Rewiring Supply Chains Through Uncoordinated Climate Policy

Climate policies aimed at curbing emissions can sometimes have unintended ripple effects on businesses and their suppliers, especially when such policies are not adopted universally. In a recent Norges Bank working paper, we examine this issue by looking at California’s pioneering cap-and-trade program – the only cap-and-trade program regulating industrial carbon emissions in the US. Our research finds that when California priced carbon emissions in 2013, it set off a “rewiring” of supply chains: companies began reconfiguring their supplier relationships to reduce the increased costs and the uncertainty of the climate policy.

By Emilia Garcia-Appendini, Norges Bank Research, Emanuela Benincasa and Olimpia Carradori, University of Zurich, Miguel Ferreira, Nova SBE

This blog post summarizes the key findings of the study, highlighting how uncoordinated climate policy in one region can disrupt supply chains, affect firms’ finances, and even lead to unintended environmental consequences.

California’s Cap-and-Trade: A Natural Experiment in Supply Chains

California’s cap-and-trade program (launched in 2013 and expanded in 2015) provides an ideal testing ground for understanding climate policy impacts on supply networks. Under this program, large emitters in California must purchase allowances for their CO2 emissions. Importantly, no other US state had a similar policy during that period, creating a within-country contrast between regulated and unregulated firms. In the paper, we leverage this context as a natural experiment: we compare “treated” suppliers (firms with facilities in California that emitted above 25,000 tons of CO2 annually and were thus subject to the cap-and-trade rules) to similar “control” suppliers not facing such regulation. By tracking thousands of supplier–customer links across the US before and after 2013, the study uses a difference-in-differences approach (combined with matching on firm characteristics) to isolate the effect of the cap-and-trade policy on business relationships. In essence, the question is: did customers end business relationships with California-regulated suppliers in favor of others, once climate transition risks kicked in?

The data underpinning the analysis come from detailed firm-level records. Supplier–customer relationships are mapped using a comprehensive dataset of production networks (FactSet Revere), and emissions data identify which suppliers fall under California’s program. Financial statements from Compustat allow us to observe the performance of each firm over time. This rich data combination enables us to observe both the network restructuring (who buys from whom) and the financial outcomes as climate regulation is introduced.

The Impact: Suppliers Lose Customers Under Uncoordinated Climate Policy

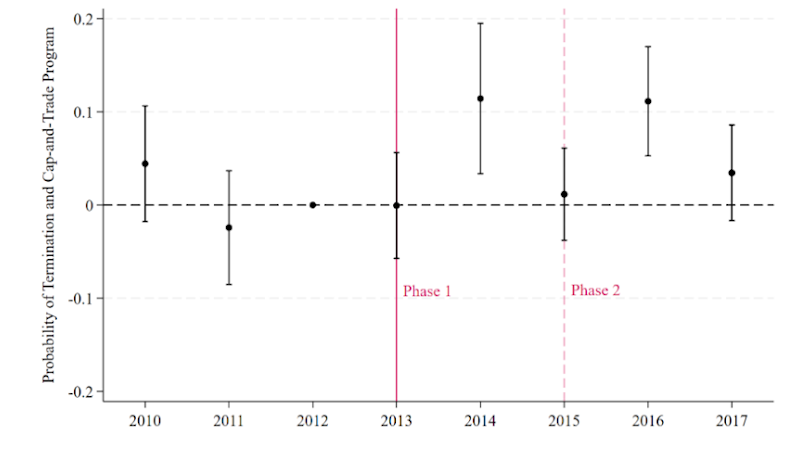

Our findings confirm that California’s climate policy significantly altered supplier-customer networks. Suppliers subject to the cap-and-trade regulation became more likely to lose existing customers compared to similar suppliers outside California. At the same time, these regulated suppliers struggled to attract new customers – they were less likely to form new supplier relationships after the policy. In practical terms, many client firms began to “rewire” their supply chains, phasing out California-based partners and sourcing inputs from alternative suppliers in other states. This effect is economically meaningful: the probability that a business relationship with a regulated supplier will be terminated following the policy change increases on the order of a 5–8 percentage point higher likelihood, roughly a 10–15% relative increase.

