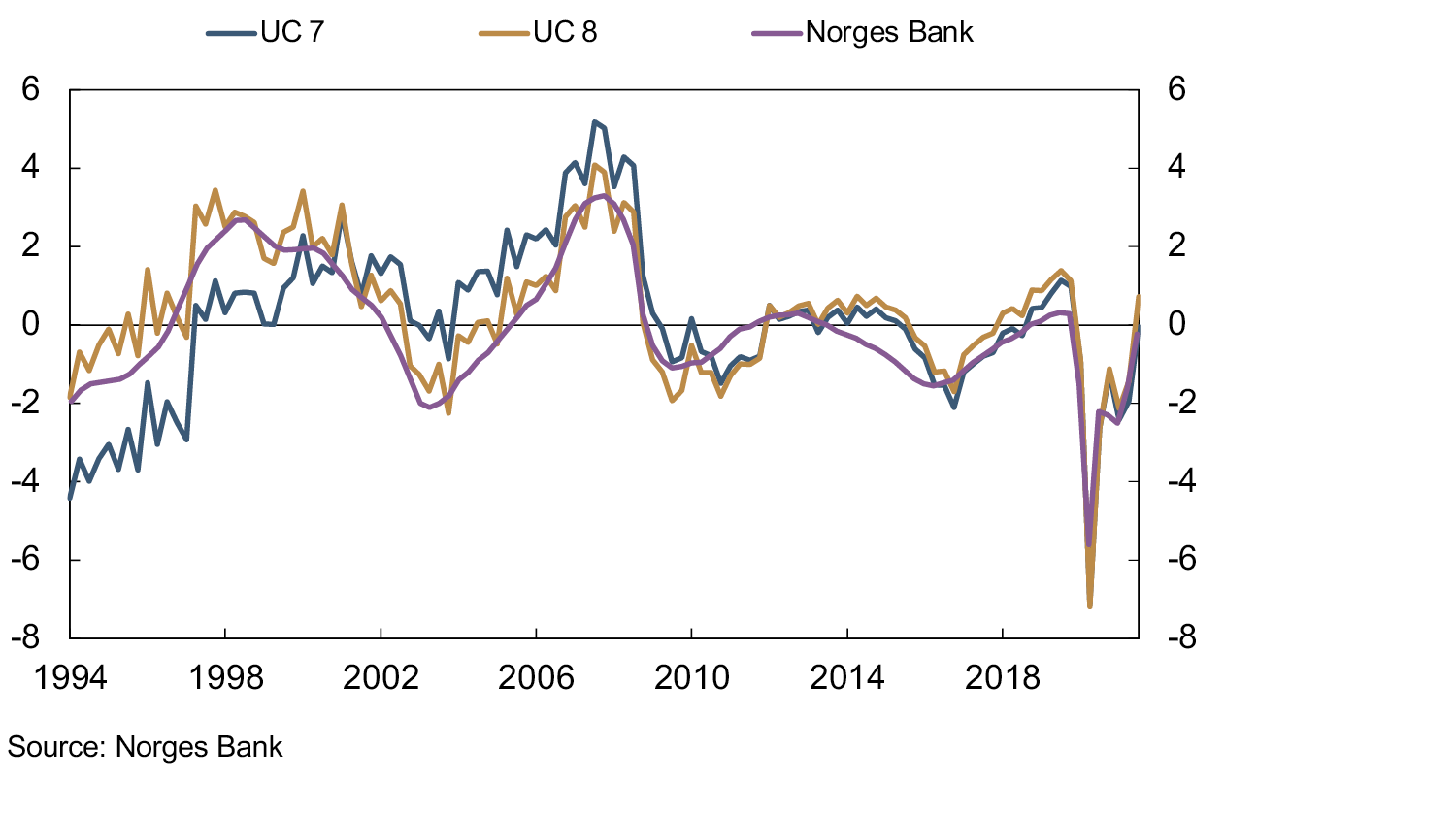

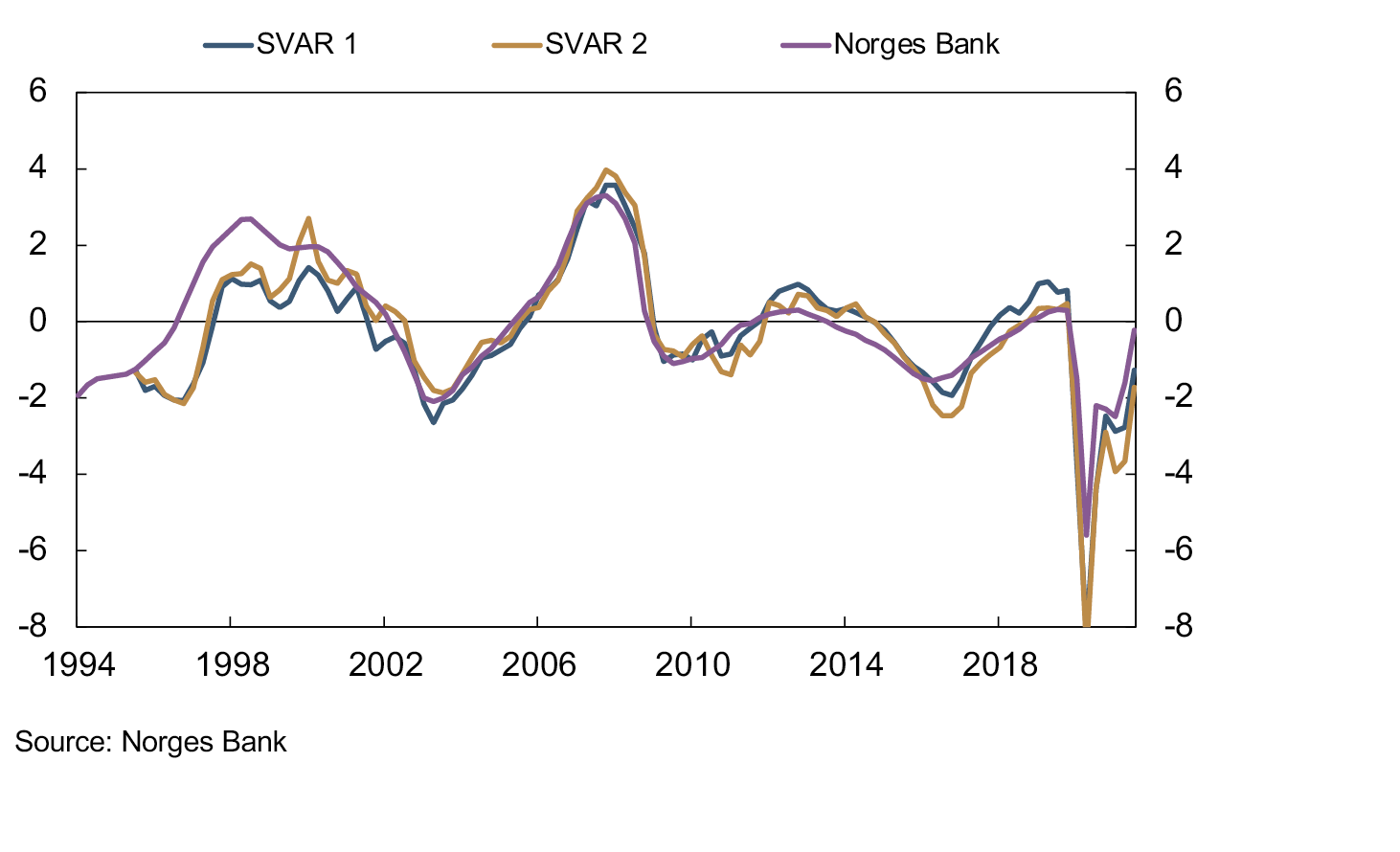

To estimate the output gap, Norges Bank uses a set of multivariate models. This is because, on the whole, an average of multivariate models has featured better forecasting properties than the individual models. The models use data on both real and nominal variables. The models are based on two different multivariate methods: unobserved component (UC) models and structural VAR (SVAR) models5. In addition, Norges Bank looks at various labour market indicators when estimating the output gap.

A UC model posits that GDP can be decomposed into an output gap and potential GDP, which are both unobservable. In addition, the model specifies how the unobserved variables evolve over time. The estimation of these equations uses information about variables such as real wage growth, unemployment, business investment, inflation, credit and house prices. At Norges Bank, we estimate eight different UC models. The models differ in terms of estimation frequency, the data used, estimation period and modelling of potential growth. All of the models are estimated using Bayesian methods and are based on published articles on the output gap.6

Like the UC models, SVAR models use data from a number of variables to estimate the output gap. We estimate two SVAR models. One (SVAR 1) uses GDP growth for mainland Norway and unemployment (NAV), while the other (SVAR 2) also includes domestic inflation.

