Increased exports despite international trade uncertainty

Regional Network contacts expect growth to remain firm in 2025 Q2 and Q3. International trade barriers are increasing uncertainty, but only a few contacts expect that this will lead to lower growth in the period to autumn. Increased defence investment and higher aquaculture output are boosting growth. Contacts also expect higher sales of durable goods and further growth in tourism. Moreover, a number of construction contacts expect residential construction to pick up somewhat through autumn. The share of contacts reporting capacity constraints is little changed from the previous survey, while the share reporting labour shortages is slightly lower. Contacts expect annual wage growth of 4.5% in 2025 and 4.0% in 2026.

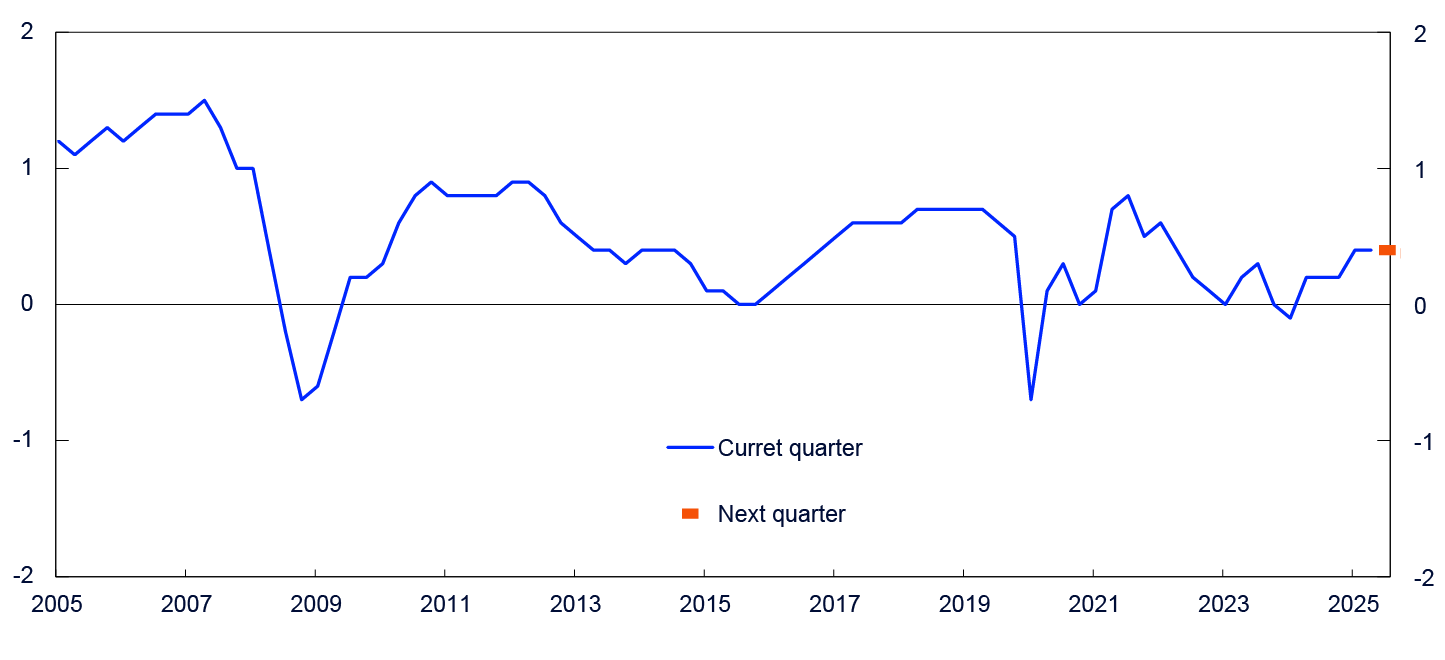

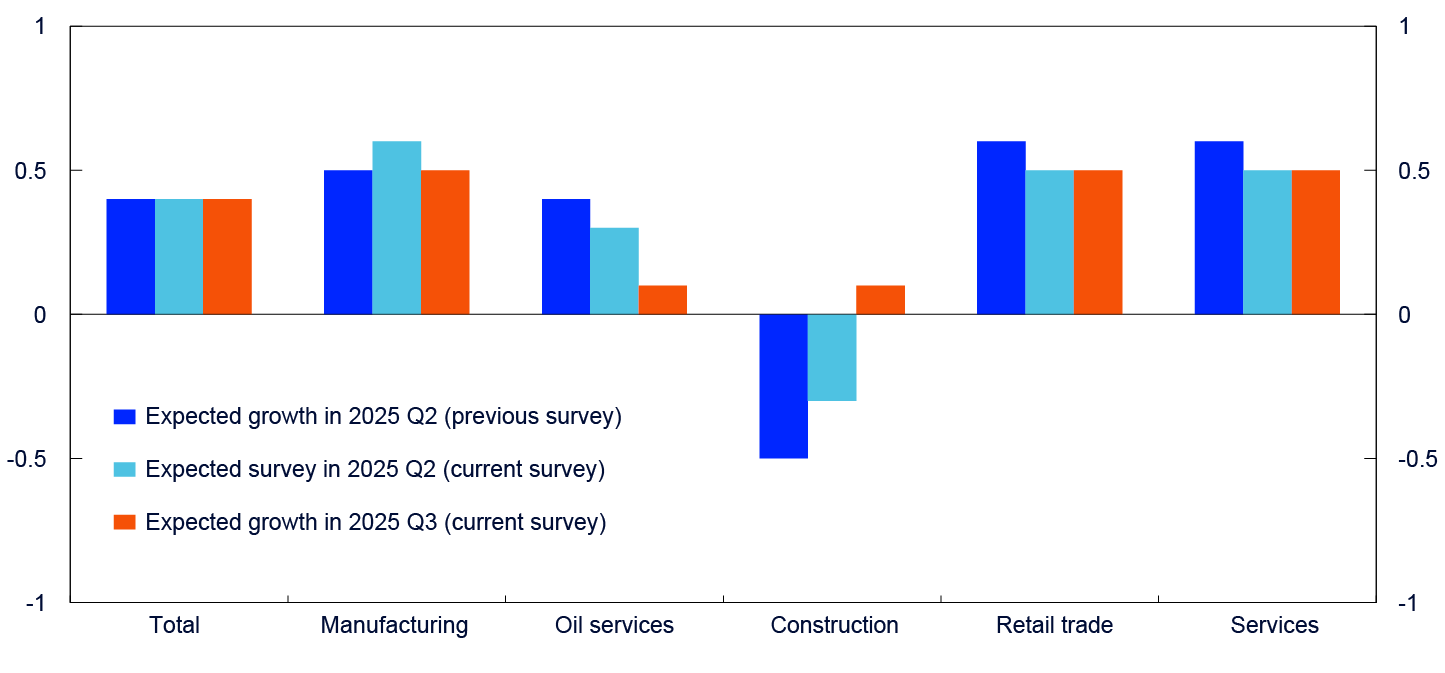

In the previous survey, contacts reported substantial international trade policy uncertainty. Trade tensions have intensified since the interviews in winter, but do not appear to have dampened growth expectations as contacts now expect growth to remain firm through 2025 Q2 and Q3 (Charts 1 and 2). For Q2, export industry contacts and oil service exporters expect the strongest growth while contacts in construction expect the weakest developments and account for the only sector that expects negative growth. For Q3 however, construction contacts expect growth to pick up slightly, while domestically-oriented oil services expect somewhat lower output.

Chart 1 Total output growth

Expected growth current quarter and next quarter. Seasonally adjusted. Percent

Chart 2 Output growth. All sectors

Expected growth current quarter and next quarter. Seasonally adjusted. Percent1

Effects of higher barriers to trade

In this survey, contacts were asked some additional questions about adjustments to and consequences of higher trade barriers. Few contacts expect tariff barriers to dampen their own exports in 2025 Q2 and Q3, primarily reflecting low exports to the US and the ability of goods exporters to largely shift to other markets. At the same time, a number of contacts point out that a European market decline would have a far greater impact, although few expect this to curb growth in Q2 and Q3. Some contacts that purchase foreign goods report that although trade barriers can shift the flow of goods, they will primarily drive up the cost of goods and freight rates with limited impact on activity. So far, mainly service contacts expect heightened global uncertainty to weigh down on activity growth.

Contacts were asked whether they had adjusted their investment plans for 2025 or 2026 in response to the higher trade barriers. A large majority of contacts responded that they had not changed their plans, and only a few responded that downward adjustments had been made. Among the contacts that did make downward adjustments, most had initially planned for relatively small investments in 2025 and 2026. Very few contacts responded that they had made upward adjustments. Contacts were also asked whether they had adjusted their planned selling prices for the next twelve months in response to the trade tensions. Here too, the majority responded that plans had not been adjusted, but the impact appears to be more pronounced on prices than on investment. Just less than one in ten contacts have made upward adjustments to their planned selling prices, with the highest share by far in construction.

1 Growth in the various industries may not add to aggregate growth due to rounding.

Increased exports boosting growth

Manufacturing contacts expect growth in 2025 Q2 to be the strongest since end-2021. The highest growth is expected in the export market. In aquaculture, favourable biological conditions are providing a substantial boost to output in Q2. Higher output and investment appetite in aquaculture are also boosting order volumes in the service sector. At the same time, lower quotas are leading to a decline in deep-sea fishing, which also reduces the activity levels of fish processors.

Manufacturing contacts report that increased defence spending, both domestically and abroad, boosts activity, but some point out that it will take time for rising defence investment to have a substantial impact on production. The energy transition is still driving growth and creating more jobs in large offshore wind and electricity supply projects. At the same time, a number of contacts report few new orders in renewables, in particular from Norwegian customers. Contacts point to low profitability in these projects and some emphasise lacking clarification regarding subsidy schemes.

Building materials output has fallen considerably in recent years. In this survey, only a few contacts expect further decline, and some expect a rise in autumn. On the other hand, some contacts are concerned that further price rises, on for example timber, will nevertheless dampen demand ahead.

