Monetary policy in turbulent times

Address by Governor Øystein Olsen at the Centre for Monetary Economics (CME)/BI Norwegian School of Management on 20 September 2012

Please note that the text below may differ slightly from the actual presentation.

- Charts in pdf-format (pdf, 230 kB)

Central banks the world over are now conducting monetary policy in what must undoubtedly be called turbulent times. My address today will focus on how and why new tools of monetary policy are being deployed internationally and our response to these developments here in Norway. The economic situation in Norway is quite different from that of surrounding countries and we have been able to operate within the established monetary policy framework.

Chart: GDP growth

Growth in the global economy has been weak since the 2008 financial crisis and has affected some countries more severely than others. Countries with large imbalances when the crisis began are now facing formidable challenges. The imbalances have been self-reinforcing. Higher pricing of risk has resulted in increased yields on the government bonds of countries with a high level of debt. Fragile government finances have become even weaker. A decrease in the value of government bonds has also generated uncertainty concerning the position of banks. Banks have had to consolidate their balance sheets and have curtailed lending to firms and households, amplifying the decrease in economic activity.

Heavily indebted countries are now working to make banks more robust and strengthen government finances. Cost competitiveness must be restored. The road will no doubt be long and arduous.

Chart: Yields on 10-year government bonds

But the situation across countries differs considerably and is reflected in wide yield spreads. Investors now demand substantial premiums for investing in less safe assets. Capital is seeking safe havens, even though real returns on presumably risk-free investments are low or negative. Wide yield spreads may persist for a period – it takes time for countries to restore competitiveness and build up stronger balances, particularly when growth is also weak in other regions. Substantial economic imbalances in Japan and the US also need to be redressed. Turbulence and bad times in Europe are now dampening activity in these countries and in emerging economies.

This situation has led to the emergence of new forms of monetary policy in many parts of the world. Interest rates have been low – close to zero – for a long period. The Federal Reserve has indicated that the federal funds rate will most likely be exceptionally low at least until mid-2015. In the event, the US key rate will have been close to zero for almost seven years.

As key rates cannot be lowered further, several central banks have decided to apply other methods. The methods fall into two main types:

The first method relates to communication. Statements concerning the future central bank key rate are being employed as a new monetary policy tool. Here at Norges Bank, the application of this method is not new – the interest rate forecast has been published by the Bank since 2005. The aim is to influence interest rate expectations and thereby contribute to achieving the objectives of monetary policy. [1] The Federal Reserve has published board members' expectations of when the first key rate increase will take place since January 2012. [2]

The second method is known as quantitative easing, or balance sheet policy, and consists of measures to change the composition and size of central bank balance sheets. This use of the balance sheet differs from the usual monetary policy operations in that instruments other than the key rate are used to influence market rates and economic activity. Traditional monetary policy operates through the commercial banking system: it influences the economy because banks let their interest rate conditions in the central bank pass through to their customers. Moreover, liquidity management is used to keep short-term rates close to the key rate. In countries where the key rate is close to zero, this instrument has been exhausted. At the same time, the effect of the key rate may be weaker than normal as many banks are consolidating and are reluctant to engage in lending.

Using balance sheet policy, the central bank seeks to influence longer-term interest rates and thereby funding costs in a more direct manner. [3]

Purchases of government or private sector bonds are intended to depress yields and push up securities prices – the so-called portfolio effect. [4] Studies from the past three or four years indicate that the portfolio effect has been in operation in both US and UK markets – bond prices have increased and long-term yields have fallen as a result of quantitative easing.[5] The aim is to achieve lower long-term yields in order to boost lending and investment.

In addition to the portfolio effect, the new use of the balance sheet can have a signal effect: central banks that engage in large-scale purchases of securities to pull down long-term yields are sending a signal that the key rate may be kept low for a long period. In this sense, balance sheet policy also contributes to anchoring expectations and supporting monetary policy communication.

It is not easy to say what the situation would have been without these measures. However, it is likely that central bank bond purchases have curbed the decline in output in the UK and the US.

