How does Norges Bank influence inflation?

Changes to the policy rate influence the economy and inflation in a number of ways, called channels. You can read more about these channels and how the policy rate affects the economy here. In general, when the policy rate is raised, inflation falls. The opposite is also true: when the policy rate is reduced, inflation rises. Reality is rarely this simple, as other, constantly changing, factors also influence economic developments. However, this is the basic principle of Norges Bank's inflation targeting regime.

Is inflation the only consideration when setting the policy rate?

Low and stable inflation is the primary objective of Norges Bank's monetary policy. However, inflation targeting shall be forward-looking and flexible so that it can contribute to high and stable output and employment and to counteracting the build-up of financial imbalances.

This means that Norges Bank shall seek to stabilise economic activity at a level that ensures that employment is as high as possible, while also maintaining low and stable inflation. In addition, Norges Bank must seek to avoid the build-up of financial imbalances, for example through high debt growth. Financial imbalances increase the risk of a sharp economic downturn in the future.

In many cases, these objectives will have to be weighed against each other when setting the policy rate, and this may involve difficult trade-offs. In order to be as transparent as possible about the trade-offs made by the central bank, Norges Bank's assessments are published after each policy rate decision. Norges Bank also publishes a monetary policy strategy, which provides a more general and overarching description of how the Bank will attempt to achieve its mission.

Short summary

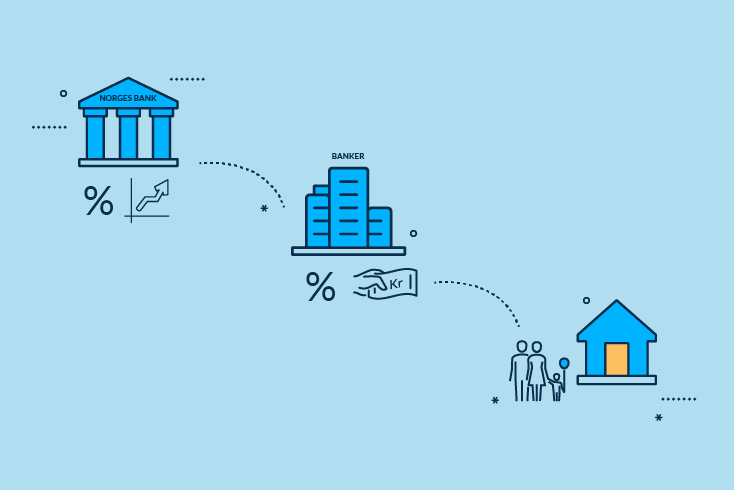

- The central bank uses the policy rate to control inflation.

- When the policy rate is raised, inflation goes down. When the policy rate is lowered, inflation goes up.

- When setting the policy rate, in addition to inflation, the central bank takes into account output, employment and the build-up of financial imbalances.