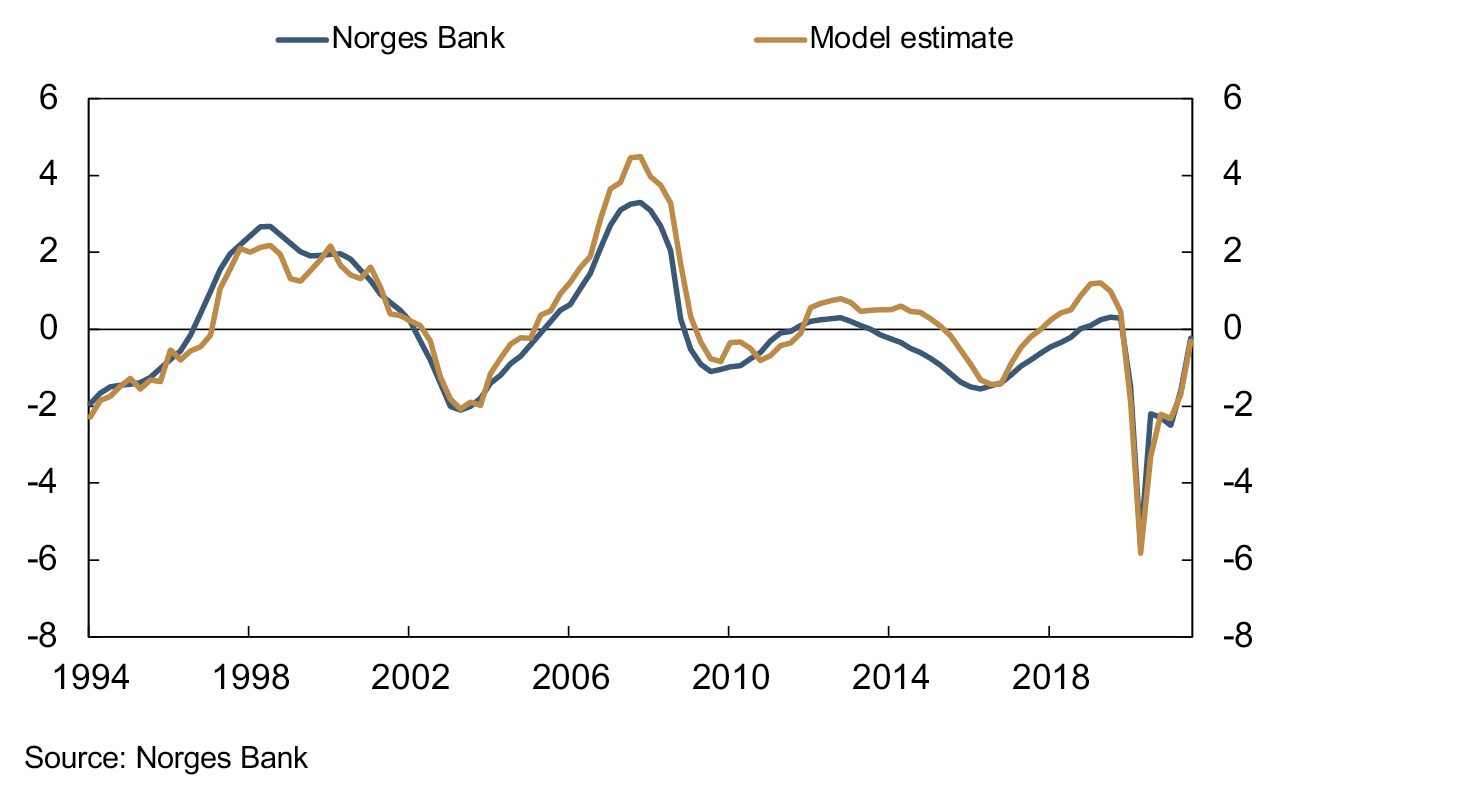

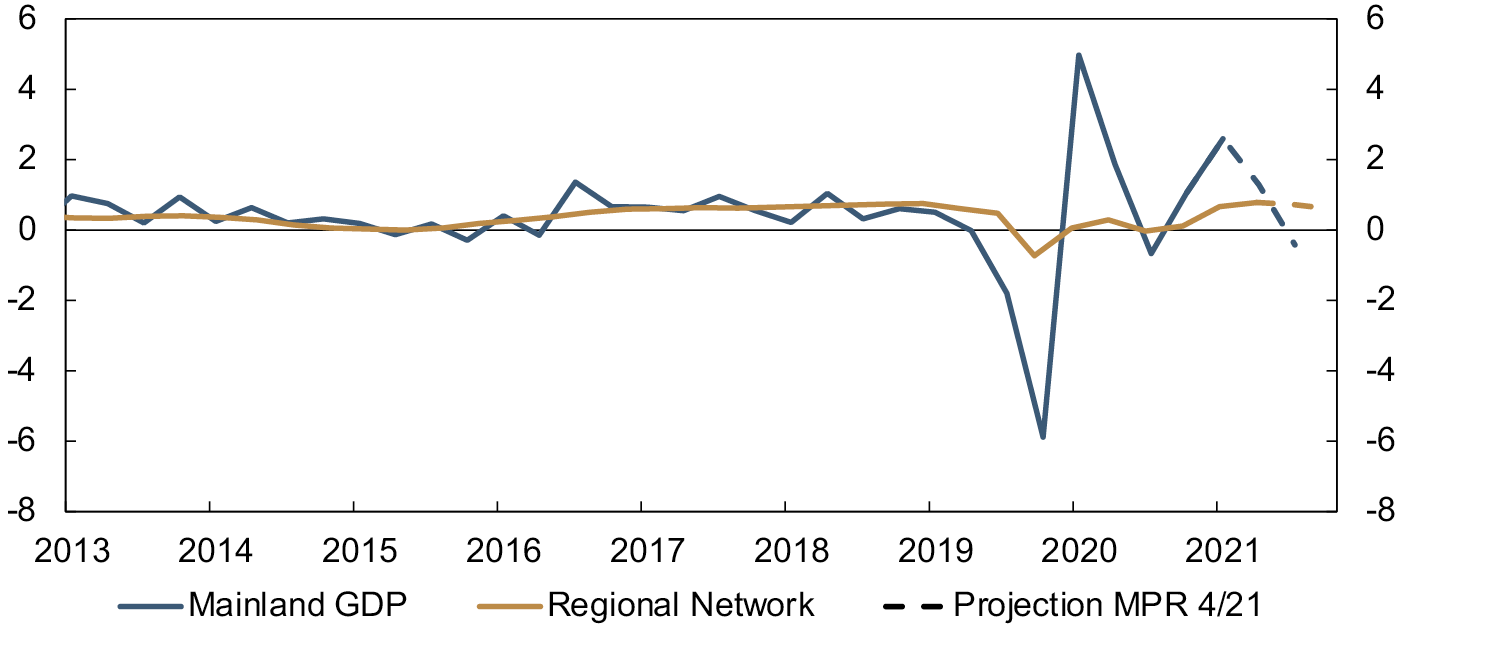

The charts below show estimates from the different models together with Norges Bank’s assessments of the output gap as presented in Monetary Policy Report 4/21. Charts 1 and 2 show estimates based on the UC models. For Chart 1, information on real wage growth, unemployment, business investment and inflation was used. For Chart 2, information on credit and house price developments was used. Chart 3 shows estimates based on the two SVAR models. Chart 4 shows an average of the models together with Norges Bank's output gap. Overall, the various models are closely in line with Norges Bank’s estimates of capacity utilisation over time.

Chart 1 Chart 1 UC models 1–6

Chart 2 UC models 7–8

Chart 3 SVAR models

Chart 4 Model estimate

There is normally a close correlation between the gap between employment and potential employment on the one hand, and overall capacity utilisation in the economy on the other. It is not possible to measure precisely the level of potential employment. When capacity utilisation is estimated to be above a normal level, employment is usually also assessed as above potential. When capacity utilisation is estimated to be below a normal level, employment appears able to increase without the risk of accelerating price and wage inflation.

Norges Bank’s assessments of the output gap include a number of important indicators, which so far are not included in the above-mentioned models. One reason is that there is little historical data for several of these indicators. An important example of such an indicator is Norges Bank's Regional Network contacts' assessment of capacity utilisation and labour supply in the Regional Network. Norges Bank will work to include this information in the Bank's model system.