Oil service exporters point to continued global activity growth. Many large projects are underway in for example Brazil and West Africa. Some exports are also to the US, but since these are largely services, they are not affected by the tariffs.

Oil service contacts serving the domestic market expect activity to decline in the period between 2025 Q2 and Q3. Shipyards in particular have undergone a period of very high activity and expect a gradual return to normal levels ahead. This reflects the completion of projects initiated when tax changes were made for the oil industry, which expire this year. Contacts expect few new and large-scale projects ahead but increased activity related to service and maintenance.

Slightly weaker growth in services

Business service providers have lowered their expectations for 2025 Q2 somewhat. A number of contacts report that customers have become more hesitant and cite increased international uncertainty. In addition, growth impulses from the energy transition have weakened, partly as a result of announced amendments to the EU’s Emissions Trading Directive. A number of contacts also point to fewer new offshore wind projects. IT services contacts continue to report growth as a result of increased digitalisation in the private and public sectors. Some service providers also report strong growth in demand from the Norwegian Armed Forces.

Growth among household-oriented service providers is held firm by the sharp rise in the tourism industry. Hotels report high occupancy rates due to many foreign tourists, and the majority expects further growth this summer. Increased tourism also has spillover effects for other parts of the services sector, including higher activity for food, transport and cleaning services. In addition to tourism, contacts report growth in services such as health and wellness and communication and media.

Households buy more consumer durables

Retail trade contacts expect higher sales in 2025 Q2 and Q3. The largest contributor is increased sales of consumer durables such as cars and furniture. Demand for these products has been low since the end of 2022, but contacts also reported improved sales in the previous survey. In addition, contacts that sell consumer goods such as clothing, shoes, food and medicine expect higher sales.

Construction set to stabilise this autumn

Construction contacts still have the weakest expectations and expect output to continue to decline in 2025 Q2. However, they expect to reach a low point in Q3. A number of housing construction contacts report that new home sales have improved, resulting in plans to launch more projects over the course of Q3. Some contacts that entered into the projects early expect higher activity. For many contacts, however, it will take time for the increased number of housing starts to generate growth. Activity remains low in commercial real estate, and contacts do not expect activity to pick up in 2025.

Looking ahead, there will be more defence-related construction projects but contacts point out that it will take time for these projects to lift activity. A number of contacts report higher order volumes from the public sector but emphasise that competition for these orders is also stronger. At the same time, increased demand from manufacturing, in particular maritime industries, lifts activity levels for some contacts.

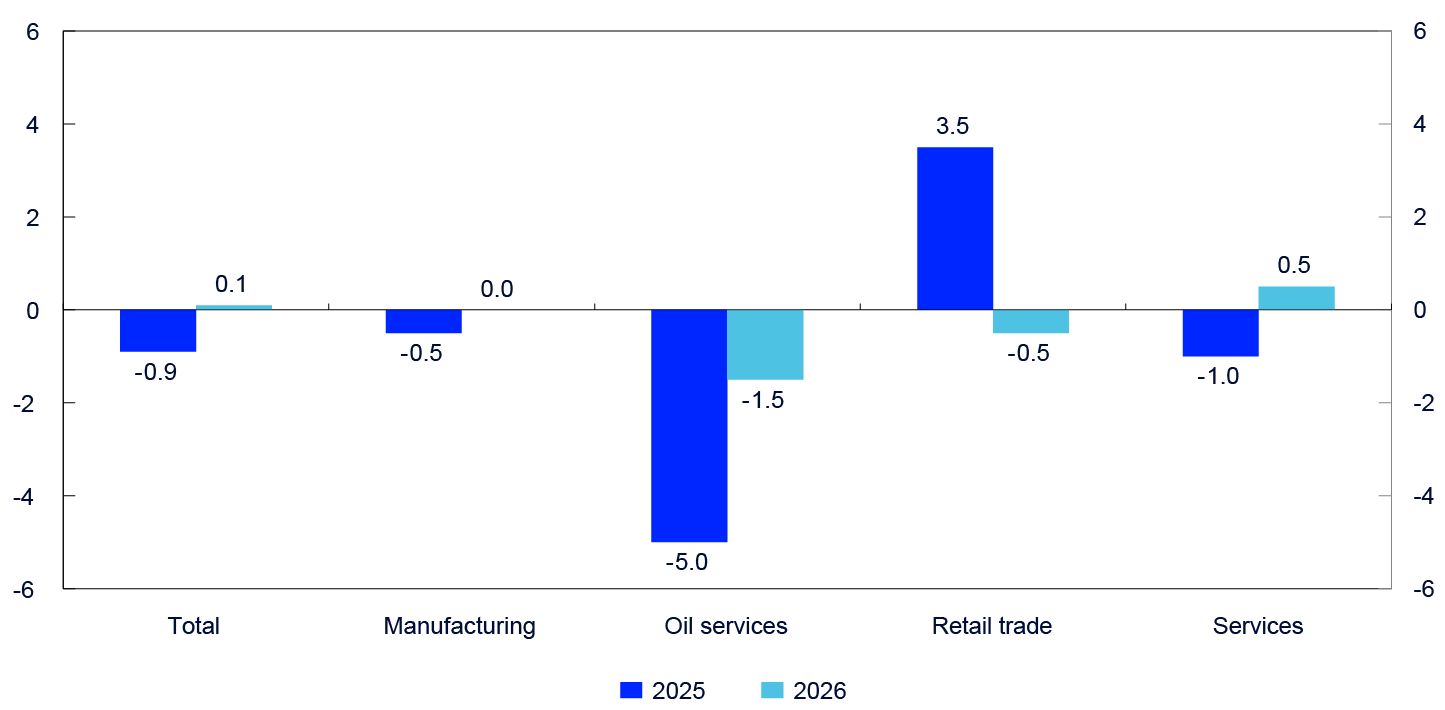

Decline in investment in 2025

Contacts expect lower investment in 2025 than in 2024 and fairly stable investment in 2026 (Chart 3). Retail trade enterprises overall is the only sector to plan an increase in investment in 2025. Many retail enterprises have invested little in recent years, and a number of contacts report that they will in 2025 make some of the investments that were previously postponed. They expect investment levels to decline somewhat again next year. Among service providers, investment in new commercial real estate in particular contributes to the decline in investment in 2025. Continued high investment costs cause many service providers to postpone investments. Service providers are alone in expecting investment to increase in 2025. For the first time since autumn 2020, manufacturers expect lower investment in the current year, due to many large investment projects now entering their final phase or recently having reached completion. Measures to lower greenhouse gas emissions and automation are still creating growth among some contacts, and some are also investing in higher production capacity, mainly in connection with existing production facilities.

