Breaking the Information Monopoly: How Deposit Relationships Can Ease Hold-Up Problem

Competition in the credit market has profound implications for loan outcomes and financial stability. In theory, greater competition among banks can benefit borrowers through lower interest rates, improved loan terms, and increased contractual flexibility. However, in reality, this ideal often remains elusive. A pervasive issue in corporate lending, known as the hold-up problem, allows banks with existing relationships to exploit their informational advantage, trapping borrowers in unfavorable deals. Recent research by Jin Cao, Emilia Garcia-Appendini, and Cédric Huylebroek sheds new light on this challenge, showing how borrowers’ financial information that is revealed through their deposit relationships can ease such hold-up problems.

This blog explores how deposit accounts at non-lender banks can dismantle information monopolies, reduce hold-up risks, and foster competition. We’ll dissect the mechanics of the hold-up problem, unpack the study’s findings, and outline policy implications for regulators and financial institutions.

The Hold-Up Problem in Banking: A Primer

The hold-up problem arises when one party in a transaction exploits its unique position to extract excess value, leaving the other party with limited recourse. In banking, this occurs when a borrowing firm’s current lender—the “inside bank”—uses its proprietary knowledge of the borrower’s creditworthiness to charge higher interest rates or impose restrictive terms. As the other lenders outside the current lending relationship (call them “outside banks”) know little about the firm’s creditworthiness, it is difficult for the borrower to exit the lending relationship and switch to an outside bank for better terms of lending, the borrower is thus often locked in the lending relationship with unfavorable terms—A hold-up problem. Previous studies show that inside banks charge 80–100 basis points (about 10% of average loan rate) more on loans compared to new lenders—a premium rooted in their informational monopoly.

The Information Contents of Deposit Relationships

Our research is based on detailed data on firm-bank relationships and loan contracts in Norway. The former are obtained from the Norwegian Tax Administration, which tracks the deposit and lending relationships of all firm-bank pairs in Norway from 2000 to 2019. This dataset allows us to better understand patterns in loan relationships and loan switching. The latter are retrieved from the credit register administered by the Financial Supervisory Authority of Norway (Finanstilsynet). These data, which are available at a yearly frequency for a shorter time horizon (2014-2019), allow us to retrieve loan exposures for every firm-bank pair. This dataset is at the firm-bank level, but contains detailed information on the underlying loan agreements, such as the total loan amount, precise interest rate, collateral to loan ratio, loan type (i.e., whether the loan agreement includes a credit line or not), and loan status (i.e., the proportion of loans written off). This dataset helps us better understand the changes in loan terms after loan switching takes place.

We find that deposit relationships can significantly reduce inside banks’ information advantage. The reason is, when firms maintain deposit accounts with multiple banks, competing outside banks can observe valuable information about the firms’ financial health through their transaction history. This information helps level the playing field between inside and outside banks, i.e. with improved information on depositors’ credit quality, outside banks can offer more competitive loan terms and induce depositors to switch away from their inside banks. In addition, the revealed financial information may also improve borrowers’ bargaining position when they negotiate new loans with outside banks.

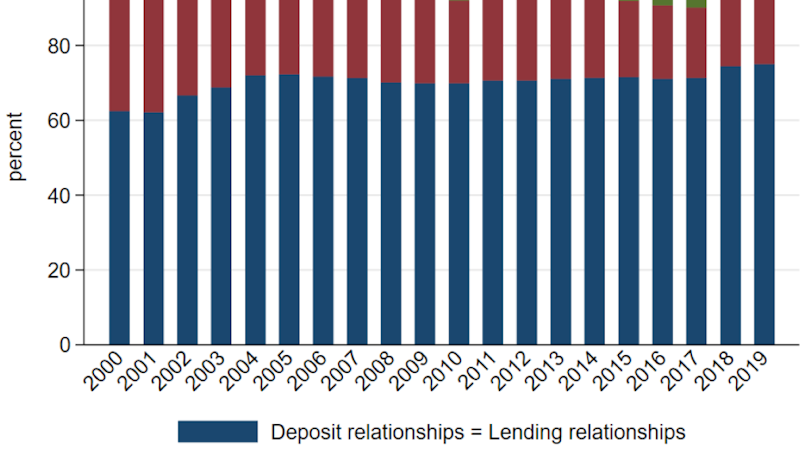

Figure 1: The structure of firm-bank relationships, based on authors’ own computations. This figure shows the proportion of firm-bank relationships that consist of both a deposit and a lending relationship in blue, only a deposit relationship in red, and only a lending relationship in green. The sample comprises all firm-bank deposit and lending relationships of firms with at least one lending relationship operating in Norway between 2000 and 2019.