Capacity utilisation during the Covid pandemic

Assessing the output gap through the Covid pandemic has been more challenging than normal. Usually it is reasonable to assume fairly steady growth in the economy’s potential output, which reflects developments in the capital stock, working age population and productivity level in the economy. But the shutdown of the economy in 2020 was a large and unusual shock that affected both the supply and demand sides of the economy.

It was assumed that part of the fall in GDP was ascribable to a temporary decline in potential GDP. Some of the factors of production in some industries were not available owing to lockdown. For example, real capital could not be utilised by firms that had been closed.

On the other hand, there was a historic increase in unemployment. Even though much of the rise in unemployment was due to furloughs, ordinary unemployment also rose. Unemployment also increased in sectors not directly affected by lockdown. Labour market developments therefore indicated that the economic downturn triggered spare capacity in the economy and thus a negative output gap. Put another way, demand in the economy fell more than supply. The fact that the Covid crisis both reduced potential output and led to a negative output gap is well in line with assessments made by other central banks.7

Throughout the pandemic, we have also been concerned that the risk of high unemployment and an abrupt decline in employment could lead to persistently negative consequences for labour supply through what are referred to as hysteresis effects. However, in the light of the rapid recovery in employment in autumn 2021 and a continued high level of labour force participation, the projections in MPR 4/21 did not assume that long-term potential employment was being affected by the pandemic, as had been assumed previously.

1 The box is based on Hagelund, Hansen and Robstad (2018).

2 See Armstrong (2015) and Kamber et al (2017).

3 See Hjelm and Jonsson (2010) for a good overview.

4 The HP filter yields potential GDP by minimising the difference between actual and potential GDP, given a limitation on how much potential GDP growth can vary over time (see Hamilton (2017) for an extensive discussion of the HP filter).

5 Vector-autoregressive (VAR) models are stochastic models used to capture the linear relationship between time series. A structural VAR model is a VAR model on which restrictions have been imposed based on economic theory.

6 See Hagelund, Hansen and Robstad (2018) displayed.

2.3 “Counteracting the build-up of financial imbalances”

2.3.1 Literature and international practice

Financial crises are rare events, historically occurring every 15 to 20 years.30 Empirical studies show that financial crises involve higher costs than other recessions and that debt-driven upturns are associated with deeper and more persistent recessions and crises (see also Section 2.2) often referred to as “credit bites back”.31 The global financial crisis in 2008 showed that instabilities in the financial system can have very adverse macroeconomic consequences.

There is a broadly held view among central bank economists that the regulation and supervision of financial institutions, including macroprudential policy, should be the first line of defence against shocks to the financial system. Monetary policy can counter the build-up of financial imbalances by “leaning against the wind”. When there is a risk of a build-up of financial imbalances in the economy, the policy rate will be kept higher than would otherwise have been the case. The purpose is to mitigate downside risks to the economy and thus reduce the risk of financial imbalances triggering or amplifying a downturn.32 33 Since financial crises are relatively rare, the empirical basis is uncertain. However, research indicates that monetary policy can contribute to some extent to reducing the likelihood and severity of future crises.34

The cost of “leaning against the wind” is a policy rate curbing, for a period, output and inflation more than would normally be implied by the central bank’s response pattern. If the policy rate is systematically kept higher than implied by price stability considerations, this may affect average inflation over time and inflation expectations may fall.