Chart 3 Investment growth

Expected investment growth. Percent2

2 Due to rounding, investment growth in the different sectors do not necessarily sum exactly to the aggregate.

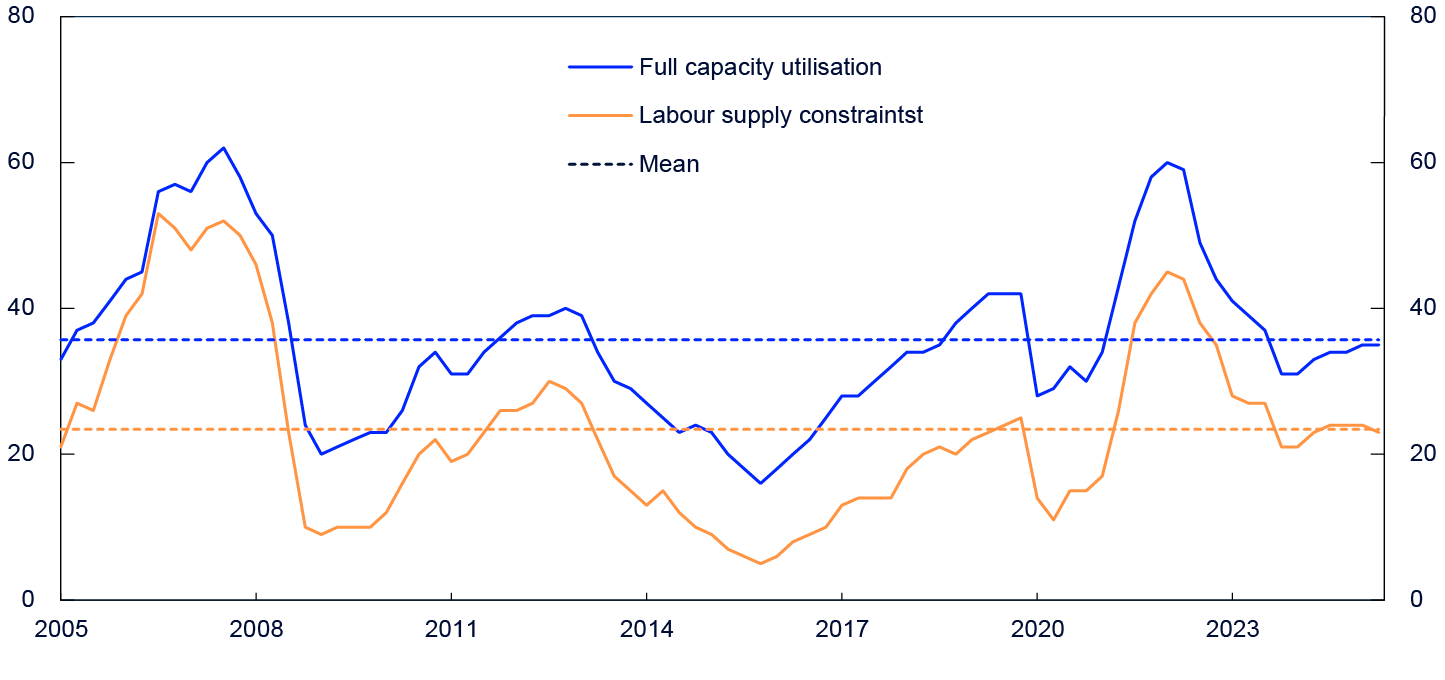

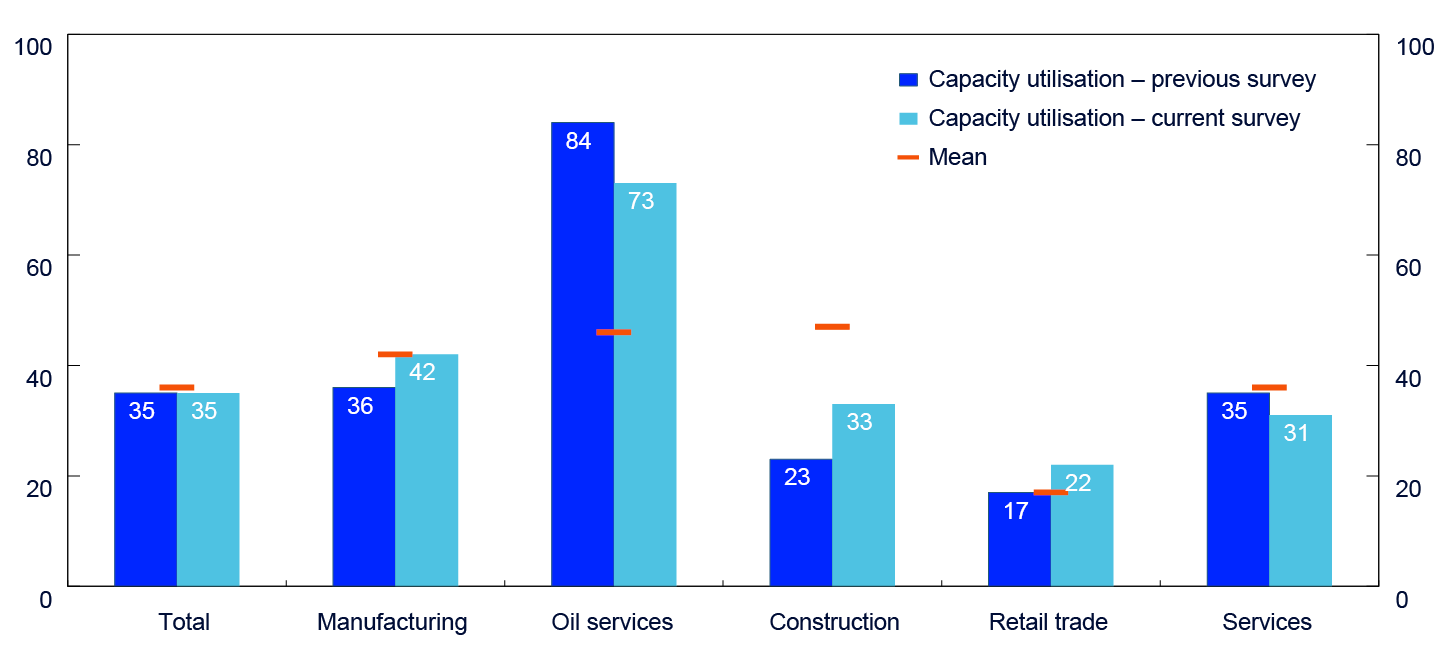

Some easing of labour market pressures

In this survey, 35% of contacts report that they would not be able to boost activity without hiring or increasing production capacity in other ways (Charts 4 and 5). This percentage is unchanged since the previous survey. At the same time, 23% of contacts, slightly fewer than in the previous survey, report difficulties in recruiting the qualified labour they need to boost activity. Although capacity constraints continue to be most widespread in oil services, they have decreased since 2025 Q1 owing to freed-up resources from the completion of a number of large projects. In services, fewer contacts also report capacity constraints, and some consultancy firms report weaker competition for labour. In construction and retail trade, the percentage of contacts reporting capacity constraints has increased since the previous survey. In construction, the percentage reached its highest level in the past two years, while the percentage in retail trade is the highest since the end of 2022. In retail trade, most contacts report no recruitment difficulties, while in construction, difficulties have increased.

Chart 4 Capacity utilisation3 and labour supply constraints4

Percentage shares

Chart 5 Capacity utilisation5

Percentage shares6

Contacts are planning to increase employment in both 2025 Q2 and Q3. Construction contacts expect employment to fall slightly in Q2. In Q3, however, they are planning to increase workforces for the first time in almost three years, reflecting the higher number of contacts expecting activity to rise towards the end of 2025.

3 Share of contacts that will face some or considerable difficulty increasing output/sales without committing additional resources such as labour or machinery.

4 Share of contacts citing shortage of labour as a constraint on production/sales. The question about labour is asked only of the enterprises reporting full capacity utilisation, but the series shows the share of all contacts included in the interview period.

5 Share of contacts that will face some or considerable difficulty increasing output/sales without committing additional resources such as labour or machinery

6 The shares in the different sectors do not necessarily sum up exactly to the aggregated shares due to rounding.

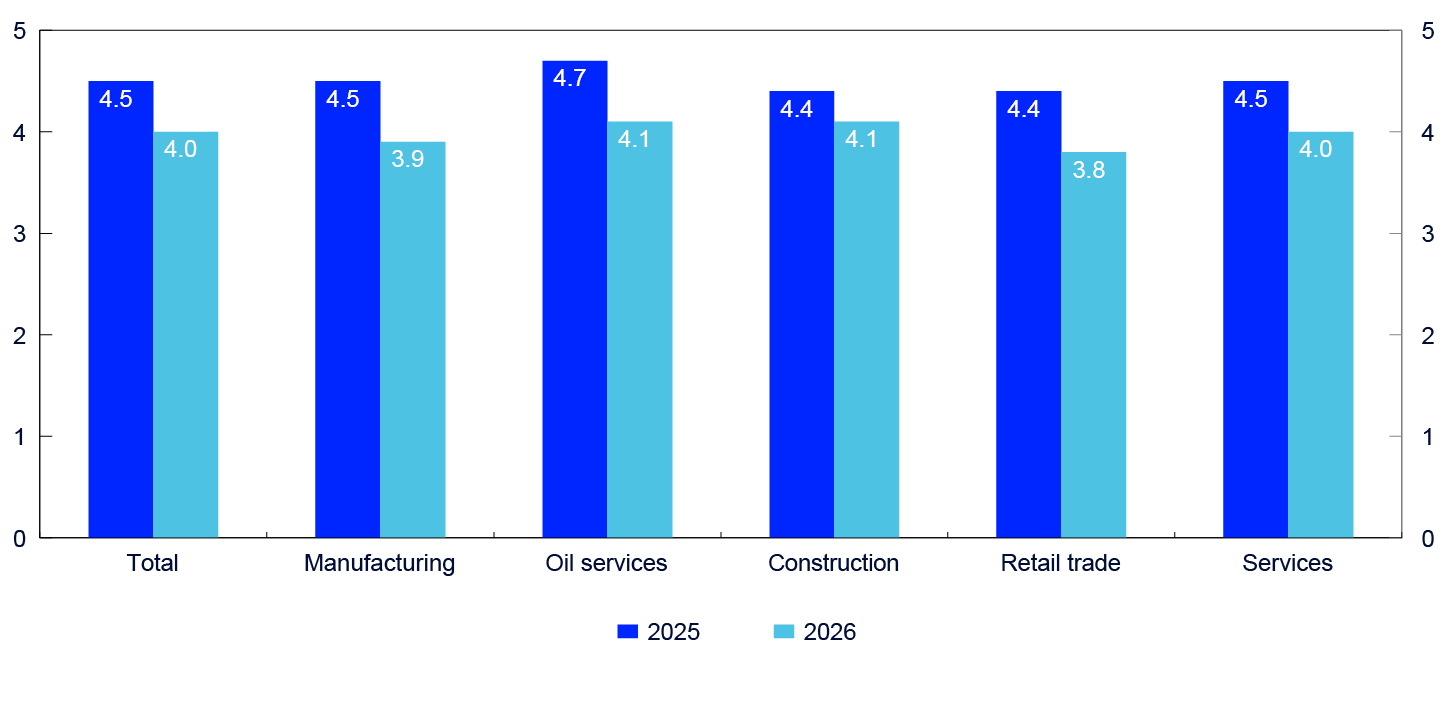

Slightly higher projections for annual wage growth

Contacts expect annual wage growth of 4.5% in 2025 and 4.0% in 2026 (Chart 6). Both projections are somewhat higher compared with the previous survey. For the 2025 projection, a large share of contacts cite the wage norm. Oil services contacts expect the highest wage growth in 2025, partly owing to solid profitability and strong competition for labour. Construction contacts have one of the lowest projections for annual wage growth for 2025, reflecting low order volumes and weak profitability. At the same time, their projections are among the highest for 2026.

Chart 6 Annual wage growth

Expected annual wage growth. Percent7

Overall, profitability among contacts has improved compared with one year ago (Chart 7). Construction contacts as a whole report small changes in profitability since 2024. Contacts have reported declining margins in construction since the start of 2019, and many point out that profitability is weak. Among a number of contacts, despite lower activity, margins have not declined further owing to cost-cutting measures, such as reducing both permanent and contract personnel. In the other sectors, contacts report improved margins.

