Report from Norges Bank Watch 2024

Remarks by Pål Longva, Deputy Governor of Norges Bank, 23 February 2024.

In February/March each year, the Centre for Monetary Economics (CME) presents a report commissioned by the Ministry of Finance on Norges Bank’s activities. A committee of independent economists assesses Norges Bank’s conduct of monetary policy. The reports are published by the CME in its Norges Bank Watch Report Series.

First, I would like to thank this year’s committee for an excellent and thorough report. An annual assessment of this kind is very useful. I would also like to thank the Centre for Monetary Economics for hosting the event and for the opportunity to comment on the report.

I would like to comment on four major topics raised by the committee: the conduct of monetary policy in 2023, modelling the krone exchange rate, taking account of international impulses and communicating uncertainty.

Let me begin with the conduct of monetary policy last year.

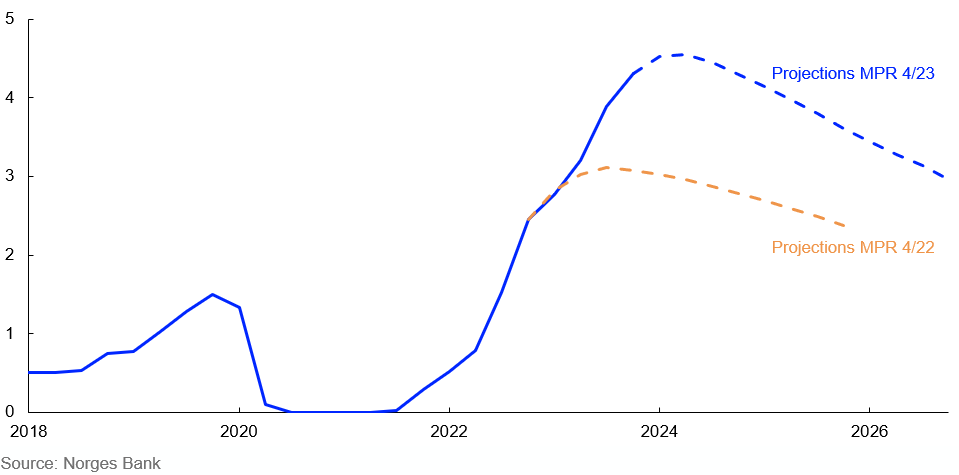

Chart: The policy rate path was revised up through 2023

Policy rate. Percent. 2018 Q1–2026 Q4

The year 2023 was marked by continued high inflation both in Norway and among its trading partners. At the beginning of that year, we expected a policy rate of around 3 percent in 2023. That didn’t happen. We revised our economic growth and inflation forecasts, and the policy rate was raised higher and faster than we had anticipated.

Norges Bank Watch’s analyses indicate that the policy rate should have been raised faster. When we set the policy rate, we must rely on the information available and our best assessment of the outlook and balance of risks. There was considerable uncertainty about the outlook for the Norwegian economy and about how high the policy rate needed to be to bring inflation back to target within a reasonable time horizon. Monetary policy trade-offs were challenging. The Monetary Policy and Financial Stability Committee was concerned with balancing the risk of tightening too much against the risk of tightening too little. If the policy rate was raised too little, inflation could remain high for a long time, in which case it could prove more costly to bring inflation down again later. On the other hand, a policy rate that was too high could contribute to a more pronounced slowdown in the Norwegian economy than necessary. This is a situation we wished to avoid.

We are committed to communicating our monetary policy decisions clearly and effectively. We are therefore pleased that Norges Bank Watch is of the opinion that our communication is effective and our response pattern is well-understood by the market.

Let me now say a few words about the krone exchange rate, which is a key topic in the report.