Chart: Central bank balance sheets, stylised

These measures, by their nature, have an impact on central bank balance sheets – in terms of both size and composition.

When a central bank purchases government bonds, it pays for the bonds with new electronic money.

Chart: Central bank balance sheets – government bond purchases

The money ends up as increased bank deposits at the central bank – also known as central bank reserves. This strengthens banks' holdings of liquid assets and may induce them to increase lending. The pricing of government bond holdings in the private sector is also affected.

Chart: Central bank balance sheets – private sector bond purchases

Private sector bond purchases can ease funding conditions for firms more directly than purchases of government bonds by depressing interest rates on private sector market funding. As with government bond purchases, central bank reserves also increase in this case. The latest measure implemented by the Federal Reserve, known as QE3, is a plan for the purchase of mortgage-backed securities.

Chart: Central bank balance sheets – foreign exchange purchases

A third form of balance sheet policy is interventions in the foreign exchange market. Central bank foreign exchange purchases are also balanced by an increase in banks' deposits in the central bank.

Chart: Central bank balance sheets. Index

In September 2011, the Swiss National Bank decided to announce a minimum exchange rate, a floor, for the Swiss franc against the euro owing to the substantial appreciation of the Swiss franc. Interest rates and inflation in Switzerland were close to zero and growth was low. According to the Swiss National Bank, a further appreciation could have resulted in a recession with deflationary developments. In order to defend the floor, the Swiss central bank has purchased foreign currency in large quantities. This has led to a considerable expansion of its balance sheet. The chart shows the wide swings in central bank balance sheets since the 2008 financial crisis. Expansion of central bank balance sheets has been particularly rapid in the UK, the US and Switzerland and somewhat more moderate in the euro area.

As I mentioned earlier, the purpose of balance sheet policy is to stimulate the economy by lowering interest rates and funding costs in a situation where the key rate is close to zero. Central banks themselves emphasise that the positive effects of balance sheet policy are uncertain – and the effects must be weighed against possible problems. [6] There are four factors that can be highlighted here:

First, it may be difficult for central banks to exit the markets once they have built up large bond holdings, and this would require considerable portfolio adjustments for households, firms and banks. Postponing a reversal of the measures could generate expectations that interest rates will remain very low for too long a period after the economy has recovered. This could in turn generate expectations of high inflation further ahead.

Indeed, the connection between inflation and the money supply constitutes the second challenge. When a central bank purchases securities or provides longer-term loans to banks, the monetary base, i.e. banks' deposits at the central bank, increases. There is no direct relationship between the monetary base and inflation. The risk of inflation can only arise if growth in the monetary base coincides with an increase in the broader monetary aggregates through higher customer deposits in banks. For the broader monetary aggregates to increase, banks must increase lending or purchase securities from enterprises outside the banking sector. Since the crisis in 2008, the monetary base in Europe and the US has grown considerably more rapidly than the broader monetary aggregates. The risk of high inflation in such a situation should be viewed in the context of central bank exit strategies. In the future, central banks will want to reverse the extraordinary measures that have resulted in substantial growth in the monetary base. This will normally be done when the crisis is over and the economy is recovering.

Third, the large sums of money involved may also affect exchange rates. Even if central banks do not intervene in exchange markets directly, the measures may in the short term reduce the value of the currency issued by a central bank. This will, in isolation, strengthen exchange rates in countries that were initially less severely hit by the crisis. Small, open economies can be vulnerable to large capital movements when powerful instruments are deployed by large countries.

A possible side-effect of balance sheet policy is that the private sector also takes longer to strengthen equity capital and reduce risk than it would otherwise have done. With the low price of capital, it costs little to postpone restructuring and put off debt repayment.

Finally, confidence in economic policy may be affected. The dividing line between monetary and fiscal policy seems to be more blurred. Balance sheet policy may dampen the effects of market volatility on interest rates and give heavily indebted countries a breathing space and time to adjust. On the other hand, the measures may also reduce the incentive to carry out necessary fiscal tightening.