Chart 7 Overall profitability growth

Change in operating margin in the current quarter compared with the same period one year earlier. Percent

7 Growth in the various industries may not add to aggregate growth due to rounding.

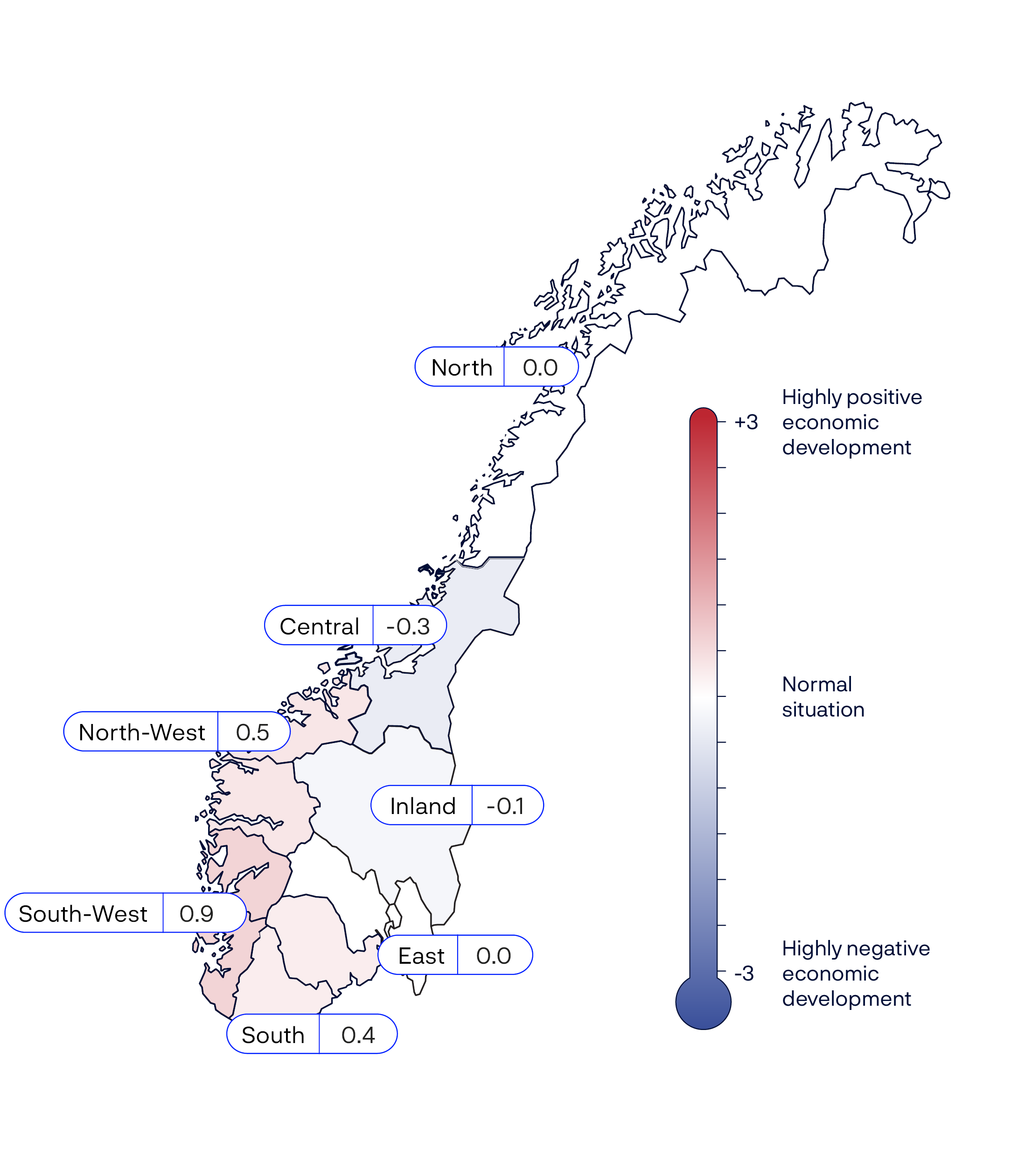

The economic situation is most robust in western Norway

Contacts are asked, on a scale between -3 and +3, how they would rate the economic situation of their enterprise in terms of demand, profitability and prospects. A value of zero indicates a normal situation. The regional indicator is an average of the responses in the individual region. In this survey, only the regions South, South-West and North-West report a positive indicator. High activity in the oil industry in particular is having positive spillover effects in the economy in these regions of Norway, and the economic situation is most robust in the region South-West. On the other hand, the indicators are negative in the regions Central and Inland. A majority of construction-related contacts are among those that pull down the regional indicators in these regions.

|

Previous survey |

This survey |

|

|---|---|---|

|

Output growth |

||

|

2025 Q2 |

||

|

Total |

0.4 |

0.4 |

|

Manufacturing |

0.5 |

0.6 |

|

Oil services |

0.4 |

0.3 |

|

Construction |

-0.5 |

-0.3 |

|

Retail trade |

0.6 |

0.5 |

|

Commercial services |

0.6 |

0.5 |

|

Household services |

0.6 |

0.6 |

|

2025 Q3 |

||

|

Total |

0.4 |

|

|

Manufacturing |

0.5 |

|

|

Oil services |

0.1 |

|

|

Construction |

0.1 |

|

|

Retail trade |

0.5 |

|

|

Commercial services |

0.5 |

|

|

Household services |

0.5 |

|

|

Investment plans |

||

|

Investment growth 2025 |

0.5 |

-0.9 |

|

Investment growth 2026 |

0.8 |

0.1 |

|

Labour market and output gap |

||

|

Employment growth 2025 Q2 |

0.2 |

0.2 |

|

Employment growth 2025 Q3 |

0.2 |

|

|

Full capacity utilisation |

35 |

35 |

|

Shortage of labour |

24 |

23 |

|

Annual wage growth |

||

|

Estimated annual wage growth 2025 |

4.4 |

4.5 |

|

Estimated annual wage growth 2026 |

3.9 |

4.0 |

Regional Network – enterprises and organisations interviewed over the past year

1881

3M

3T PRODUKTER

4SERVICE EIR RENHOLD

4SUBSEA

7. HIMMEL

A. HANSEN

A. MARKUSSEN

A-2

AB ØKONOMI

ABB

ABYSS

ACADEMIC WORK

ACCENTURE

ACCOUNTOR

ACEL

ACRYLICON, NORD-NORGE

ACTIVEPEOPLE

ADDSECURE

ADECCO

ADECCO, STAVANGER

ADMENTO

ADRESSEAVISEN

ADV. WIERSHOLM

ADVANSIA AFRY

ADVISO ADVOKATFIRMA

ADVOKATFIRMA KJÆR

ADVOKATFIRMA TOFTE HALD

ADVOKATFIRMAET BAHR

ADVOKATFIRMAET GRETTE

ADVOKATFIRMAET SCHJØDT

ADVOKATFIRMAET THALLAUG

ADVOKATFIRMAET THOMMESSEN

ADVOKATFIRMAET ØVERBØ GJØRTZ

AERO

AF

AFTENPOSTEN

AGAIA

AGNITIO

AGRA

AHLSELL

AIBEL

AIBEL, ASKER

AIBEL, HARSTAD

AIDER, STAVANGER

AIR PRODUCTS

AIRLIFT

AKER SOLUTIONS

AKER SOLUTIONS, EGERSUND

AKER SOLUTIONS, MMO

AKER SOLUTIONS, STORD

AKER SOLUTIONS, VERDAL

AKERSHUSGARTNEREN

AKERSHUSGRUPPEN

AKOFS OPERATIONS

AKSEL ENDRESEN TRANSPORT

AKSELL

AKSELL, KRISTIANSAND

AKSESS BEMANNING

AKTIESELSKAPET VINMONOPOLET

AKTIV BEMANNING

AKTIV EIENDOMSMEGLING

AKVA GROUP

AKVAPLAN-NIVA

AKVARIET I BERGEN

ALCOA

ALCOA, LISTA

ALENTO

ALLER MEDIA

ALLIANCE HEALTHCARE APOTEKDRIFT

ALLNEX

ALLOC

ALPINCO

ALTA MØBLER

ALTERA INFRASTRUCTURE

ALTI FORVALTNING

ALTIBOX

ALUDYNE

ALVDAL SKURLAG

ALVDAL-TYNSET SPORT

AMEDIA

AMESTO SOLUTIONS

AMFI MOA

ANDERS O GREVSTAD

ANDERSEN MEKANISKE VERKSTED

ANDERSEN OG AKSNES RØRLEGGERBEDRIFT

ANGVIK EIENDOM

ANGVIK GRYTNES ENTREPRENØR

ANKO

ANLEGG ØST ENTREPRENØR

ANORA

ANTICIMEX

APOLLO REISER

APOTEK 1

APPETITE FOR PRODUCTION

APPEX

APPLICA

APROPOS INTERNETT

APTUM

AQILA

AQUARAMA BAD

AQUASHIP

ARBOR

ARCHER

ARCTIC PLAST

ARE TREINDUSTRIER, KAUPANGER

ARENA TRENINGSSENTER

ARENDAL BRYGGERI

ARGES

ARK BOKHANDEL

ARKI ARKITEKTAR

ARKITEMA

ARKWRIGHT CONSULTING

ARM

ARNA & ÅSANE RØRLEGGERSERVICE

ARNTZEN DE BESCHE ADVOKATFIRMA

ARTEC AQUA

ARTESIA SPA

ARVID GJERDE

AS BETONG

AS3

ASAP PERSONAL

ASCO, SANDNESSJØEN

ASK MEDIA

ASKO

ASKO, NORD

ASKO, MIDT-NORGE

ASPELIN RAMM EIENDOM

ASPLAN VIAK

AT ARKITEKTUR

ATEA

ATEC BEMANNING

ATELIER EKREN

ATLANTERHAVSPARKEN

AUKSJONEN.NO

AURORA GROUP

AURSTAD

AUTOPLAN

AVANTOR

AVINOR

AVINOR, TRONDHEIM LUFTHAVN

AVINOR, BERGEN LUFTHAVN

AVINOR, STAVANGER LUFTHAVN

AVIS BILUTLEIE

AWORD

BACKE

BACKE, OPPLAND

BACKE, ROGALAND

BACKE, SANDEFJORD

BACKE, SØR

BACKE, TRONDHEIM

BACKERGRUPPEN

BAKEHUSET, NORD-NORGE

BALLANGEN SJØFARM

BALLSTAD SLIP

BAMA

BAMEK

BANDAK

BANESERVICE

BARCO FREDRIKSTAD

BAREL

BARNAS HUS

BARTEC

BATE BOLIGBYGGELAG

BATTERI ELEKTRO

BAUER MEDIA

BAVARIA, NORDVEST

BCD TRAVEL

BECKMANN

BEERENBERG CORP.