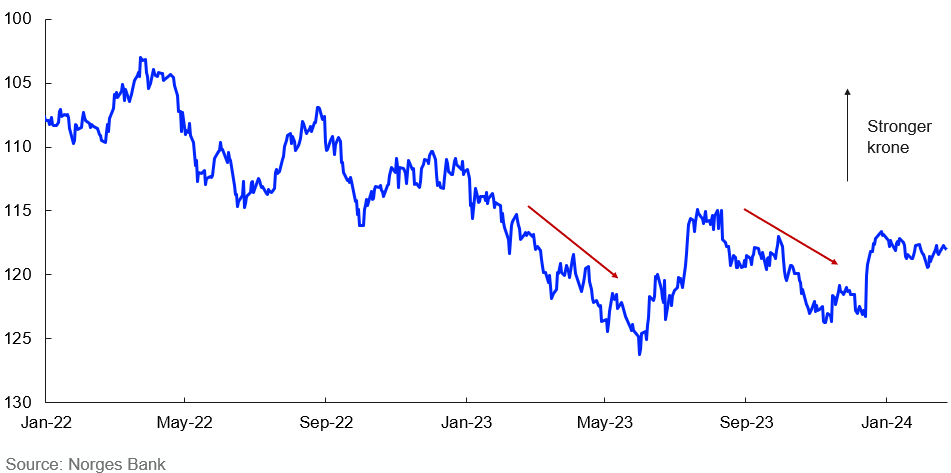

Chart: The krone depreciated through 2023

Import-weighted exchange rate index (I-44). 1 January 2021–21 February 2024

The krone depreciated through 2023, especially in the first half of the year. This surprised many observers, Norges Bank included. Norges Bank Watch presents a model that forecasts a significant depreciation last year. The forecast depreciation is steeper than was actually the case, but the model more accurately forecast exchange rate movements than we did.

Norges Bank Watch interprets the model results to mean that more long-term factors, such as price level differences between Norway and other countries, may have played a more important role for the krone exchange rate than assumed in our projections. At the same time, the report shows that the exchange rate projections are very sensitive to the long-run trend assumed for the exchange rate. Under a different assumption for this trend, the exchange rate more closely follows Norges Bank’s projections. It is challenging to forecast exchange rates and difficult to determine which model is best.

There are many factors that can influence the krone exchange rate that we can neither foresee nor do anything about. Monetary policy influences the krone exchange rate through policy rate setting, but what central banks in other countries do is also important. Through the first half of last year, the interest rate differential against our main trading partners fell and eventually became markedly negative. The decline in the interest rate differential coincided with a krone depreciation.

Our projection for the krone exchange rate will normally change relatively little over the forecast horizon from its recent level. Over time, we believe that this approach will give us the best forecasts and the best basis for making the right trade-offs in the conduct of monetary policy.

A third topic that is mentioned is how we respond to what is happening internationally.

Norges Bank Watch questions whether we could have been quicker to capture international impulses. Over time, there has been an evolution in this area at Norges Bank. The Norwegian economy has been hit by large international shocks in recent years. In the wake of the pandemic and subsequently as a consequence of Russia’s invasion of Ukraine, there was a surge in freight rates and many commodity prices. It became important for us to improve our understanding of how international price impulses affect domestic prices.

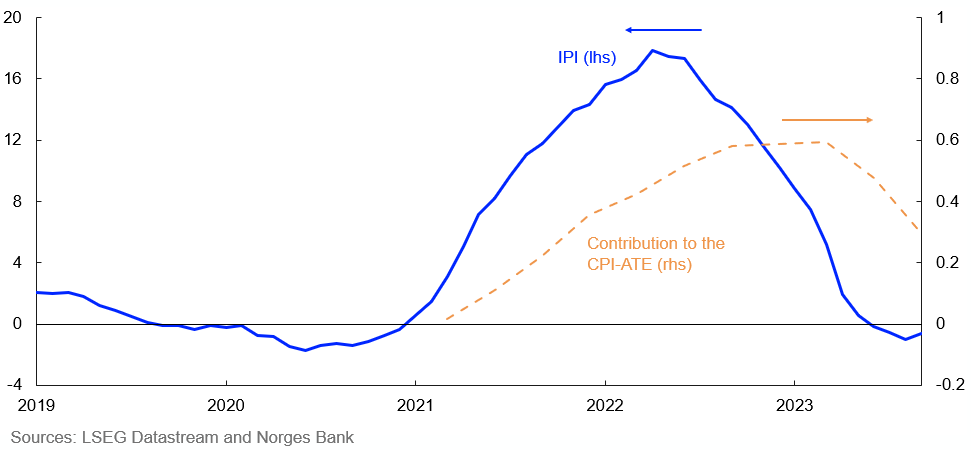

Chart: International price impulses have lifted inflation in Norway

International price impulses to Norwegian intermediate goods (IPI). Twelve-month change. Percent. Contribution to the 12-month change in the CPI-ATE. Percentage points

We have long had an indicator of price developments for imported consumer goods.[1] In recent years, we have looked more closely at how international price impulses affect domestic inflation. The chart shows an indicator that we have constructed to capture developments in prices for imported intermediate and capital goods.[2] The indicator appears to influence inflation with a marked lag. This gives us a better overview of price changes at early stages of the value chain and enables us to capture changes in price impulses more quickly. This may lead to better projections for overall consumer price inflation in Norway.