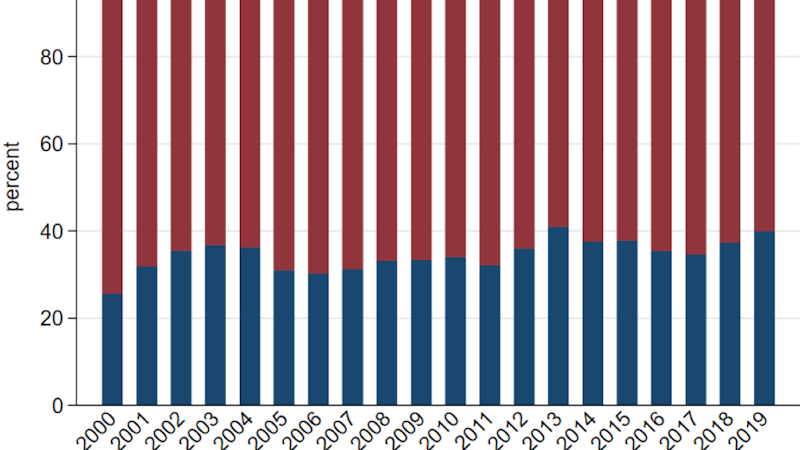

Figure 2: Proportion of switching firms with pre-existing deposit relationships, based on authors’ own computations. This figure shows the proportion of switching firms that had a deposit relationship with their new (outside) lender prior to switching in blue, and the proportion of switching firms that did not have a deposit relationship with their new (outside) lender prior to switching in red. The sample comprises all switching firms operating in Norway between 2000 and 2019.

The data reveals that about 20% of firms maintain more deposit relationships than lending relationships, as shown in Figure 1. Among all the firms that successfully switched lenders, about 40% of them had a pre-switching deposit relationship with the new bank that they switched to, as shown in Figure 2. Overall, we find that firms with deposits at outside banks are 8 percentage points more likely to switch lenders within a year, a 50% increase over the baseline switching rate.

For those firms that switched to banks where they had pre-existing deposit relationships, they also benefit from better terms of loans. We find that the lending rate offered by the new lender is lower; non-price terms (loan size, credit lines) are also improved, with no added collateral requirements.

We show that it is the financial information that is revealed in deposit relationships mitigates inside banks’ information monopoly, allowing borrowers to switch to competing outside banks for better terms of loans:

- Our results are strongest for transaction accounts. Compared with term deposit accounts, transaction accounts reveal more firms’ financial information through detailed transaction data to outside banks, which can help mitigate the inside banks’ information monopoly.

- Our results are stronger for those firms that are moving a larger share of deposits (hence, revealing a larger share of financial information) to outside banks.

- Our results are more pronounced for those borrowers that suffer more from information disadvantages, for example, young and informationally opaque firms. As these firms have shorter business history and are less known to the public, outside banks are less willing to bid on loans to them; therefore, the financial information that they can reveal to outside banks through deposit relationships can increase their chance of receiving favorable loans provided by outside banks.

In addition, we find that deposit relationship improve banks’ capability to predict borrowers’ probability of default: The relationship between outside banks’ credit rating on switchers and future loan performance is much stronger for switchers with prior deposit relationship, suggesting that deposit relationships improve outside banks’ screening capabilities.

Policy Implications

By showing that borrowers’ revealing financial information to competing outside banks can increase the likelihood of beneficial loan switching and improve competition in the loan market, our research provides support for the current open banking initiatives that give firms greater control over their transaction data. For instance, by allowing firms to share their banking history with potential lenders more easily, policymakers could mitigate the hold-up problems in banking relationships and encourage more competition in credit markets.

Furthermore, switching costs can keep firms tied to suboptimal banks and lending relationships, therefore, policy efforts to reduce switching costs in deposit markets and credit market may have positive effect on fostering competition in bank lending. For instance, EU Payment Services Directive 2 (PSD2) aims to reduce the administrative burden of opening a deposit account, and our research implies that such deposit market reforms may generate desirable spillovers to the credit market.

0 Kommentarer