BEITOSTØLEN RESORT

BEKK CONSULTING

BELSVIK

BENESTAD SOLUTIONS

BERG BETONG

BERGE SAG

BERGEN ENGINES

BERGEN FIBER

BERGEN KINO

BERGEN PERSONAL

BERGENE HOLM

BERGET

BERG-HANSEN REISEBUREAU

BERG-HANSEN REISEBUREAU, VESTFOLD

BERRY PACKAGING

BERTEL O. STEEN, ROGALAND

BERTELSEN & GARPESTAD

BEST EVENT

BEST GLOBAL LOGISTICS

BETONMAST, INNLANDET

BETONMAST, RØSAND

BEWI INSULATION

BEYONDER

B-G ENTREPRENØR

BIBLIOTEK SYSTEMER A/S

BICO BYGG

BIL I NORD

BIL I NORD NARVIK

BILALLIANSEN

BILECO CAR PARTS

BILFINGER ENGINEERING & MAINT, HØYANGER

BILFINGER ENGINEERING & MAINT, ÅRDAL

BILFINGER INDUSTRIAL SERVICES

BILFINGER, KARMØY

BILSENTERET NAMSOS

BILTEMA

BILTEMA SØRLANDSPARKEN

BIOMAR

BIOSIRK

BITASTAD

BJØRØYA

BLANK

BLIKSUND

BLOCK WATNE

BLOWTECH GT

BLU ELECTRO

BMO ELEKTRO

BMO ENTREPRENØR

BN ENTREPRENØR

BO ANDRÉN

BOA OFFSHORE

BOASSON

BOEN BRUK

BOHUS

BOLAKS

BOLIDEN, ODDA

BOLSETH GLASS

BORREGAARD

BOSS INDUSTRI OG MEKANISK VERKSTED

BOURBON OFFSHORE

BOUVET

BOUVET, ARENDAL

BOUVET, TRONDHEIM

BRAVIDA

BRAVIDA BERGEN

BRAVIDA, FØRDE

BRAVIDA, TRONDHEIM

BREMANGER QUARRY

BREVIK ENGINEERING

BRG

BRIMER

BRITANNIA HOTEL

BRUMUNDDAL REGNSKAP

BRUNVOLL

BRYGGELOFTET & STUENE INVEST

BRØDRENE GUDBRANDSEN

BRØDRENE JAKOBSEN

BRØDRENE SPERRE

BRØDRENE ULVESETH

BSA OFFSHORE

BSH HUSHOLDNINGSAPPARATER

BULLDOZER MASKINLAG ENTREPRENØR

BUNDEGRUPPEN

BUNNPRIS

BUNNPRIS, MØRE

BUSENGDAL

BUSSBYGG

BUSSRING

BWISE

BY NORTH

BYBERG

BYGG OG MASKIN

BYGGIMPULS

BYGGMAKKER

BYGGMAKKER HANDEL

BYGGMESTER SAGEN

BYGGPARTNERE

BYGGSERVICE INNLANDET

BYHAVEN KJØPESENTER

BYKLE VINDU

BYRAA BODØ

BÆRUM RØRLEGGERBEDRIFT

BØRSTAD TRANSPORT

CAPGEMINI

CARANORD

CARGILL AQUA NUTRITION

CARNEGIE

CARPENTER

CARSHINE

CAVERION

CAVERION, BERGEN

CAVERION, GJØVIK

CAVERION, SUNNMØRE

CC DAGLIGVARE

CC GJØVIK OG HAMAR

CEGAL

CELSA ARMERINGSSTÅL

CEMASYS

CEMO

CENIKA

CERMAQ

CFLOW FISH HANDLING

CGG

CGI

CHRISTIANIA RØRLEGGERBEDRIFT

CHRISTIE & OPSAHL

CHSNOR

CITY LADE

CLAMPON

CLARION ERNST HOTELL KRISTIANSAND

CLARION HOTEL ENERGY

CLARKES

CLAS OHLSON

CLASSIC NORWAY

CMS KLUGE ADVOKATFIRMA

COGNIA

COGNITE

COLDWATER PRAWNS PRODUCTION

COLLICARE LOGISTICS

COLOR LINE, KRISTIANSAND

COMFORT HOTEL KRISTIANSAND

COMFORT HOTEL PORSGRUNN

CONCEPT RESTAUTRANTS

CONCEPTOR

CON-FORM

CON-FORM, ORKANGER

CONSTO

CONSTO, MIDT-NORGE

COOP

COOP NORDVEST

COOP NORDVEST, FØRDE

COOP, HORDALAND

COOP, INNLANDET

COOP, MIDT-NORGE

COOP, NORD

COOP, NORDLAND

COOP, SØRVEST

COOP, ØKONOM

COROMATIC

CORONA INTERIØR

COSL

COWI

CRAMO

CRYOGENETICS

CSUB

CTM LYNG

CUROTECH

DALE OF NORWAY

DALEN HOTEL

DANSKE BANK

DARK

DE BERGENSKE

DEDICARE

DEFENDABLE

DEKKTEAM

DELITEK

DELOITTE

DELOITTE, GJØVIK

DELTA ELETRONICS

DELY

DEN NORSKE OPERA & BALLETT

DEVOTEAM

DIALECTA KOMMUNIKASJON

DIALOG EXE

DIGITAL ETIKETT

DINAMO

DNB BANK, NORD

DNB BANK, STAVANGER

DNB EIENDOM

DNB EIENDOM, HAMAR

DNB EIENDOM, TRONDHEIM

DNB EIENDOM, TØNSBERG

DNB NÆRINGSEIENDOM

DNB NÆRINGSMEGLING

DNB NÆRINGSMEGLING, TRONDHEIM

DNB TRONDHEIM

DNH DEN NORSKE HØYTTALERFABRIKK

DNV

DOBLOUG

DOMSTEIN

DRAG INDUSTRIER

DRAMMEN LIFTUTLEIE

DROMEDAR KAFFEBAR

DUPONT NUTRITION

DURI FAGPROFIL

DYNEA

DYRSKUN

DØLAKJØTT

E A SMITH

E I NORD

E. FLASNES TRANSPORT

ECOSØR

EFFEKTIVT RENHOLD

EGENCIA

EGERSUND GROUP

EID ELEKTRO

EIDESVIK OFFSHORE

EIDSVAAG

EIENDOMSHUSET MALLING & CO

EIENDOMSMEGLER 1, INNLANDET

EIENDOMSMEGLER 1, KRISTIANSAND

EIENDOMSMEGLER 1, MIDT-NORGE

EIENDOMSMEGLER 1, NORD-NORGE

EIENDOMSMEGLER 1, SR-EIENDOM

EIENDOMSMEGLER 1, TELEMARK

EIENDOMSMEGLER VEST

EIENDOMSSPAR

EIGEDOMSMEKLING SOGN OG FJORDANE

EIK SERVERING

EIKA

EINAR ØGREY FARSUND

EKORNES

ELAS

ELECTRO TEAM

ELEFUN

ELEKTRO 4

ELEKTRO BODØ

ELEKTRO INSTALLASJON

ELEKTRO-KONTAKTEN

ELEMENT NOR

ELEMENT SØR

ELKEM, BJØLVEFOSSEN

ELKEM, BREMANGER

ELKEM, SALTEN VERK

ELKEM, THAMSHAVN

ELKJØP

ELKJØP, FJORDANE

ELKJØP, FORUS

ELMO TEKNIKK

ELTA RESTAURANTBEDRIFT

EL-TEAM

ELTEL NETWORKS

ELTERAGRUPPEN

EL-TJENESTE

ELVERUM SPORT BILSALG

ENGERS LEFSEBAKERI

ENGØ GÅRD

ENIVEST

ENRX/IPT

ENTRA

ENTRACK

ENTRO

EPAX

EPINOVA

EPIROC

EPLEHUSET

ERAMET, KVINESDAL

ERAMET, SAUDA

EURO SKO

EUROPRIS

EUROSPAR, BRUMUNDDAL

EVENSEN & EVENSEN

EVENSTAD MUSIKK -DISTRIBUSJON

EVERZINC

EVIDIA

EXBO SØRLANDET

EXPLORO

EXTRA LEKER

EY

EY, BERGEN

EY, SUNNMØRE

F8 BYGG

FABELAKTIV

FABER BYGG

FABI

FAGTRYKK

FARRIS BAD

FAUN

FELLESKJØPET, ROGALAND AGDER

FENIX OUTDOOR

FERDA

FIGGJO

FINN OG ALBERT EGELAND

FINNEID SVEISEVERKSTED

FINNFJORD

FINNY SIREVAAG

FINNØY GEAR & PROPELLER

FIRDA BILLAG

FIRDA MEDIA

FIRESAFE

FIRING &THORSEN

FIRMENICH BJØRGE BIOMARIN

FIRST HOUSE

FISKERSTRAND VERFT

FISKÅ MØLLE

FIVEN

FIXIT 24

FJELDSETH

FJELLSPORT.NO

FJORD1

FJORDKJØKKEN

FLAKK

FLEKKERØY VVS

FLISA TRYKKERI

FLISEKOMPANIET

FLOKK

FLUID CONTROL SERVICE

FLYTOGET

FLØIBANEN

FOCUS CARE

FOKUS ELEKTRO

FOLK

FOOD FOLK

FOODMAN

FOODORA

FOODTECH INTERIØR OG STORKJØKKEN

FORCE TECHNOLOGY, KRISTIANSAND

FORD MOTOR

FORENOM

FORESTIA

FORMUE

FOSDALEN

FOSS FABRIKKER

FOURPHASE

FPE SONTUM

FRAM REVISJON

FRAMO

FRAMSIKT

FRANZEFOSS MINERALS

FRANZEFOSS PUKK

FREJA TRANSPORT AND LOGISTICS

FREMTIND FORSIKRING

FRENDE FORSIKRING

FRESH FITNESS

FRONTLINE POS

FRYDENBØ BIL

FRYDENBØ BIL FØRDE

FRYDENBØ INDUSTRI ØKSFJORD

FRØY

FSV

FUGLEFJELLET

FUGRO

FUNDAMENTERING – FAS

FURNES JERNSTØPERI

FURSET