In the euro area, different considerations are now being balanced in the new "Outright Monetary Transactions" (OMT) programme. Under this programme, the European Central Bank (ECB) may only purchase bonds from countries that have entered into a loan agreement under the European Financial Stability Facility (EFSF) or the European Stability Mechanism (ESM) – which in turn is conditional on a commitment to fiscal tightening.

Chart: Corporate borrowing rates

One reason for the ECB's decision to establish the OMT programme is the partial breakdown of the monetary policy transmission mechanism in the euro area economy. There are wide differences in interest rates facing banks and firms across Europe. Although the same key rates apply to all the euro area countries, average corporate borrowing rates differ widely from country to country. Some of the variation is due to differences in credit risk across countries owing to very different economic situations. Additional risk premiums may reflect fears that one or more countries might at some point have to replace the euro with a new local currency. ECB President Mario Draghi has referred to these as convertibility risk premiums. One of the objectives of the OMT programme is to reduce this premium and restore the proper transmission of monetary policy.

The OMT programme can be regarded as an answer to the signs of financial market fragmentation in the euro area. Differences in financial conditions across countries have become considerable and the willingness to provide loans across national borders has declined. The same picture is reflected in the so-called TARGET2 balances.

TARGET2 is the central interbank settlement system in the euro area. In all countries, interbank payment settlement is carried out by the national central bank. One bank's payment to another is settled by adjusting the two banks' deposits in the central bank. Central bank reserves are the means of interbank payment.

In the euro area, interbank payment settlement takes place in two stages: banks have their settlement account in the national central bank, while each country's central bank has, in turn, an account at the ECB. If, for example, deposits are transferred from a Greek bank to a German bank, the Greek bank's deposits in the Greek central bank are reduced, while the German bank's deposits in the Bundesbank increase by the same amount. The Greek central bank's debt to the ECB increases in turn, while the Bundesbank's claims on the ECB increase accordingly. Such changes in claims and liabilities are expressed in the TARGET2 balances.

Chart: TARGET2 balances

In a well functioning market, the bank that had drained its central bank reserves would borrow to replace them in the interbank market, balancing the transfer described above. Imbalances in TARGET2 are a symptom of an interbank market that is not functioning efficiently between all countries in the euro area. If banks in the north are no longer willing to lend to banks in the south, the southern banks must meet their need for reserves by borrowing directly from the central bank. The northern banks increase their reserves at the central bank accordingly. In addition to increasing the claims in the TARGET2 system, this inflates the Eurosystem balance sheet. The central banks are the hub of the system and are required to receive deposits from areas where banks have a surplus of reserves and extend loans to areas where banks as a whole need more funding. Imbalances between countries in the TARGET2 system give no indication of who will bear the losses if a bank defaults and the value of the collateral posted is not sufficient. Any losses are allocated among the participating national central banks according to their relative shares in the ECB's paid-up capital.

To sum up the international picture: over the past year, growth prospects have been lowered for all the large advanced regions. In Europe, activity is likely to decline this year owing to debt problems and fiscal tightening. Unemployment is on the rise. Fiscal and monetary policy space is limited, or virtually exhausted. Many countries must tighten fiscal policy to reduce debt to a sustainable level. Central banks have responded by communicating that interest rates will be held low for an extended period. And they have stretched the limits of monetary policy to counteract a deeper and more persistent downturn.

Chart: GDP growth

The economic situation in our external surrounding environment stands in contrast to that of Norway. Domestic activity is particularly high in the oil industry and construction sector, and both employment and the supply of labour are on the increase. Unemployment remains low and stable. Public finances are healthy. Norway's terms of trade are favourable, with high export prices and low import prices. At the same time, house prices and household debt are still rising. Nonetheless, the Norwegian economy is not unaffected by the turbulence abroad. Developments in Europe and a strong krone exchange rate are adversely affecting some Norwegian export industries, such as the paper, metal, and furniture industries.

While other countries have used non-traditional instruments, we have managed to come through by using our main instrument – the key policy rate – which is now 1.5 per cent. It is low because inflation is low and because adverse conditions abroad are curbing growth in a number of industry sectors in Norway. Very low interest rates abroad and high risk premiums in money and capital markets underpin this picture.