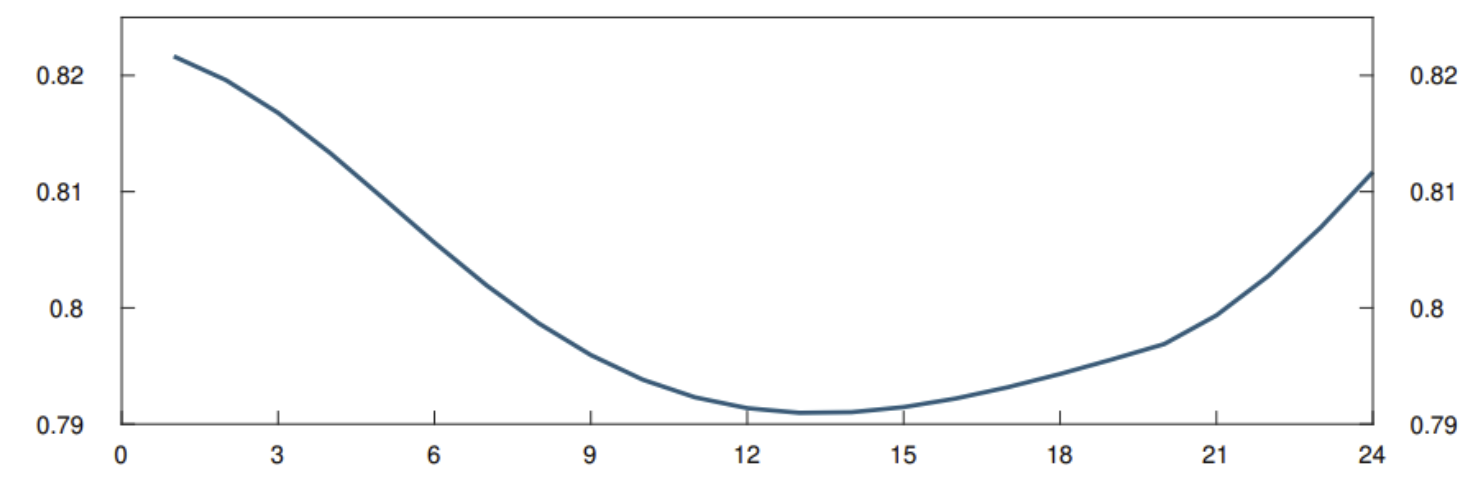

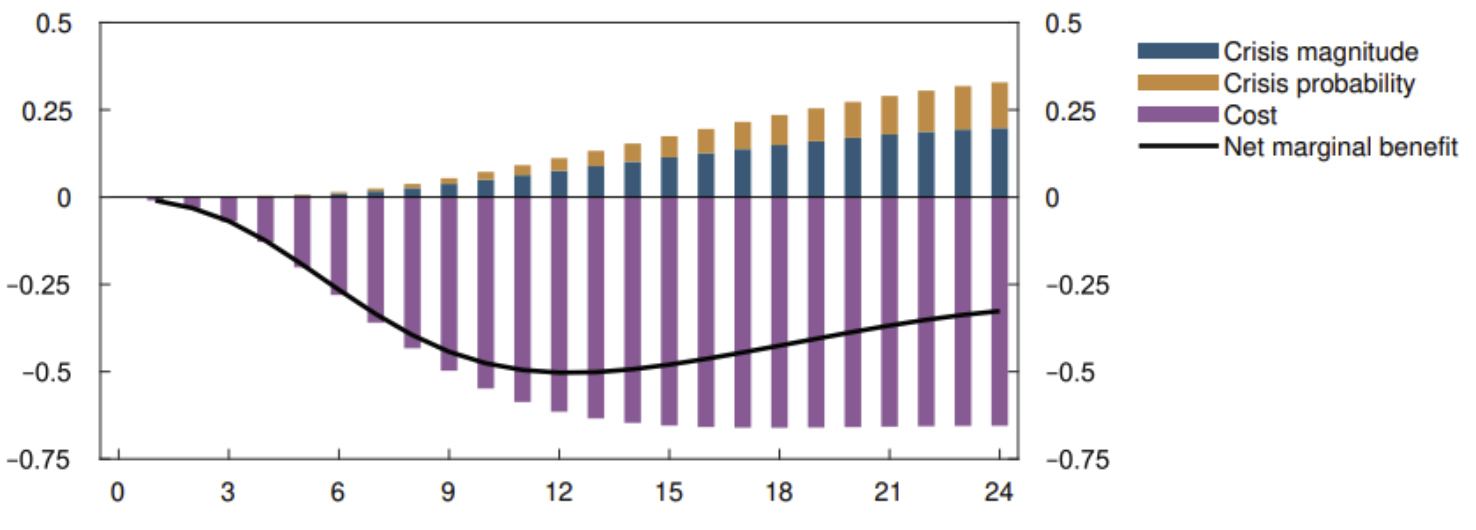

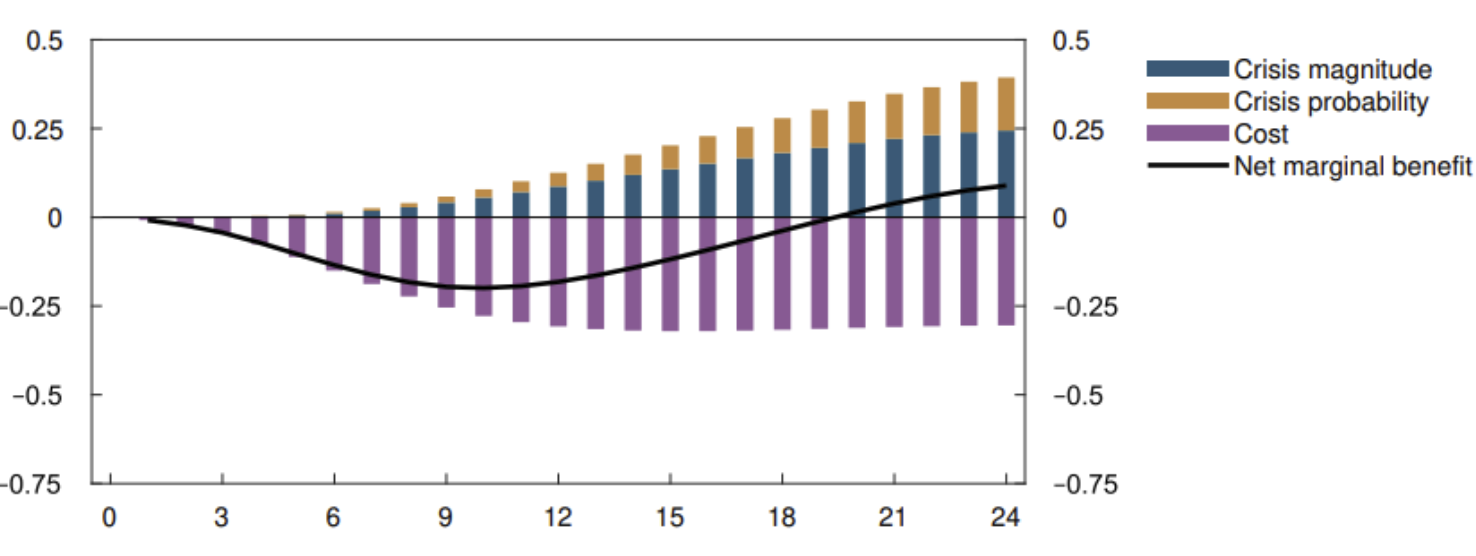

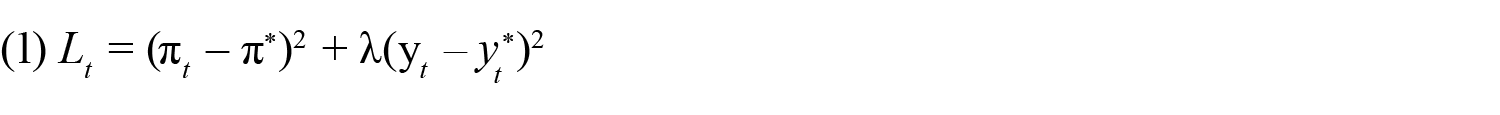

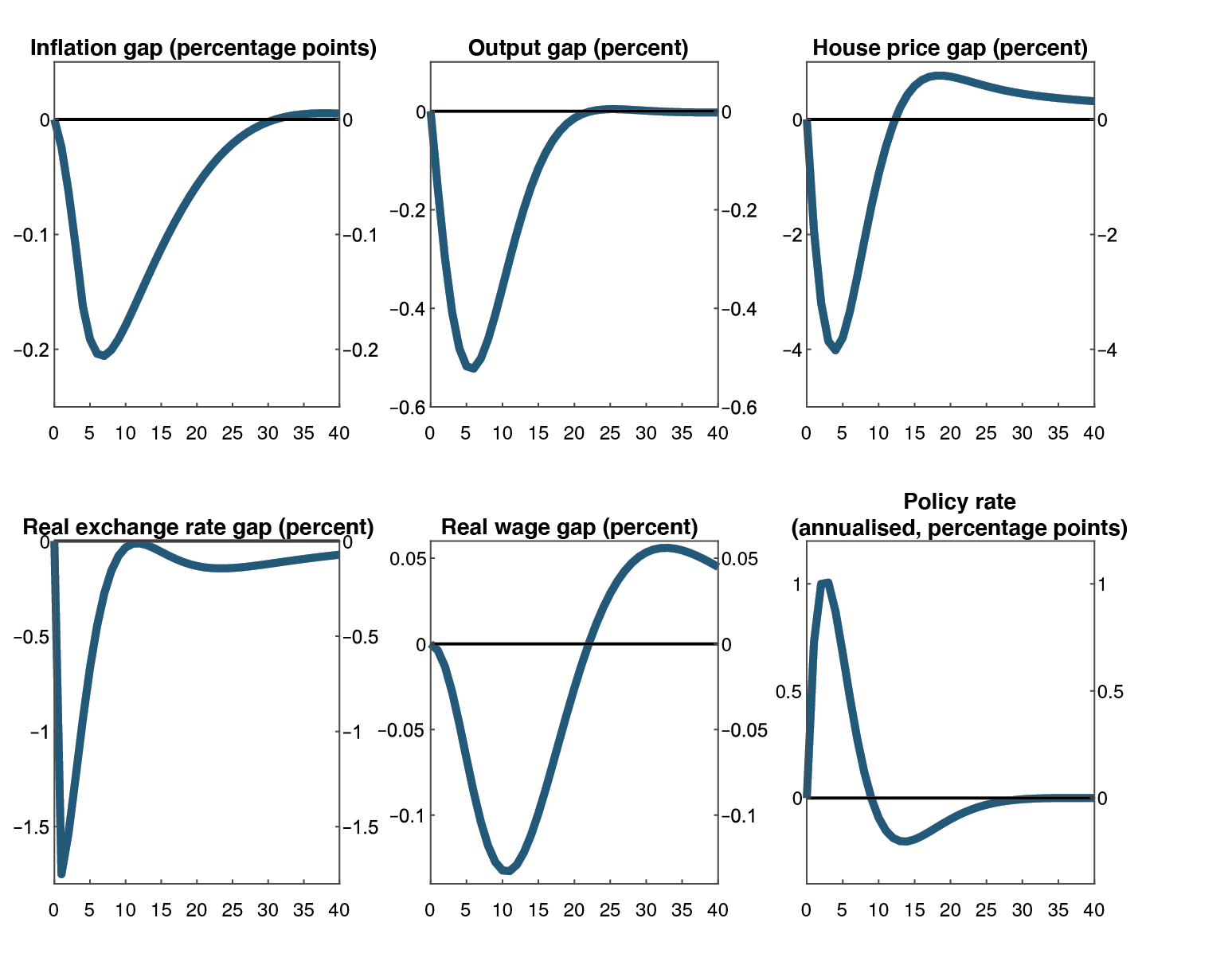

No clear consensus has been reached, among researchers or policymakers, on whether monetary policy should “lean against the wind”. Some conclude that the benefit of “leaning”, in the form of reduced probability and severity of a crisis, is most likely lower than the costs of such a policy.35 But there are also studies that show that "leaning" may be favourable in certain situations, particularly when implemented early in a period of strong asset price inflation and credit growth.36 Among the large international institutions, the Bank of International Settlements (BIS) has long argued that central banks should “lean against the wind”37, while the International Monetary Fund (IMF) has been more sceptical.38 