FURSTÅL

FUTURE PRODUCTION

FÆDRELANDSVENNEN

FØRDE SEMENTVARE

FØRRE TREVAREFABRIKK

G3 GAUSDAL TREINDUSTRIER

GAGAMA ELEKTRO

GALVANO INDUSTRI

GANN TRE

GANT RETAIL

GAST ENTREPRENØR

GAUPEN-HENGER

GAUPNETUNET HOTELL & HYTTER

GAUSDAL LANDHANDLERI

GC RIEBER VIVOMEGA

GE HEALTHCARE, SPANGEREID

GE VINGMED ULTRASOUND

GEILOGRUPPEN

GET INSPIRED

GEXCON

GIGANTE HAVBRUK

GILJE TRE

GINA TRICOT

GJENSIDIG ASSURANSEFORENING

GJENSIDIGE FORSIKRING

GJØCO

GJØVIK GRAVESERVICE

GK

GK, LILLEHAMMER

GKN AEROSPACE

GLACIO

GLAMOX

GLAVA

GLENCORE NIKKELVERK

GLOBALCONNECT

GLOMMA PAPP

GLØR PARTNER

GLÅMDALEN

GMC

GNIST ARKITEKTER

GOKSTADAPOTEKENE

GOODTECH

GORINES

GRADE JOBBNORGE

GRAND HOTELL EGERSUND

GRANDE ENTREPRENØR

GRAPE ARCHITECTS

GREEN H

GREEN MOUNTAIN

GRIEG SEAFOOD, FINNMARK

GRILSTAD

GRILSTAD, BRUMUNDDAL

GRILSTAD, STRANDA

GROMSTAD AUTO

GROTNES STEEL

GRUNN-SERVICE

GRØNSBERG BYGG

G-TRAVEL

GUDBRANDSDAL ENERGI

GUDBRANDSDALENS ULDVAREFARBRIK

GULLSMED J. FRISENBERG

GUMPEN

GUNNAR HIPPE PLATE OG SVEISEVERKSTED

GUNNAR KLO

GUNVALD JOHANSEN HANDEL

GYLDENDAL

H & K SANDNES

H. MYDLAND

HAGEN

HALLGRUPPEN

HALLIBURTON

HALLINGPLAST

HALOGEN

HAMMERFEST INDUSTRISERVICE

HANDELSBANKEN

HANDELSBANKEN, TRONDHEIM

HANS H. IVERSEN

HANSEN OG JUSTNÆS

HAPLAST

HAREID GROUP, BYGG & INDUSTRI

HAREID GROUP, FORBRUKERELEKTRONIKK

HAREID GROUP, MARITIM INDUSTRI

HARRIS ADVOKATFIRMA

HARSTAD MASKIN

HARSTAD MEK. VERKSTED

HAUCON

HAUGESUND SPAREBANK

HAV EIENDOM

HAV GROUP

HAV LINE

HAVER ADVOKATFIRMA

HAVFRAM

HAVILA SHIPPING

HAVILA SUBSEA & RENEWABLES

HD HYUNDAI INFRACORE

HEAD ENERGY

HEATWORK

HEGSTAD & BLAKSTAD

HEIDELBERG MATERIALS SEMENT

HEIDELBERG MATERIALS TILSLAG

HEIMDAL BOLIG

HEIMDAL EIENDOMSMEGLING

HEIMSTADEN

HELEN & HARD

HELGE KLYVE

HELGELAND MARINASYSTEMER

HELGELAND PLAST

HELGELANDSBASE

HELGESEN TEKNISKE BYGG

HELLENES INDUSTRIER

HELLY HANSEN

HELP FORSIKRING

HEMMINGODDEN LOFOTEN FISHING LODGE

HENDUG BYGG

HENNIG-OLSEN IS

HENT

HEPRO

HERLIGE STAVANGER RESTAURANTER

HERREGALLERIET

HERTZ

HESSELBERG

HEXAGON RAGASCO

HEYMAT

HG BYGG

HIGHSOFT

HITEC PRODUCTS

HK TROMSØ REKLAMEBYRÅ

HMH

HOB GODS

HOEL GÅRD PLUSS

HOFSETH INTERNATIONAL

HOLBERG FORVALTNING

HOLDBART

HOLE ANLEGG

HOLMØY MARITIME

HOLTE CONSULTING

HORISONT ENERGI

HOTEL ALEXANDRA

HOTEL UNION GEIRANGER

HOTEL VICTORIA

HOTELL VIC

HOTELLDRIFT ÅLESUND

HOVDEN HYTTESERVICE

HOVE WEST

HOVLI AUTO

HRL

HSH ENTREPRENØR

HTH

HTS DYNAMICS

HUNDERFOSSEN FAMILIEPARK

HUNTER DOUGLAS

HUNTON FIBER

HUNTONIT

HURTIGRUTEN

HUSTAD MØBLER

HYDAL ALUMINIUM PROFILER

HYDRO

HYDRO EXTRUSION

HYDROLIFT

HÆHRE ENTREPRENØRER

HØGEVARDE

HÅ ELEMENT

HAALAND NORD

HÅNDVERKSGRUPPEN

I P HUSE

IBIZA BOATS

ICOPALTAK

IGLAND GARASJEN

IGLO MANO

IK

IKEA

IKEA, FORUS

IKEA, LEANGEN

IKEA, RINGSAKER

IKEA, ÅSANE

IKM

IKM ACONA

IMPEC

IMPULSE TRENINGSSENTER

IMS

IMS TECHNOLOGIES

INDIRA

INDUSTRIVISUALISERING

INGENIØR IVAR PETTERSEN

INISSION LØKKEN

INNOMHUS

INNOVA

INNOVENTI

INNTRE

INNVIK

INOVYN

INPEX IDEMITSU

INRIGO

INSENTI

INSIDER FACILITY SOLUTIONS

INSPIRIT365

INTEK ENGINEERING

INTERFIL

INTILITY

INVENT SPORT

INVENTURA

ISIFLO

ISLAND OFFSHORE

ISOLA

ISS FACILITY SERVICES

ITAB INDUSTRIER

ITEAM

ITERA

IV GROUP LEKSVIK

IZOMAX

J H NÆVDAL BYGG

JANGAARD EXPORT

JANSEN OG WILLUMSEN SERVICES

JANUSFABRIKKEN

JARO

JC DECAUX

JESL

JM

JM HANSEN

JM ROBOTICS

JOHAN KJELLMARK

JOHN GREGER

JOHS J SYLTERN

JOTRON

JOTUN

JULA

JULIUS JAKHELLN

JÆGER SENTRUM

JÆRBAKEREN ARNE JOHANNESEN

JÆREN SPAREBANK

K A RASMUSSEN

K EKRHEIM

K. LUND

K. NORDANG

KAEFER ENERGY

KAFFEBØNNA

KANFA

KANTEGA

KAPPAHL

KARABIN

KARMSUND GROUP

KARSTEN MOHOLT

KAVLI

KB ARKITEKTER

KCA DEUTAG DRILLING

KELLER GEOTEKNIKK

KELLY SERVICES

KEWA INVEST

KICKS

KID INTERIØR

KIMEK

KINN BRYGGERI

KITCH'N

KIWI

KLETOR

KLP EIENDOM

KLP EIENDOM, TRONDHEIM

KNOWIT OBJECTNET

KNOWIT, KRISTIANSAND

KOMPLETT

KONGEPARKEN

KONGSBERG AUTOMOTIVE, RAUFOSS

KONGSBERG ENTREPRENØR

KONGSBERG GRUPPEN

KONGSBERG MARITIME, TRONDHEIM

KONGSBERG MARITIME, ÅLESUND

KONGSBERG TEKNOLOGIPARK

KONKURRENTEN

KPMG

KPMG, TRONDHEIM

K-PRODUKSJON

KRAFTLAUGET

KRAGERØ RESORT

KRANPROFFEN

KREDINOR SA

KRISTIANSAND DYREPARK

KROGSVEEN

KROGSVEEN, HAMAR

KROKEN CARAVAN

KRUSE LARSEN

KVALE ADVOKATFIRMA

KVENNA

KVERNELAND

KVITNES DRIFT

KYSTDESIGN

LAB

LABORA

LAERDAL MEDICAL

LAG ENTREPRENØR

LANDSKAPSENTREPRENØRENE

LARSNES MEK VERKSTED

LEBA

LEFDAL MINE DATACENTER

LEIRVIK

LEIV SAND TRANSPORT

LENDO

LEONHARD NILSEN & SØNNER

LERUM

LERØY HAVFISK

LERØY SEAFOODS

LERØY SEAFOOD

LETT-TAK SYSTEMER

LIAN VINDUER

LILLEBORG, INDUSTRI

LILLRENT

LINDESNES HAVHOTELL

LINDEX

LINDUM

LINGALAKS

LINJEBYGG

LINK ARKITEKTUR

LITRA

LITRA GASS

LIVSFORSIKRINGSSELSKAPET NORDEA

LMG MARIN

LOCALHOST

LOFOT ENTREPRENØR

LOFOTEN VIKING

LOS

LOVUNDLAKS

LOYDS INDUSTRI

LPO ARKITEKTER

LUCKY BOWL

LUNDAL NORD

LUNDHS

LYRECO

LØPLABBET

LØVLIEN GEORÅD

LØVOLD

LAADER BERG

MADLA HANDELSLAG

MADSHUS

MAGNETEN KJØPESENTER

MAGNUS M. THUNESTVEDT

MAKING VIEW

MANDAL HOTEL

MANPOWER

MANPOWER, TRONDHEIM

MANTENA

MARBRE EIENDOM

MARINE INSTALLASJONER

MARINE TECHNOLOGIES LLC

MARITIM CENTER

MARITIM SVEISESERVICE

MARITIME PARTNER

MARNAR BRUK

MARTHES RENSERI

MARTIN M. BAKKEN

MASCHMANNS

MASCOT HØIE

MASKE

MASTERCARD PAYMENT SERVICES

MAT & DRIKKE

MBA ENTREPRENØR

MCC LABEL

MEDIABRANDS