Why did customers switch? The cap-and-trade program imposed new costs on California-based producers (either directly through permit purchases or via compliance expenditures and increased uncertainty). Firms purchasing from those suppliers could avoid the uncertainties of dealing with the California suppliers by turning to unregulated suppliers elsewhere. The result was a restructuring of supply chains to sidestep the localized carbon price. Notably, we find no evidence that firms preemptively adjusted their partnerships before the policy took effect – the big shifts occurred only after cap-and-trade was implemented, indicating a causal response to the new regulation and not just broader trends.

Figure 1: The introduction of California’s cap-and-trade in 2013, and its expansion to more sectors in 2015, led to a higher probability of supplier relationship termination for regulated (treated) firms compared to similar unregulated firms. The chart shows the difference in termination rates between treated and control suppliers over time (the zero line indicates no difference). After the cap-and-trade launch (Phase 1) and its subsequent expansion (Phase 2), a clear gap emerges, with treated suppliers experiencing significantly more relationship breakups than their peers.

The Role of Competition and Switching Costs

Crucially, the disruption was not uniform across all suppliers – it depended on market conditions and the nature of the supplier’s product. We find that the exodus of customers was most pronounced for suppliers operating in highly competitive markets and those offering more standardized (commodity-like) inputs. In such cases, customers had many alternative vendors to choose from, making it easier to drop a California-based supplier when its costs rose. Similarly, suppliers that invested less in R&D (innovation) suffered larger customer losses, consistent with the idea that they offered more generic products that could be easily replaced.

Switching costs also played a key role. Lower switching costs – for example, shorter or weaker prior relationships between a supplier and customer – meant a smoother path to switch to a new supplier. On the customer side, who the clients were also mattered: the break-up rate was concentrated among customers headquartered in regions with weaker environmental policy sentiments.

Financial Consequences for Regulated Suppliers

For the California-based suppliers caught under the new carbon regime, these ruptured relationships translated into significant financial strains. We document that treated suppliers saw notable declines in their sales, total assets, and profitability relative to the control group after the cap-and-trade kicked in. These results underscore the competitive disadvantage faced by firms in a region with stricter climate regulation when their competitors elsewhere do not bear the same costs. In short, uncoordinated climate policy created winners and losers: the burdened firms in California struggled, while their out-of-state competitors gained an edge in capturing business.

It’s worth noting that these financial impacts are not simply due to an overall economic downturn or unrelated factors – the careful matching and comparison in the research design ensure that the divergences in performance are linked to the cap-and-trade exposure. The findings align with concerns often voiced by industry about uneven climate policies: companies subject to carbon regulation worry about competitiveness if their rivals elsewhere operate under looser environmental rules.

Carbon Leakage: Environmental Costs of Rewiring

Perhaps the most interesting finding is that this supply chain “flight” away from regulated firms may undermine the very environmental goals of the climate policy. The reshuffling of suppliers led to carbon leakage – emissions reductions in the regulated region are offset (or even reversed) by increases elsewhere. In fact, we find that customers who shifted away from California suppliers ended up with higher carbon intensity in their supply chains on average. In moving to out-of-state suppliers (which were not subject to cap-and-trade), these companies likely sourced from producers with higher or unregulated emissions, thereby increasing the indirect (Scope 3) emissions associated with their inputs. In fact, we show that the overall carbon footprint of the supply chain worsened for firms that rewired their networks after the policy.

Relevance of the study

This research highlights a broader lesson: without coordination, climate policies can lead to unintended cross-border (or cross-region) effects that blunt their effectiveness. In response to concerns about leakage, Norway has largely pursued climate policies in tandem with the EU (such as participating in the EU Emissions Trading System), which helps mitigate internal leakage within Europe. On an even larger scale, the EU is introducing a Carbon Border Adjustment Mechanism (CBAM) to level the playing field by imposing carbon costs on imports from less-regulated regions. Our results, however, point towards the need for different adjustment mechanisms, focusing on the exports of goods from regulated areas (and not only the imports as in the CBAM). In sum, more harmonized climate action is needed to prevent firms from simply shifting their activities (or supply chains) to dodge carbon costs.

0 Kommentarer