Different results are arrived at owing to alternative assumptions about economic relationships and the estimated effects of the policy rate on output and inflation on the one hand and financial imbalances and crisis severity on the other. The potential benefits and costs of leaning against the wind are discussed in more detail in the box “Illustration of potential costs and benefits of leaning against the wind in monetary policy”.

How financial stability considerations are taken into account differs among inflation-targeting central banks, but the main tendency is that monetary policy is rarely used to counter financial imbalances. The conclusion drawn by the Bank of Canada in connection with its regular review of its monetary policy framework is similar to the view reflected in research from the IMF.39 The Bank of Canada concluded that monetary policy should be adjusted to address financial imbalances only in exceptional circumstances and that the effective use of macroprudential tools “will reduce the incidence of significant tension between monetary policy’s objective of low and stable inflation and potential risks to financial stability”. In its most recent review of monetary policy in December 2021, the Bank’s view was very similar to the view expressed in 2016. The Bank wrote the following: “The Bank will continue to assess financial system vulnerabilities, recognising that a low interest rate environment can be more prone to the development of financial imbalances. A variety of other policy instruments, such as macroprudential tools, are better suited than monetary policy to address these vulnerabilities. But because monetary policy can exacerbate financial vulnerabilities, the Bank will continue to be mindful of the risk that such vulnerabilities can lead to worse economic outcomes down the road.”40