We are continuing our work to improve our analyses, so that we can capture relevant information from other countries more quickly.

The last topic I would like to comment on is communicating uncertainty.

As Norges Bank Watch points out, macroeconomic forecasts are associated with considerable uncertainty. We may perhaps be able to quantify some of this uncertainty, but other types of uncertainty are difficult or impossible to measure. Examples of the latter may be the economic consequences of pandemics, war, climate change and technological innovation.

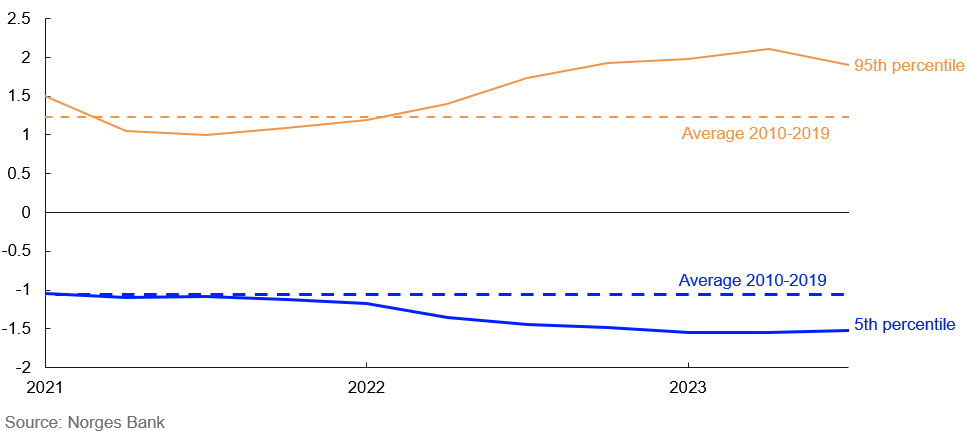

Chart: Uncertainty surrounding consumer price inflation

Eight quarters ahead. Spread between percentiles and median from quantile regressions. Four-quarter change in the CPI-ATE. Percentage points

Prior to the pandemic, we used fan charts for our projections. Such fan charts can illustrate the uncertainty surrounding projections based on historical forecast errors. When the pandemic hit, it became obvious that these fan charts did not adequately express uncertainty ahead. This illustrates a challenge posed by probability bands. They may give the impression that we are able to quantify uncertainty that in reality cannot be measured. Symmetrical fan charts in particular, which we used previously, may be misleading. The type of asymmetrical fan charts that Norges Bank Watch proposes is better. In our most recent monetary policy reports we have illustrated uncertainty surrounding some key projections. We use a method that also allows uncertainty to be asymmetrical and vary over time. This is useful. At the same time, these estimates do not take into account all possible outcomes either.

An alternative is to develop conceivable scenarios. These may illustrate how possible shocks might affect the economy. At the same time, such scenarios do not always hit the mark.

The Monetary Policy and Financial Stability Committee devotes considerable time to discussing the risks around our forecasts. In our monetary policy reports we seek to communicate the risk factors the Committee has given weight to. At the same time, we agree with Norges Bank Watch that this part of our communication can be developed further. Going forward, we will seek to express our assessments of various risk factors better.

Let me conclude by again thanking Norges Bank Watch for an excellent report. These annual evaluations are very useful for us and make an important contribution to our work to improve our analyses and communication.

Thank you for your attention!

[1] For documentation of IPK, see Fastbø, T. (2018) “Import fra lavkostland demper norsk prisvekst“ [Imports from low-cost countries are having a dampening effect on Norwegian inflation]. Blogpost published on Bankplassen blogg, 2 May 2018. Norges Bank and Røstøen, J.Ø. (2004) “External price impulses to imported consumer goods”. Economic Bulletin, 25 (3), October, pp 96–102.

[2] For more information on the indicator IPI, see box “Imported price impulses to intermediate and capital goods” in Monetary Policy Report 4/23.