MEDIEHUSET HAUGESUNDS AVIS

MEDIEHUSET STAVANGER AFTENBLAD

MEKONOMEN

MELBU SYSTEMS

MELHUS SPAREBANK

MENTO

MENTO, HAMMERFEST ENGROS

MESTA

MESTER GRØNN

MESTERGRUPPEN ARKITEKTER

METALLTEKNIKK

MEYERSHIP

MIELE

MILES, STAVANGER

MINDSHARE

MINTRA

MJØRUD

MM KARTON FOLLACELL

MMC FIRST PROCESS

MOELVEN BYGGMODUL

MOELVEN LIMTRE

MOELVEN MODUS

MOELVEN VAN SEVEREN

MOELVEN WOOD

MOI RØR

MOMEK

MONGSTAD TAVLETEKNIKK

MONTEL

MONTÉR, LYNGDAL

MONTERA

MORELD APPLY

MOSAIQUE

MOSJØEN KULDE OG KLIMASERVICE

MOWI

MOWI FEED

MRC GLOBAL

MULTI MARITIME

MULTI-BYGG

MULTICONSULT

MULTICONSULT, BERGEN

MULTICONSULT, STAVANGER

MUR I SØR

MURMESTER DAG ARNE NILSEN, SEM

MUSEENE I SØR-TRØNDELAG

MUSTAD AUTOLINE

MYSTORE.NO

MØBELGALLERIET TROMSØ

MØBELRINGEN

MØBELTRE

MØLLER BIL

MØLLER BIL, LARVIK

MØLLER BIL, SØR-ROGALAND

MØRE DRIFT

MØRE TRAFO

MØRENOT AQUACULTURE

MÅLSELV MASKIN & TRANSPORT

MAALØY SEAFOOD

MÅSØVAL FISKEOPPDRETT

NABOEN UTLEIE

NAMMO

NARVIKFJELLET

NAUSTDAL DAMPBAKERI

NEDIG

NEKTON

NEMKO

NERGÅRD

NESSEPLAST

NETTPARTNER

NEUMANN BYGG, TROMSØ

NEXANS

NICRO

NILLE

NILS SPERRE

NILSSON

NOBIA

NOBLE DRILLING

NOEN

NOFI TROMSØ

NOHA

NOMEK

NORCABEL

NORCONSULT

NORCONSULT, TRONDHEIM

NORD NORSK BILUTLEIE

NORDBOLIG INNLANDET

NORDBØ MASKIN

NORDEA, KRISTIANSAND

NORDFJORD KJØTT

NORDIC BULK

NORDIC DOOR

NORDIC LAST OG BUSS

NORDIC MINING

NORDIC OFFICE OF ARCHITECTURE

NORDIC SEMICONDUCTOR

NORDIC UNMANNED

NORDICGSA

NORDKONTAKT

NORDLAKS OPPDRETT

NORDLAND BETONG

NORDNORSK LEDERUTVIKLING

NORDNORSK REVISJON

NORDOX

NORDVEST BEMANNING

NORDVESTVINDUET

NORENGROS GUSTAV PEDERSEN

NORFLOOR

NORGES HANDELS- OG SJØFARTSTIDENDE

NORGESFÔR

NORGESGRUPPEN

NORGESHUS

NORGESHUS, OPPDAL BYGG

NORGESKJELL

NORGESMØLLENE, BUVIKA

NORGESPERSONAL

NORGESPLASTER

NORGESVINDUET BJØRLO

NORGRO

NORLI

NORMATIC

NORNER

NORREK DYPFRYS

NORRØNA

NORRØNA STORKJØKKEN

NORSEA

NORSEA POLARBASE

NORSEYE

NORSK FOLKEMUSEUM

NORSK KJERNEKRAFT

NORSK KLEBER

NORSK KYLLING

NORSK REGNESENTRAL

NORSK SJØMAT STRANDA

NORSK TEKNISK MUSEUM

NORSK TIPPING

NORSKE BACKER

NORSKE SKOG, SKOGN

NORSOL

NORTHERN LIGHTS

NORTRANSPORT

NORTURA

NORTURA, FORUS

NORTURA, FØRDE

NORWEGIAN

NORWEGIAN CONCEPT

NORWEGIAN SHIP DESIGN

NOS

NOTABENE ENGROS

NOTAR HOVEDKONTOR

NOV

NOV, APL

NOV, MOLDE

NOVA INTERIØR

NOVA SEA

NRC

NSE FAGSTILLAS

NSK SHIP DESIGN

NSW

NTT DATA BUSINESS SOLUTIONS

NUSFJORD DRIFT

NUTRIMAR

NY FRISØR OG VELVÆRE

NYEVEIER

NYLANDER & PARTNERS

NYMO

NYMO BIL

NÆRINGSBANKEN

NÆRINGSMEGLEREN SÆDBERG OG HODNE

NØSTED KJETTING

O. MUSTAD & SON

OBOS

OCEAN ELECTRONICS

OCEAN SUPREME

OCEANEERING

OCEANEERING ROTATOR

ODAL SPAREBANK

ODDA PLAST

ODDA TECHNOLOGY

ODEON KINO, STAVANGER OG SANDNES

ODFJELL DRILLING

OEG OFFSHORE

OFFSHORE & TRAWL SUPPLY

OK MARINE

OLAV THON EIENDOMSSELSKAP

OLAV THON SURNADAL, SERVERING OG SERVICE

OLAV THON SURNADAL, VAREHANDEL

OLYMPIC SUBSEA

OMD

OMEGA 365

OMYA HUSTADMARMOR

ONESUBSEA PROCESSING

ONNINEN

ONRAIL

OPS MEKANISKE

OPTIMERA, SØR

OPTIMERA, VEST

OPUS

ORICA

ORIGO SOLUTIONS

ORKEL

ORKLA FOODS

ORKLA FOODS, TORO ELVERUM

OS ID

OSC

OSHAUG METALL

OSKAR PEDERSEN

OSKAR SYLTE MINERALVANNFABRIKK

OSLAND HAVBRUK

OSM THOME LTD

OSS-NOR

OSTEHUSET

OSWO

OTOVO

OTTADALEN MØLLE

OTTEM

OTTO OLSEN

OTTS

OVE SKÅR

OVERHALLA BETONGBYGG

OXER EIENDOM

P4

PALA KAFFEBRENNERI

PALLEFABRIKKEN HALSA

PANTERRA

PARAT HALVORSEN

PARETO BANK

PATOGEN

PAUL NYGAARD

PEAB

PEAB BYGG

PEDAGOGISK VIKARSENTRAL

PEGASUS KONTROLL

PELAGIA

PETORO

PHARMAQ

PHD MEDIA

PIPELIFE

PIZZABAKEREN

PKA ARKTITEKTER

PLAN 1

PLASTO

POB ENTREPRENØR

POLARIS EIENDOM

POLARISE PROPERTY

POLARKONSULT

POSTEN

POSTNORD

POWEROFFICE

PRIMA ASSISTANSE

PRIMA SEAFOOD

PRIME CARGO

PRINCESS

PRIVATMEGLEREN

PRIVATMEGLEREN, SÆDBERG OG LIAN

PROACTIMA

PROFILTEAM

PROFITBASE

PROGNOSESENTERET

PROPLAN

PROSERV

PROSJEKTIL

PROXLL

PSW

PETROLEUM TECHNOLOGY COMPANY

PTG

PUBLICIS

PWC

PWC, NORDVEST

PWC, TRONDHEIM

PAA BORDET

PÅ HÅRET FRISØR

Q4 NÆRINGSMEGLING

Q-FREE

QUALIFIED SOLUTIONS SØRLANDET

QUALITY HOTEL, GRAND KRISTIANSUND

QUALITY HOTEL, STRAND GJØVIK

QUALITY HOTEL, WATERFRONT ÅLESUND

RADISSON BLU ATLANTIC HOTEL, STAVANGER

RADISSON BLU CALEDONIEN HOTEL, KRISTIANSAND

RAMBØLL, MIDT-NORGE

RAMCO

RAMUDDEN

RANA GRUBER

RANDABERG GROUP

RANDEM & HÜBERT

RANDSTAD

RANHEIM PAPER AND BOARD

RAPP BOMEK

RASMUS TALLAKSEN

RATIO ARKITEKTER

RAUFOSS TECHNOLOGY

REITAN EIENDOM

REKEFJORD STONE

REKLAMESTASJONEN

REM OFFSHORE

REMA 1000

REMA 1000, VEST

RENEX

RENSERIET SANDNES

RENTAL ONE

RESPONS ANALYSE

RESPONSE NORDIC

RESQ GRIMSTAD

RETAIL MANAGEMENT

RETRO

RETURKRAFT

REVICOM

REVISJON SØR

REVISORKONSULT

RIKSTV

RIKTIG SPOR

RINGALM TRE

RINGNES

RISA

RITEK

ROCKETFARM

ROCKWOOL

ROGALAND ELEKTRO

ROLLS ROYCE ELECTRICAL

ROMARHEIM ENTREPRENØR

ROMSDALS BUDSTIKKE

ROSEN

ROSENBERG WORLEYPARSONS

RSM

RUSTFRIE BERGH

RUTA ENTREPRENØR

RÆDERGÅRD ENTREPRENØR

RØDNE

RØDVEN TRANSPORT

RØRA FABRIKKER

RØROS HOTELL

RØRTEK

RØST SJØMAT

RØSTAD ENTREPRENØR

RØYRÅS TREINDUSTRI

RØYSETH MASKIN

RÅDGIVENDE BIOLOGER

SAFE BEMANNING

SAFECLEAN

SAFEJOB ENERGY

SAFEROAD TRAFFIC

SAFETEC NORDIC

SAGA BOATS

SAGA FISK

SAGA FJORDBASE

SAINT-GOBAIN DISTRIBUTION

SALMAR

SALMON EVOLUTION

SALSNES FILTER

SALT LOFOTEN

SALT SHIP DESIGN

SALTHAMMER BÅTBYGGERI

SANCO SHIPPING

SANDELLA FABRIKKEN

SANDERMOEN

SANDNES GARN