Norges Bank's conduct of monetary policy is geared towards low and stable inflation. The operational target of monetary policy is consumer price inflation of close to 2.5 per cent over time. At the same time, monetary policy shall contribute to stabilising output and employment. We also give weight to the risk that low interest rates may over time lead to excessive risk-taking and debt accumulation in the household and business sector. Such imbalances can give rise to negative ripple effects further ahead, with a considerable impact on output and employment.

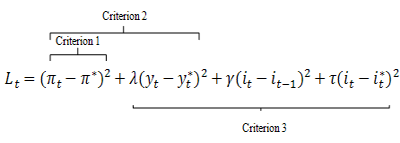

Chart: Criteria for an appropriate interest rate path and loss function

In Norges Bank's March 2012 Monetary Policy Report, the Bank clarified how the various considerations are expressed in Norges Bank's response pattern. Adjustments were made to the criteria for an appropriate interest rate path. In the Bank's system of analysis, the criteria are expressed as a loss function for monetary policy.

Criterion 1, which states that the inflation target is reached, is covered by the first segment, where the loss is higher the more actual inflation πt deviates from the target π*. Criterion 2, which states that for given inflation developments, the loss Lt will increase with fluctuations in economic activity, is covered by the first and second segments. Criterion 3, which states that monetary policy shall be robust, is covered by the second, third and fourth segments.

The adjustments made in March were expressed by slightly increasing the weight given to the output gap, , because financial imbalances can often build up in periods of high capacity utilisation. At the same time, weight was given to avoiding substantial deviations in the interest rate from a normal level. This consideration is expressed in the final segment in the loss function. This can help to mitigate the risk of a build-up of financial imbalances, even in periods when capacity utilisation is not particularly high.

Chart: Key policy rate

Normally, the key policy rate cannot achieve several objectives simultaneously. In the case of conflicting objectives, the choice of interest rate path will involve a trade-off between different considerations.

If monetary policy only took into account the low level of inflation, the key policy rate would be rapidly reduced and kept close to zero for a good while. Inflation might then pick up faster, partly as a result of a weaker krone. In the light of the trade-off against other considerations, however, the Bank does not want to accelerate the pace of inflation. The result would be a pronounced impact on output and employment. A prolonged period of even lower interest rates would increase the risk that debt and asset prices will be driven up to levels that are unsustainable over time. We thus obtain a smoother interest rate path when we also give weight to the other two criteria.

The criteria and loss function reflect the Bank's reaction pattern in the period following the financial crisis. We are responding to new insight and lessons learned. The loss function is a mathematical illustration and must be regarded as a simplified representation of the more extensive assessments underlying interest rate decisions. Interest rate setting is based on the Executive Board's assessment, not a model calculation. Mathematics and models can, however, clarify the alternatives.

There is considerable uncertainty as to the effect of low interest rates over extended periods on risk-taking behaviour and the build-up of financial imbalances. [7] In this regard, we are in quite uncharted waters. How financial imbalances build up is not explicitly considered in the analytical apparatus. Work is in progress both in Norway and internationally to further develop the economic models used in monetary policy analysis. As we gain new insight and gather experience, our assessments of economic relationships may change. This will also influence the formulation of our models.

Chart: Household debt burden and interest burden

In Norway, house prices and household debt have reached historically high levels. The rapid growth in incomes has been a primary driving force. The high household debt burden in Norway represents a risk of financial instability in the longer term. Households can be a source of both direct and indirect losses for banks. Banks' loan losses will depend on households' capacity to pay interest and principal, and to the value of the underlying collateral, which is primarily in the form of dwellings in Norway. Banks are also exposed to the economic repercussion effects that may occur in the event of a fall in household consumption. In the short run, the risk of disturbances is probably small because interest rates are low and the vast majority of households have job and income security.