SANDNES SPAREBANK

SANDVIK TEENESS

SANNGRUND

SAR

SARTOR & DRANGE

SAS

SATSELIXIA

SB TRANSPORT

SCALA EIENDOM

SCALE AQUACULTURE

SCAN TRADE

SCANBIO MARINE

SCANDIC HOTELS, BERGEN

SCANDIC HOTELS, HELL

SCANDIC HOTELS, KRISTIANSAND

SCANDIC HOTELS, LILLEHAMMER

SCANDIC HOTELS, SANDEFJORD

SCANFLEX

SCANMATIC

SCANPOLE

SCATEC

SCHIBSTED DISTRIBUSJON VEST

SCHWENKE & SØNN

SD WORX

SEA1 OFFSHORE

SEABORN

SEAONICS

SECURITAS

SELFA TRONDHEIM

SELSTAD, SVOLVÆR NOTBØTERI

SELVAAG

SERVI

SERVIT CATERING

SERVOGEAR

SG ARMATUREN

SHARECAT SOLUTIONS

SHAWCOR

SHEARWATER GEOSERVICES

SIEMENS ENERGY, RUBBESTADNESET

SIEMENS, DIGITAL INDUSTRIES

SIG. HALVORSEN

SIGNAL MARKED

SIGNICAT

SIKTEDUKFABRIKKEN

SIMEX RØR

SIMON MØKSTER SHIPPING

SIMONA STADPIPE

SIMPLICITY

SINTEF

SJ

SJØ-SPORT SERVICE

SKALA FABRIKK, TRONDHEIM

SKANDINAVISK HØYFJELLSUTSTYR, TRONDHEIM

SKANSKA

SKANSKA, AGDER

SKANSKA, MIDT

SKANSKA, STAVANGER

SKARPNES

SKEVIG LASTEBILTRANSPORT

SKIDOO SENTERET

SKIEN FRITIDSPARK

SKIPNES

SKIPSTEKNISK

SKISTAR, TRYSIL

SKJÆVELAND & MULTIBLOKK

SKO HUUSE

SKRETTING

SLAGEN

SLAKTHUSET EIDSMO DULLUM

SLB KRISTIANSAND

SLETTVOLL MØBLER

SLETTVOLL STAVANGER

SLIPEN MEKANISKE

SMAKEN AV GRIMSTAD

SMARTDOK

SMURFIT WESTROCK

SNØHETTA

SODEXO

SOGN SPAREBANK

SOILTECH OFFSHORE SERVICES

SOKKELDIREKTORATET

SOLA STRANDHOTELL

SOLBERG BIL

SOLID ENTREPRENØR

SOLSTAD OFFSHORE

SOLWR SOFTWARE

SONAT

SONEPAR

SORRISNIVA

SORTLAND ENTREPRENØR

SOTRA FISKEINDUSTRI

SPAR KJØP

SPAREBANK 1

SPAREBANK 1 NORDMØRE

SPAREBANK 1 SMN

SPAREBANK 1 SR-BANK

SPAREBANK 1, BODØ

SPAREBANK 1, HELGELAND

SPAREBANK 1, LOM OG SKJÅK

SPAREBANK 1, ØSTLANDET

SPAREBANK 68 GRADER NORD

SPAREBANK1, NORD-ØSTERDAL TYNSET

SPAREBANK1, REGNSKAPSHUSET

SPAREBANKEN MØRE

SPAREBANKEN SOGN OG FJORDANE

SPAREBANKEN SØR KONSERN

SPAREBANKEN VEST

SPEIRA

SPICHEREN TRENINGSSENTER

SPILKA

SPORVEIEN

SPRELL

SPRINT CONSULTING

SR GROUP

STAMAS SOLUTIONS

STANGELAND MASKIN

STANGESKOVENE

STELLA POLARIS

STERLING HALIBUT

STICOS

STILLKOM

STJERN

STOLTZ ENTREPRENØR

STORDAL MØBEL

STOREBRAND

STORMGEO

STORVIK

STRAND SEA SERVICE

STRANDMAN ANLEGGSGARTNERFIRMA

STRANDTORGET KJØPESENTER

STRATUM RESORVOIR

STRAUMEN BIL

STRAWBERRY

STRAWBERRY, BRYGGEPARKEN

STRONGPOINT

STRUKTURPLAST

STRYVO

STRYVO, BISMO

STRØMMES24

STS

STUDENTSAMSKIPNADEN I STAVANGER

STUDENTSAMSKIPNADEN I TRONDHEIM

STUDENTSAMSKIPNADEN PÅ VESTLANDET

STUDIO NSW

SUB SEA SERVICES

SUBSEA 7

SUBSHORE

SULLAND

SULLAND BODØ

SULLAND, VERDAL

SUNDE GROUP

SUNKOST BUTIKK

SUNNDAL SPAREBANK

SUNNMØRSPOSTEN

SVALINN

SVEHOLMEN

SVEINS AUTO

SVEVIA

SVORKA

SWECO

SWECO SØR

SWECO, PORSGRUNN

SYKKYLVEN STÅL

SYLJUÅSEN

SYLTEOSEN BETONG

SYLVSMIDJA

SYNLIGHET

SØBSTAD

SØGNE OG GREIPSTAD SPAREBANK

SØRENSEN MASKIN

SØRLANDSBADET

SØRLANDSKJØKKEN

SØRLANDSLISTEN

SØRMEGLEREN

SØR-VARANGER BILTEKNIKK

SØSTRENE KARLSEN

T FJELLAND & CO

TAKEDA

TALGØ MØRETRE

TANG OG JACOBSEN RENHOLD

TANK DESIGN TROMSØ

TEAM HELGELAND

TEAMTEC

TECHNIPFMC

TELENOR

TELENOR MARITIME

TELIA

TELLUS EIENDOM

TEMA EIENDOM

TEPAS INDUSTRIER

TESS, NORD

TEXCON

TGS

TH. FALKANGER

THAUGLAND

THE FJORDS

THE QUARTZ CORP

THEVIT

THON HOTEL HØYERS

THON HOTELS

THON HOTELS, ORION

TIBE REKLAMEBYRÅ

TIBNOR

TIDE

TINE

TINE, BYRKJELO

TITANIA

TIZIR TITANIUM & IRON

TKS HEIS

TO ROM OG KJØKKEN

TOKLE

TOMA

TOMRA SYSTEMS

TORGHATTEN SØR

TORGKVARTALET KJØPESENTER

TOSTRUP INVEST

TOTAL BETONG

TOTEN TRANSPORT

TOTENS SPAREBANK

TOYOTA

TOYOTA, FØRDE

TRAFIKKJENTENE

TRANSBORDER STUDIO

TRANSFRED, FØRDE

TRANSTEMA CONNECT

TRASTI & TRINE

TRE OG BETONG

TREBETONG

TREHUSEKSPERTEN

TROLL SYSTEMS

TROMSØ KJØKKEN & INTERIØR

TROMSØ SKOTØIMAGASIN

TRONDHEIM KINO

TRONDHEIM PIRBAD

TRONDHEIM STÅL

TRONDHEIM TORG

TRY REKLAMEBYRÅ

TRØNDELAG TEATER

TT ANLEGG

TUI

TV 2

TVERÅS MASKIN & TRANSPORT

TWODAY AVENTO

TYRHOLM & FARSTAD

TYSSE MEKANISKE VERKSTED

TØNNESEN SKO

TØNSBERG BLAD

ULDAL

ULEFOS JERNVÆRK

ULMATEC

ULSTEIN

UMOE INDUSTRIES

UMOE MANDAL

UNDERHAUG – HERDE INDUSTRIER

UNIL

UNIMICRO

UNIT4

UPTIME

VAFOS PULP

VAKRE VENE

VALDRES SPAREBANK

VARD

VARIG FORSIKRING VALDRES GFS

VARNER

VARTDAL PLAST BODØ

VARTDAL PLASTINDUSTRI

VASSBAKK & STOL

VB

VEDAL ENTREPRENØR

VEF ENTREPRENØR

VEGA CONSULTANTS

VEIDEKKE

VEIDEKKE, BERGEN

VEIDEKKE, MØRE OG ROMSDAL

VEIDEKKE, STAVANGER

VEINOR

VEISIKRING

VENI

VERTECH OFFSHORE

VERTICAL PLAYGROUND

VESO APOTEK

VESTERÅLEN MARINE OLJER

VESTERAALENS

VESTKORN MILLING

VESTLANDSHUS

VESTSIDEN INVEST

VEØY

VIEW LEDGER

VIGMOSTAD & BJØRKE

VIK ØRSTA

VIKEN FIBER

VIKING LIFE-SAVING EQUIPMENT

VIKINGBAD

VINTERVOLL

VIPO

VISNES KALK

VOICE

VOLDA MASKIN

VONIN REFA

VOSS PRODUCTION

VP METALL

VYRK

VYSUS

VAAGLAND BÅTBYGGERI

WACKER CHEMICAL

WASHINGTON MILLS

WAY NOR

WB SAMSON

WEATHERFORD

WELLPARTNER

WELLTEC OILFIELD SERVICES

WESTCO MILJØ

WESTCON GEO

WESTCON HELGELAND

WESTCON YARDS

WESTCONTROL

WIDERØE

WIKBORG, REIN & CO

WILLIKSEN EKSPORT

WILSON MANAGEMENT

WIST LAST OG BUSS

WK ENTREPRENØR

WOLT

WONDERLAND

WOOLLAND

WORKINN

WULFF & CO

WÜRTH

WÄRTSILÄ GAS SOLUTIONS

X5 ELEKTRO

XL-BYGG, HARSTAD

XL-BYGG, SORTLAND

YAPRIL

YARA

YC RØR

ZAPTEC

ÆVENTYR 1

Ø M FJELD

ØDEGAARD ENGROS

ØGLÆND INDUSTRIER

ØKSFJORD FISKEINDUSTRI

ØSTBØ

ØSTER HUS

ØSTRAADT RØR

ØVREBERG INSTALLASJONSFORRETNING

ÅLGÅRD OFFSET

ÅLHYTTA

AARBAKKE

ÅRDAL MASKINERING

AARSLAND MØBELFABRIKK

ÅSEN & ØVRELID