Chart: Household financial wealth by debt burden

Household saving has been high in recent years, but households with the highest debt have the lowest financial wealth. In 2009, only about ten percent of financial assets were held by households with a high debt burden – that is to say those with debt that was more than five times their disposable income. These households also accounted for around one third of total household debt.

Chart: High population growth and low residential construction rate

In recent years, pressures in the housing market have been amplified by high population growth. Despite rising housing construction, the number of housing completions remains low in relation to population growth. The housing deficit has grown over several years and is pushing up house prices. The housing shortage requires measures in the real economy – in this case, an increase in housing construction. Monetary policy cannot aim to redress such real economic imbalances.

Low interest rates over time can increase the risk of driving up debt levels and asset prices, bringing them to a level that is unsustainable over time. This is an important lesson from the financial crisis. We take account of this when setting the key policy rate, as has been made clear in the most recent formulation of the loss function. At the same time, there is – with one instrument available to us – the key policy rate – a limit to how many tasks can be assigned to monetary policy. In order to counter financial imbalances, instruments in addition to those available to monetary policy must come into play.

Macroprudential regulation of the financial industry will play a greater role in the years ahead. The overall risk in the financial system is greater than the sum of the risk represented by each individual bank. Which macroprudential instruments would be the most suitable is currently being discussed in detail in various international fora and central banks. One instrument that will be introduced is the countercyclical capital buffer for banks.

The purpose of this buffer is to reduce the procyclicality of bank lending. When banks are required to hold more capital in a period of high credit growth, they will be more robust to large loan losses. In addition, increased capital requirements could restrain credit growth. The Ministry of Finance has the overriding responsibility for regulating the financial industry, but Norges Bank will be given the primary responsibility for elaborating the basis for the establishment of the countercyclical capital buffer.

With a buffer ceiling of 2.5 percent of banks' risk-weighted assets, the buffer will probably have a limited downward impact on banks' lending enthusiasm in good times. But banks that have solid capital reserves can take larger losses before having to limit lending to creditworthy customers.

The countercyclical buffer comes on top of a new, comprehensive regulatory framework. Equity capital requirements will be tightened. Banks will face stricter maturity requirements for funding, limiting their share of short-term funding. They will be required to hold more liquid assets. All in all, the new regulatory regime will contribute to a more robust financial system and reduce fluctuations in credit growth.

The turbulence in Europe, which started with the problems in Greece, has now prevailed for close to two and a half years. Financial market sentiment and banks' access to funding have varied widely during the period. The nascent market optimism may continue, but it is fragile. Should the economic situation abroad worsen again, and credit markets dry up, other tools can be put to use in Norway. During the financial crisis in 2008, several measures were deployed, such as the so-called swap arrangement, which provided banks with access to liquid government securities in exchange for covered bonds. Smaller banks were given loans with longer maturities. The measures aimed at improving banks' access to long-term funding. The measures enabled banks to maintain virtually normal lending standards for Norwegian households and businesses.

Norway's swap arrangement and quantitative easing have some common features: bonds shift from private to public hands, and banks' funding costs become lower than would otherwise have been the case. But there is an important difference. The swap arrangement was reflected in the government's balance sheet – not the central bank's. Quantitative easing, which increases the size of a central bank's balance sheet, as observed in the US and the UK, is still not a relevant approach for Norway. Normally, the provision of capital and liquidity by authorities is not to replace banks' own sound liquidity management and long-term market funding. Any decision relating to the use of the creditworthiness of government or taxpayers to finance banks and businesses rests with the Government and the Storting (Norwegian parliament).

Chart: Liquidity and EUR/NOK exchange rate

International turbulence can push the krone in both directions.

On the one hand, in periods of severe market turbulence, investors have tended to shy away from presumably less liquid currencies. The krone market is among the less liquid markets. One indicator of liquidity is the so called bid-ask spread. [8] An exit from the krone market may be tight when many investors seek to shift out of krone positions at the same time. This can trigger a considerable depreciation of the krone, as experienced in autumn 2008.

On the other hand, Norwegian securities can be perceived as safe havens because the associated credit risk is perceived to be low. Experience has also shown that international turbulence can in periods lead to an appreciation of the krone.

A krone that is too strong can over time result in inflation that is too low and growth that is too weak. In that case, monetary policy measures will be taken. In Norway, the key policy rate is the relevant instrument. We still have room for manoeuvre in interest rate setting – in both directions. Foreign exchange interventions are not in principle an instrument suited to influencing the krone exchange rate over a longer period. It would only be relevant should the krone exchange rate move significantly out of line with that deemed reasonable in relation to the underlying fundamentals of the Norwegian economy, and should developments at the same time threaten the credibility of the inflation target. In addition, the interest rate weapon must have already been exhausted.

Over the past decade, inflation has been low and stable. This shows that monetary policy has functioned effectively. Transparency about the response pattern and key policy rate forecasts reinforce the impact of monetary policy. With firmly anchored inflation expectations, Norges Bank has also been able to give weight to economic stability when setting the key policy rate. Further light is being shed on the interaction between monetary policy and financial stability. Inflation targeting in Norway has become more flexible. At the same time, we cannot overburden monetary policy. In weighing the various considerations, we will in our interest rate setting adhere to the primary objective of monetary policy – low and stable inflation.

Thank you for your attention.

Footnotes

[1] See speech by Janet L. Yellen, 25 February 2011: "Unconventional Monetary Policy and Central Bank Communications", http://www.federalreserve.gov/newsevents/speech/yellen20110225a.htm

[2] See the Federal Reserve's "Monetary Policy Report to the Congress", February 2012, http://www.federalreserve.gov/monetarypolicy/mpr_20120229_part1.htm

[3] For a description by the Bank of England of how quantitative easing works, see http://www.bankofengland.co.uk/. For a description by the Federal Reserve, see for example speech by Ben Bernanke, 31 August 2012, http://www.federalreserve.gov/newsevents/speech/bernanke20120831a.htm

For a theoretical description of the effects, see Michael Woodford (2012): "Methods of Policy Accommodation at the Interest-Rate Lower Bound", http://kansascityfed.org/publicat/sympos/2012/mw.pdf?sm=jh083112-4 . See also Economic Commentaries 1/2011: "Om nye virkemidler i pengepolitikken. Avgrensning mellom pengepolitikken og finanspolitikken" (New monetary policy instruments. Delimitation between monetary policy and fiscal policy), Ragna Alstadheim (Norwegian only).

[4] Classic references are James Tobin (1965): "The Monetary Interpretation of History", American Economic Review, Vol 55, pp. 464-85 and (1969): "A General Equilibrium Approach to Monetary Theory", Journal of Money, Credit and Banking, Vol 1 (February), pp. 15-29. For a more modern presentation, see Javier Andres, David Lopez-Salido and Edward Nelson (2004): "Tobin's imperfect Asset Substitution in Optimizing General Equilibrium", Journal of Money, Credit and Banking, Vol 36 (August), pp. 665-90.

[5] See for example Arvind Krishnamurthy and Annette Vissing-Jørgensen (2011): "The Effects of Quantitative Easing on Interest Rates: Channels and Implications for Policy", Brookings Papers on Economic Activity, Fall, pp 215-65 and Jonathan Wright (2012): "What does Monetary Policy Do to Long-Term Interest Rates at the Zero Lower Bound?", NBER Working Paper Series 17154.

[6] See for example speech by Federal Reserve Chairman Ben Bernanke: "Monetary Policy since the Onset of the Crisis", the Federal Reserve Bank of Kansas City Economic symposium, Jackson Hole, Wyoming, 31 August 2012. See also speech by Spencer Dale, Chief Economist at the Bank of England: "Limits of monetary policy"

[7] Monetary Policy Report 1/12, box on pages 15-16, Norges Bank, and "Norges Bank's new monetary policy loss function – further discussion", Snorre Evjen and Thea B. Kloster, Norges Bank Staff Memo 11/2012.

[8] "Liquidity in the foreign exchange market for EUR/NOK", Kathrine Lund, Norges Bank Economic Commentaries 3/2011.